"Price is what you pay; value is what you get. Whether we're talking about socks or stocks, I like buying quality merchandise when it is marked down."

Actually, make that "whether we're talking about socks, stocks ... or AR-15 semiautomatic rifles with polycarbonate stocks." Because today, dear investor, we're going to take a short break from the subject of investing in stocks (although that's our very favorite subject), to talk instead about investing in guns.

Specifically, the AR-15 rifle.

Image source: Getty Images.

Investing in guns: The Myth ...

You may have heard the stories about how some lucky folks make a fortune from investing in guns. To cite just one recent example, in April 2014, a .45 caliber revolver once owned by Wyatt Earp -- which probably cost about $20 when it was manufactured back in the 1800s -- sold at auction for the princely sum of $225,000. That there's a 1,124,900% profit, folks -- or a very respectable 7% annualized return on investment, dating from the presumed date of purchase.

So what are the chances of an investor in more common guns, such as the AR-15 rifle, which sells for a price of $800 or less, making anything like that kind of profit?

... and the reality

Truth be told, profits like that earned at the Wyatt Earp revolver auction come but once in 150 years. As a general rule, guns such as the AR-15 make for poor investments for one simple fact: unlike land, or gold, these guns are not finite in quantity.

Traditionally, real estate investors have touted investments in land as safe because "God isn't making any more of it." Investors in gold can, of course, make similar claims. (And do.) And sure, Wyatt Earp-owned handguns are like land and gold in that they're limited in quantity -- which explains the high price fetched in April's auction. In that respect, singular firearms such as Earp's revolver might well make for good investments.

Supplies of workaday firearms like the AR-15, however, are constantly being replenished. Indeed, Colt, Smith & Wesson (SWHC 0.47%), Glock, and Sturm, Ruger (RGR +0.45%) can be reliably expected to churn out more and more guns with each passing year. And as a result, even if demand for AR-15s is strong, this won't necessarily translate into a higher price for the rifle. Rather, it will result in gun manufacturers doing what they do best -- manufacturing more guns!

Data provided to me by the good folks at BudsGunShop.com -- one of the Internet's largest retailers of new and used firearms -- describe the fluctuations in retail price of a popular AR-15 rifle that Bud's has sold since 2007.

It shows that over the course of 7 1/2 years of sales, an average AR-15 rifle's price has basically come full circle. From $798.85 in March 2007, it rocketed as high as $1,199 (in the wake of President Barack Obama's election to a second term of office), then plunged below $600 (when said reelection failed to result in a new assault weapons ban), only to end up at $786 earlier this month.

That's a pretty rocky road -- and a long road to travel to end up at essentially zero profit on your AR-15. (Actually, about a 2% loss, with the AR-15 rifle's price now $12.85 below the March 2007 level).

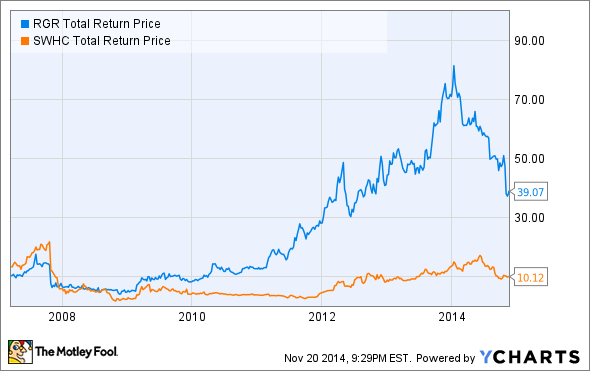

Now look at a couple of stock charts for the two biggest publicly traded gun manufacturers, Smith & Wesson and Sturm, Ruger, and see if you can spot the difference:

RGR Total Return Price data by YCharts.

S&W's stock chart (the yellow line) shows much the same results as we see for Bud's AR-15 model -- seven years of ups and downs, ending with a stock price somewhat lower than where it began. Sturm, Ruger, on the other hand, has delivered tremendous returns to its investors -- as much as an eightfold profit at its height earlier this year, and still an impressive fourfold return at recent prices. As a result, investors in Sturm, Ruger have outperformed investors in Smith & Wesson -- and investors in AR-15 rifles -- quite handily over the years.

The upshot for investors

Does all this mean that you should never, under any circumstances, invest in firearms? Hardly.

In fact, the impressive movement in AR-15 rifle prices between October 2012 (before Obama's reelection) and March 2013 (more than a month after his second inauguration) suggests that if you buy a popular firearm such as the AR-15 -- and buy it at the right price and the right time -- you may earn a nice profit if you sell it at the right time.

Say the upcoming 2016 elections features a presidential candidate more dedicated to gun control than Obama has proven to be -- or the potential for more Democrats in Congress. (After the 2014 results, there could hardly be fewer.) The prospect of tighter gun control could get people worried again -- maybe even worried enough to spark another 50%-in-six-months gain in AR-15 rifle prices.

Then again, as we saw post-election, those profits can quickly evaporate when the risk fails to materialize. And over the long term, it does appear that there are more profits to be made -- and more consistent, growing profits ... and dividends -- from investing in the shares of quality firearms manufacturers like Sturm, Ruger, than from trying to invest in the products they make -- like the AR-15 rifle.