AT&T is rolling out gigabit Internet to more metro areas in the near future. Source: AT&T.

If you're thinking about signing up for a gigabit Internet connection, call up AT&T (T +0.51%) or Google (GOOG 0.94%) (GOOGL 1.07%) to see if they're bringing the goods to your neighborhood. Aside from a few local businesses, those two are the only companies rolling out gigabit Internet service around the country.

Cable companies have responded by increasing their top speeds, but those tiers are often priced significantly higher than what AT&T and Google are charging for gigabit speeds. Verizon (VZ 1.18%), which also provides fiber-to-the-home services similar to Google and AT&T, has maxed out its speeds at half a gig, or 500 Mb/s. For that luxury, FiOS customers will have to pay $285 per month -- nowhere near the $70 per month Google offers.

But it doesn't look like Verizon plans to roll out gigabit Internet speeds, at least not in the same manner as AT&T and Google. Instead it will focus on its competitive wireless business and cede part of the growing broadband Internet business to the cable companies along with Google and AT&T.

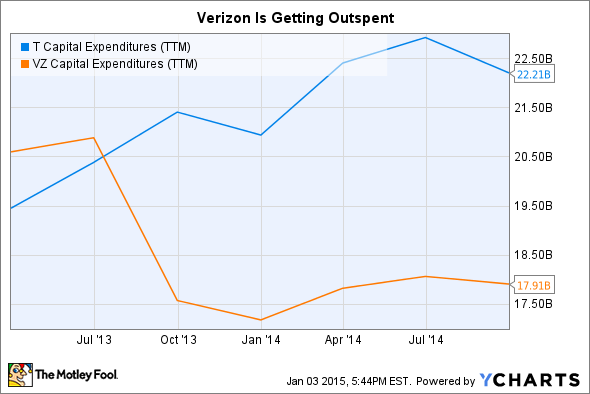

Cutting capital expenditures

At a recent UBS conference, Verizon CFO Francis Shammo told investors, "[Y]ou should anticipate that wireless [capital expenditures] will continue to trend up; wireline will continue to trend down."

FiOS is part of Verizon's wireline segment, and it passes 16 million homes. Of those households, 6.5 million, or 40.6%, subscribe to FiOS Internet service. Verizon has an additional 2.6 million DSL customers that it's slowly converting over to FiOS.

If Verizon is done growing its capex on wireline services, it will slow the growth in households passed and total subscribers. Fiber-to-the-home is expensive, especially enough to support 1 Gb/s broadband speeds.

AT&T, meanwhile, has shown a willingness to spend heavily. Since the beginning of 2013, AT&T has increased capex 14% while Verizon's capital expenditures declined 13%.

Data by YCharts

Google, too, has ramped up spending, but its strategy with gigabit Internet is to invest in building fiber-to-the-home in select cities where existing infrastructure makes its cost-efficient. It can't outspend AT&T or other competitors, but it still benefits from higher Internet speeds no matter who provides them.

Protecting the wireless business

Verizon is currently feeling the pressure from competition in its wireless segment, which has prompted it to lower prices in some cases while offering limited-time promotions throughout the year. As a result, the company has seen the impact in its margins. Wireless operating margin declined to 31.9% in the third quarter from 33.8% in the year-ago period.

The fierce competition for wireless customers means Verizon will need to continue investing in its 4G LTE network. It's already hit the broad strokes with its network, covering more ground than any other network. Now, it just needs to make the network more dense by building out small cells. Doing so will allow the company to stay ahead of the competition and ahead of customer demand for wireless data.

To protect its wireless business, it's sacrificing potential growth in its wireline business. With FiOS representing a significant revenue driver, it could slow the company's total revenue growth in 2015.

Gigabit Internet is growing in both supply and demand, and being first to a market can be a huge advantage. With the growing number of over-the-top services streaming live and on-demand programming and the potential for all television programming to eventually get delivered over the Internet, gigabit Internet speeds will become the norm in the not-too-distant future.