Let's get this out of the way first: General Electric (GE 0.63%) and Cisco Systems (CSCO +1.47%) don't exactly have the same business model. GE is a worldwide conglomerate with its hands in airplane turbines, energy management, household appliances, transportation, health care devices, and more, while Cisco makes routers, telecom switches, and technology management software.

But both are two of the biggest proponents of the Internet of Things (IoT), so it's worth taking a look at each company's IoT innovations to see which could bring the most value to its investors.

The broad strokes of the IoT

One of GE's most famous takes on the Internet of Things -- or the "Industrial Internet," as the company calls it -- is IoT's "power of one percent". The company believes that using sensors and software to make current industrial procedures and equipment just 1% more efficient will result in billions of saving for its customers.

For example, GE believes a 1% increase in efficiency for the oil and gas industry would result in $90 billion of savings over 15 years. Similarly, the health care industry will experience a $63 billion in overall savings, and commercial aviation will see a $30 billion savings in fuel costs over the same period.

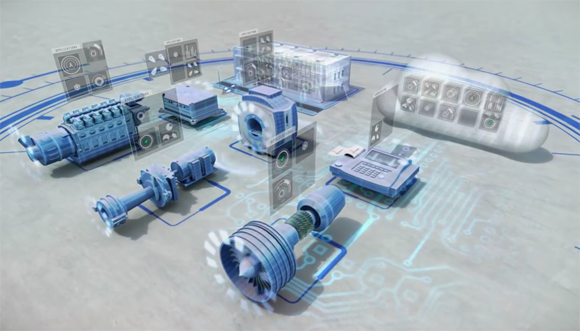

GE uses Predix software to analyze equipment efficiency. Source: GE.

GE's already started building IoT solutions by incorporating sensors into industrial equipment and then collecting and analyzing their data with software. For GE, the analytics side is what's most important right now. The company's invested about $1 billion into its Industrial Internet push, including its proprietary software, called Predix, which is used for managing and analyzing industrial equipment.

As Bloomberg recently noted, the company now has more than 10 million sensors in the equipment it sells. The key question for GE investors is how much the company can make from its Industrial Internet focus. According to its CEO, Jeffrey Immelt, the company could see sales of up to $5 billion from helping businesses collect industrial equipment data by 2017.

Right now, the software analytics side of its business is expected to generate more than $1 billion in revenue this year, compared to its Industrial Internet revenue of $800 million last year. For context, GE's total revenue in 2013 was $146 billion.

What may be most important for investors is that GE said last month that its Predix software will be available to any company in 2015. This could accelerate the company's IoT revenue as more companies use the GE's software to make their equipment and systems more efficient.

The hands-on approach

Like GE, Cisco's involvement in the Internet of Things spans many industries. The company's embedded wireless routers, switches for collecting data, and IoT management software are used in manufacturing, mining, utilities, and for oil and gas companies.

Cisco's Internet of Things equipment can remotely monitor industrial equipment. Source: Cisco.

By 2020, Cisco expects there to 50 billion things connected to the Internet -- up from 10 billion last year -- and the company believes the majority of these connected things will be applied to industrial uses, and not the commercial market. In a blog post last month, Wim Elfrink, Cisco's executive vice president for industry solutions, wrote, "Today, 37% of total device (things) connections to the Internet come from industrial applications, and industrial connections will surpass consumer-based connections in 2017."

But unlike GE, Cisco hasn't disclosed how much it's making from its Internet of Things business just yet. Though the company has made very liberal estimates on how big the IOT market will be -- Cisco CEO John Chambers said earlier this year that the Internet of Things could be worth $19 trillion over the next decade. Estimates from Gartner put the Internet of Things' market opportunity at a more conservative $1.9 trillion by 2020, but either way it's a very large market.

The importance the Internet of Things for Cisco can't be overstated. The company is looking to the IoT as the next wave of worldwide connectivity, and it wants to be one of the biggest players in the space. Right now the company makes about two-thirds of its product revenue from switches and routers, but some companies are starting to opt for cheaper hardware products and rely more on software. These software defined networks (SDN) could hurt Cisco's gross margins -- which sit around 62% right now -- as customers focus more on software rather than expensive hardware.

Foolish thoughts

GE and Cisco are very different companies, and, as such, they have different approaches to the Internet of Things. But I think Cisco has the most upside opportunity for investors simply because the company's IoT revenue could be a larger percentage of its total revenue than GE's.

Even if GE hits its target of $5 billion in IoT revenue by 2017, that would still be less than 4% of the company's total revenue last year. On the other hand, if Cisco builds out its IoT business, it could eventually account for a much larger percentage of total revenue, because Cisco's businesses are entirely entwined with Internet connections. This allows the company not only to sell equipment for the Internet of Things, but also increase service revenue in the IoT space as well.

Having said that, Cisco also has more to lose. If the Internet of Things market grows as big (or even close to as big) as Cisco estimates and the company fails to turn that into a lucrative business, then Cisco and its investors could miss out. But for now I think the company's on the right track, even if we all don't know exactly where this IoT train is headed.