In recent weeks the S&P 500 has plunged as much as 7.5% off its recent highs and the volatility index, a sign of investor fear, has soared.

Many investors are concerned that we may be on the verge of a correction or even a full fledged bear market given growing concerns over slowing economic growth in China, Europe, Japan, and South Korea.

Given the market's historic overvaluation, this is a justified concern. For example, the cyclically adjusted P/E ratio (CAPE), which tracks the average 10 pe adjusted for inflation, indicates that the market is 61% overvalued. The current CAPE is 25.69, compared to its historical median value of 15.93.

With the stock market recently peaking at a CAPE of 26.12, some investors are warning that a bear market may be imminent given that this high of market valuation is often associated with sharp stock crashes.

| Period | CAPE at Market Peak | Stock Market Decline |

|---|---|---|

| 1929-1932 | 33 | 85% |

| 1937-1938 | 22 | 45.30% |

| 1969-1970 | 21 | 27.60% |

| 1973-1974 | 19 | 42.50% |

| 1987-1988 | 18 | 19.70% |

| 2000-2001 | 42 | 29% |

| 2002-2003 | 30 | 27.50% |

| 2007-2009 | 27.3 | 51% |

| Historical Average | 26.54 | 40.95% |

| Recent Peak | 26.12 |

Don't get me wrong, I'm not saying that such concerns aren't justified. Any time stocks prices are violently declining its natural to feel fear and consternation. However, I would like to point out two things that is often forgotten when markets slide.

Market corrections are a normal and necessary part of the market's cyclical nature. As my Motley Fool colleague Morgan Housel has pointed out, historically the S&P 500 has suffered a correction, (a 10+% decline) once per year and a 20+% bear market every few years. Given that it's been nearly three years since the last correction, one is overdue.

Rather than fear a correction, or even an outright market crash, investors should revel in the idea of, in the words of Warren Buffett, "being greedy when others are fearful."

That's why I've assembled a list of four high-yielding companies/MLPs whom I believe have secure payouts and who are offering high- yields that can not only help investors generate income, but raise the chances of beating the market in the long-term.

4 high-yield stocks to consider buying today

| Company/MLP | Current Yield | Peak Yield in 2009 | Dividend Change 2008-2009 | Dividend Growth since 2009 | Yield on shares/units bought in 2009 |

| Williams Companies | 4.20% | 6.48% | 2.30% | 409% | 33.13% |

| Williams Partners | 7.4% | 39.94% | 1.60% | 45.30% | 57.80% |

| Kinder Morgan | 4.5% | 13.74% | 4.48% | 32.90% | 19.08% |

| Main Street Capital | 7.28% | 25.04% | 0% | 49.30% | 39.22% |

| Average | 5.85% | 21.30% | 2.10% | 134.13% | 37.31% |

Sources: Yahoo Finance, Fastgraphs

In addition to believing that shares/units of Williams Companies (WMB +0.59%), its MLP Williams Partners (NYSE: WPZ), Kinder Morgan Inc (KMI +0.85%), and Main Street Capital (MAIN +0.21%), represent exceptional long-term investments today, I'd like to use the above table to highlight a few key points.

First, note that at the height of the financial panic a portfolio of these four companies/MLPs was yielding 21.3%.

Yet all of these companies/MLPs managed to maintain, or even slightly grow their payouts, not only during the financial panic, but impressively afterwards. If investors had kept your head during the great recession and bought at the peak of market panic you'd be rewarded with portfolio that is today paying you over 37% in annual dividends/distributions.

So, why exactly do I think investors should consider buying these four companies/MLPs today? Because no one can predict a market crash, or even a correction. Therefore its worth owning these great companies/MLPs (and collecting the income) even if the market is overdue to crash.

Why investors should own Kinder Morgan, Williams Companies, and Williams Partners

There are three primary reasons to own shares/units of these midstream companies/MLPs.

The first is the long-term energy megatrend that is occuring today, and likely to last for decades, providing a strong growth catalyst to the industry as a whole.

