It might not be obvious to the casual observer, but right now, today, CalAmp (CAMP +0.00%) stock offers one of the best values available in the fast-growing "Internet of Things," or IOT, industry, where appliances talk to other appliances, taking humans out of the loop.

Why? Two reasons.

CalAmp stock is cheap

With a stock down 28% over the past year (but H1 profits up 33% year over year, according to S&P Capital IQ), CalAmp stock is beginning to look awfully attractive relative to similar-sized IOT players such as Sierra Wireless (SWIR +0.00%) and Silver Spring Networks (NYSE: SSNI).

Valued on market cap, CalAmp's market capitalization of $640 million slots it in right between smaller Silver Spring, and larger Sierra Wireless. CalAmp's sales are similarly greater than Silver Spring's, but less than Sierra's, while its workforce, estimated at 420 employees by Yahoo! Finance, makes CalAmp the smallest of the three companies. More importantly for investors, though, is that right now, today, CalAmp stock sports the smallest valuation of the three companies.

The only one of the three companies boasting actual GAAP profits, CalAmp's P/E ratio is the cheapest based on trailing results. And looking toward next year's estimated earnings, analysts give CalAmp a forward P/E ratio cheaper than its peers as well:

Source: Finviz.com.

CalAmp stock pays you best

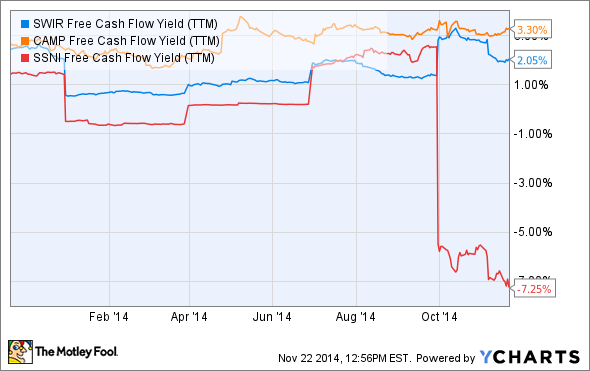

One of the best ways for investors to confirm that a company's profits are actually profits worth having is seeing them reported in the form of cold, hard cash -- free cash flow -- rather than mere "accounting profits." In this regard, only CalAmp and Sierra Wireless actually fit the bill. (Silver Spring, unfortunately, has no positive free cash flow to speak of.) And of the two companies currently rolling in real cash, CalAmp does the better job of converting revenues to cash profits.

CAMP Free Cash Flow Yield (TTM) data by YCharts.

Measured by dividing a firm's market capitalization (the price you pay for CalAmp stock) into its free cash flow (the money your investment generates for you), the "free cash flow yield" at CalAmp is a respectable 3.3% today. Simply put, for every dollar you invest in a share of CalAmp stock, you can expect the firm to generate about three-and-a-third cents worth of real, cash profits. That compares with the 2.05% FCF yield at Sierra Wireless ... and the negative 7.25% FCF yield at Silver Spring Networks.

What will CalAmp do with all this cash? It's hard to say. It might, for example, choose to initiate a dividend payment to shareholders. (None of the three companies currently pays a dividend.) Or CalAmp may decide to buy back shares (increasing the size of your stake in the company for every share it takes off the table). Or it may simply take the cash and reinvest it in its business. Whichever use it puts the cash to, the simple fact that CalAmp is churning out more cash than its rivals is good news for investors.

And it's a great reason to buy CalAmp stock.