The dollar store chain racks up another quarter of growth as the $1 for everything price point resonates with a financially challenged customer. Photo: Flickr via Mike Mozart

Although deep discount variety store Dollar Tree (DLTR +2.11%) continues to see a drag on its performance from its pursuit of industry rival Family Dollar (FDO +0.00%), the big takeaway from its third-quarter earnings results released this morning seems to be it's growing organically anyway.

| DLTR Guidance | Consensus Wall St. Est. | Actual | Yr. Ago | % Chg. | |

| Revenue | $2.02 billion -$2.07 billion | $2.06 billion | $2.1 billion | $1.88 billion | 11.1% |

| EPS | $0.061-$0.66 | $0.64 | $0.69 | $0.58 | 19% |

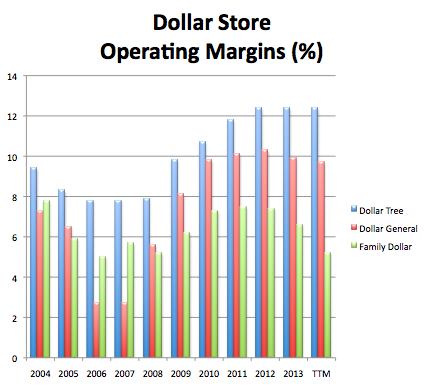

The value proposition of the true dollar store chain is evident in its operating profits. Data: Dollar Tree annual SEC filings

Last quarter, I suggested management was being conservative with its guidance, but also that the pursuit of Family Dollar would likely weigh on results going forward. While both of those statements were borne out this quarter, the consumer response to Dollar Tree's core business outweighed those items and we see the improvements that made.