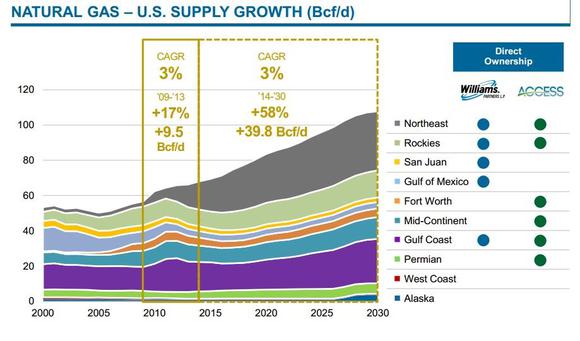

For example, according to analyst firm Woods Mackenzie demand for natural gas in the US will rise by 36% over the next decade, driven primarily by a switch from coal to gas fired power plants, and fast growth of LNG (liquefied natural gas) exports.

Meanwhile the supply of gas is expected to rise by 58% through 2030, fueled by a 112% increase in the hyper prolific Utica and Marcellus shale formations over the next 10 years.

Source: Williams Companies Barclays CEO-Energy Conference presentation

This explosion of gas production is expected to generate demand for $640 billion of midstream (gathering, transport pipelines, processing, and storage) infrastructure by 2035 alone.

Which brings me to my second reason to own these stocks/units. Williams and Kinder Morgan have some of the largest project backlogs of any firm in their industry.

As this slide shows, Williams Companies and Williams Partners has $29 billion in planned and likely projects scheduled to be completed over the next five years. Meanwhile, Kinder Morgan just announced that it's grown its project backlog by 5.3% to $17.9 billion in just the last quarter alone (a 22.9% annualized rate).

Which brings me to my final reason for owning Kinder and Williams, dividend/distribution growth, courtesy of some recent large mergers.

Mega mergers mean mega dividends

Williams Companies recently bought the general partner rights of Access Midstream Partners (NYSE: ACMP) and plans to merge it into Williams Partners by the end of this quarter. Upon the completion of the merger Williams Companies is expected to raise its dividend by 32% and grow it 15% annually through 2017.

Williams Partners, meanwhile, is looking at a 10%-12% likely distribution growth rate during that time with management confident that it can maintain a coverage ratio of 1.1, meaning a highly secure payout.

Kinder Morgan Inc recently announced the buyout of its three MLPs, Kinder Morgan Energy Partners (NYSE: KMP), Kinder Morgan Management (NYSE: KMR), and El Paso Pipeline Partners (EPB +0.00%), for $70 billion. The deal is expected to close by the end of the year and management has pledged to grow its dividend 16% next year, and 10% annually through 2020, as a result.

Main Street Capital: high-yield, paid monthly

Simply put, Main Street Capital, a business development corporation which lends money to, and takes equity stakes in small to medium size businesses, is one of the top companies in its industries. There are three strong reasons for you to consider it for your income portfolio.

The first reason is that Main Street pays a monthly dividend, making it ideal for both paying monthly expenses, (which retirees will love) and maximizing the compounding power of dividend reinvestment.

Second, Main Street is a master of growing its book value and high-quality portfolio of diversified, first lien senior secured loans (which results in far less credit risk than many of its competitors). Combined with its industry leading low costs, (because its internally managed) this allows the company to grow dividends at an impressive rate, which in turn has resulted in sensational total returns over the years.

MAIN Total Return Price data by YCharts

In fact, since its IPO in 2007, on a per share basis Mainstreet's portfolio of loans and equity stakes in 180 companies has allowed it to grow its book value and dividend at a 7.32% and 6.46% compound annual rate, respectively.

Finally, Main Street Capital is well positioned to take advantage of rising interest rates, with 95% of its loan portfolio composed of floating rate loans. This means that as interest rates rise, Main Street can adjust the interest it charges its clients upwards and actually increase its profitability. This should help it maintain its stellar dividend growth track record for many years to come.

Takeaway

Market crashes can be scary, but long-term investors need to remember that the best time to buy great companies comes when market panic is at its worst. Dividend growth stocks such as Kinder Morgan, Williams Companies, Williams Partners, and Main Street Capital represent high-yield stocks/MLPs that investors can buy today and feel confident the high payout is secure and likely to grow in years to come.