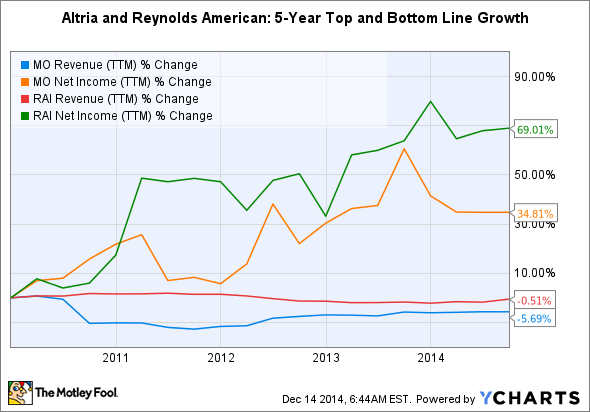

Altria (MO +0.20%) and Reynolds American (RAI +0.00%) -- which will soon acquire Lorillard (LO +0.00%) -- are the two biggest tobacco companies in the United States.

The challenges facing both companies are well known -- the percentage of American smokers has declined from 42% in 1965 to 18% in 2012, according to the Surgeon General's Report on Smoking and Health. In response to this shrinking market, both companies slashed jobs, raised prices, and expanded into non-cigarette product categories to protect their bottom lines.

Source: YCharts

But will that delicate balancing act be sustainable over the next 10 years? Let's look at several potential pitfalls and catalysts which could shape the future of both tobacco giants.

The price ceiling myth

Altria and Reynolds American regularly raise their prices to offset declining cigarette shipment volumes. Bearish arguments against both companies usually declare that rising prices, exacerbated by higher excise taxes, will hit a ceiling and cause revenues to decline.

That argument initially makes sense when we compare the price of cigarettes in the U.S. to other nations. Forty percent of adults smoke in Russia, where a pack of cigarettes costs $1.74 with taxes included. By comparison, 18% of adults smoke in the U.S., where an average pack of cigarettes (averaged across all states) costs $6.36.

But when we calculate the price of cigarettes as a percentage of average monthly income (based on UNECE and ILO statistics), the average Russian spends 0.17% on one pack of cigarettes, compared with 0.14% for the average American.

Meanwhile, smokers in the U.K. spend $10.99 (0.32% of their monthly income) on a pack of cigarettes, yet the country has a higher smoking rate of 19%. In Australia, where a pack of cigarettes costs $12.14 (0.47% of monthly income), 17.5% of adults still smoke. These comparisons suggest that Altria and Reynolds American can probably afford to nearly double their U.S. prices over the next decade without any noticeable impact on smoking rates.

However, increased health awareness and public bans against smoking could reduce the nationwide smoking rate. Higher federal and state excise taxes, which rose over 120 times between 2000 and 2013, could also throttle tobacco companies' ability to raise their own wholesale prices.

E-cigarettes might not be the solution

Altria and Reynolds have both diversified into e-cigarettes with their respective MarkTen and Vuse e-cigarettes.

Altria's MarkTen e-cigarettes. Source: Altria.

Altria expanded that portfolio by acquiring premium e-cig brand Green Smoke earlier this year. Reynolds only agreed to acquire Lorillard after selling its market-leading Blu eCigs brand to Imperial Tobacco Group in July to ease antitrust concerns. Blu accounts for roughly half of the domestic e-cig market, compared with single-digit market shares for Altria and Reynolds.

Despite all the hype, the U.S. e-cigarette market is still tiny. For 2014, U.S. e-cigarette sales will account for only $1 billion of the $2.5 billion e-vapor market, according to Nielsen C-Store Database. The other $1.5 billion will come from customizable tanks and nicotine juice, which are purchased at local "vape shops." By comparison, Altria, Reynolds American, and Lorillard generated nearly $40 billion in revenues in fiscal 2013.

Over the next decade, increased regulation and new excise taxes could discourage the widespread adoption of e-cigarettes. A recent study by Japan's Health Ministry found that e-cigs have 10 times the amount of carcinogens as regular cigarettes, dealing a major blow to the e-cig as a smoking cessation device.

But what about legalized marijuana?

Although the future growth of the e-cigarettes market is questionable, several analysts have suggested that Altria and Reynolds could profit from the legalization of recreational marijuana across the United States.

Colorado, the first state to legalize recreational marijuana use, reported $67.5 million in legal marijuana sales in August, with $34.1 million coming from recreational sales and $33.4 million coming from medical sales. If marijuana is legalized nationwide, and every state in the U.S. spent as much on marijuana per person as Colorado, which has a population of 5.26 million, domestic marijuana sales could hit nearly $50 billion annually. If that scenario comes true, Altria and Reynolds' annual revenue could more than double from 2013 levels.

Selling marijuana would represent a huge leap of faith for Altria and Reynolds American, but they certainly have the technology and facilities to mass-produce commercial marijuana. To date, only three states have legalized marijuana, but a lot can change within 10 years.

The next 10 years

As a long-term Altria shareholder, I consider domestic tobacco stocks to be great income generators, but I wouldn't consider them "buy and hold forever" stocks.

Domestic tobacco companies might maintain pricing power for years to come, but shifts in cultural attitudes and excise taxes outpacing price hikes could cause shipments to fall faster than expected. For now, investors should pay attention to Altria and Reynolds' expansions into non-smoking businesses. In addition to e-cigarettes, Altria holds a stake in SABMiller and manufactures snuff, while Reynolds sells snuff and nicotine gum.

If steady growth in these businesses (and possibly marijuana in the future) offsets a slowdown in cigarette shipments, both stocks will be worth holding. But once price hikes fail to offset revenue declines, it might be time to look elsewhere for big dividends.