J.C. Penney looks like it will be jingling all the way to bank thanks to the Christmas shopping season, but that doesn't mean other retailers will be doing the same. Photo: Sam Howzit via Flickr

Wall Street is looking to the upbeat holiday sales report from J.C. Penney (JCP +0.00%) as a sign we will see equally positive news from other retailers like Kohl's (KSS +1.11%), Macy's (M +0.43%), and Nordstrom. But they might be jumping the gun, and just as they were surprised at how strong J.C. Penney's November to December sales were, they may end up being taken aback to find it's come at the expense of its rivals.

Taking the lead

J.C. Penney reported that same-store sales for the two-month holiday sales period rose 3.7% from the previous year, better than the 3.1% it recorded in 2013 and certainly better than the 2.7% analysts were expecting. The retailer now expects comps for the fourth quarter to come in at the top end of its previous guidance of a 2% to 4% increase.

There's reason to think the trickle-down effect will apply here. The National Retail Federation had anticipated strong 4.1% growth overall for November and December, and MasterCard's spending report for the year-over-year period between Thanksgiving Day and Christmas Eve was even better than that: a 5.5% increase.

Moreover, Kohl's and Macy's are coming up against some especially easy comparisons from last year when bitter cold weather and a series of snowstorms helped drive customers away from the malls.

Last year Kohl's same-store sales fell 2% in the fourth quarter while Macy's were up 1.4%. Both results, though, were a significant deterioration from sales the previous year, when they posted comps of 1.9% and 3.9%, respectively.

Keeping its head above water

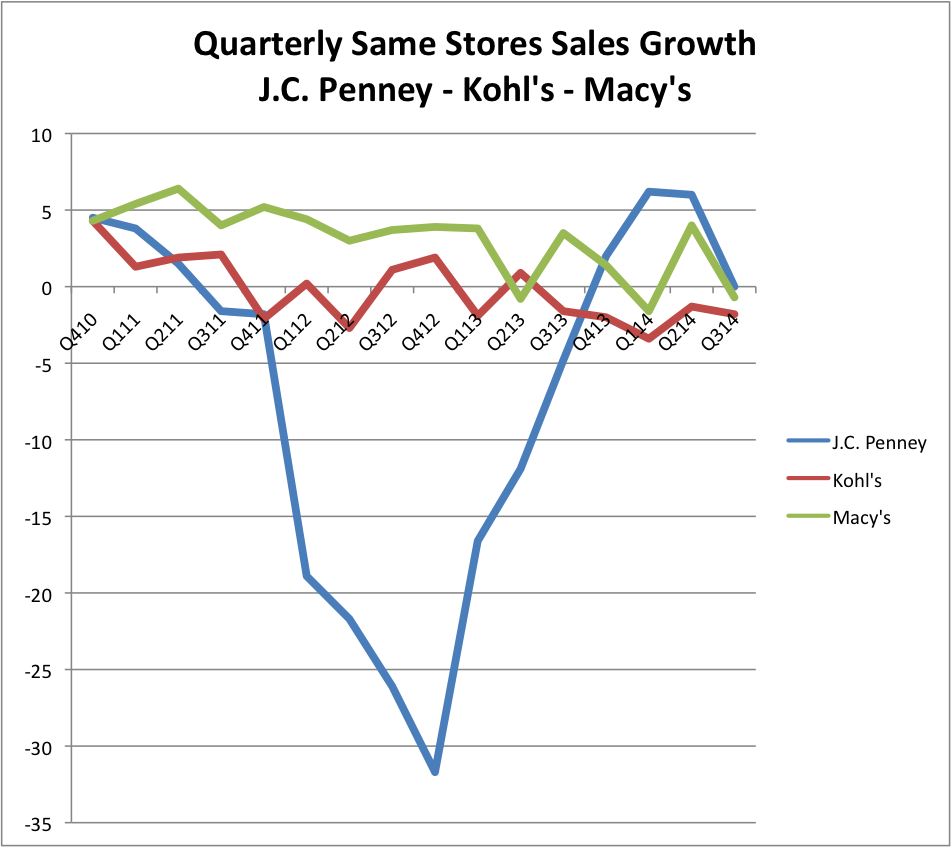

It's worth noting that as Kohl's and Macy's were stumbling, J.C.Penney was on the march toward improvement, and its fourth-quarter comps last year came in 2% higher than in the prior year. Of course, considering the absolutely horrendous year the department store chain had in 2012, any sales growth would be a welcome sign, but J.C. Penney has continued to outperform its rivals as its condition stabilized.

That's not to say it won't have challenges going forward as 2015 will mark the first full year that it's lapped its return to positive sales growth. Though hard to quantify, with Penney reporting comps gains over the past year and its rivals seeing same-store sales trending lower, it seems customers may have been migrating from Macy's and Kohl's and heading back to J.C. Penney.

Both J.C. Penney and Macy's have since announced store closings and layoffs as part of restructurings needed to meet the changing demands of consumers who are increasingly looking online to shop. Macy's also reported higher holiday sales on muted expectations while Kohl's has yet to announce its sales numbers.

Kohl's in particular has been on a downward path that, while not nearly as dramatic as the road J.C. Penney took, is harmful enough to have damaged it. The department-store operator has witnessed negative same-store sales in six out of the last seven quarters and net sales have been on the decline since mid-2012.

Nordstrom is really a different class of retailer than its mid-tier peers, and its sales have been more resilient over the time frames we're looking at. Third-quarter comps, for example, were up nearly 4% for the high-end department store, which it notes has been generally consistent throughout the year.

Clearing out the cobwebs

J.C. Penney has been holding the line on markdowns this year as it clambers to profitability again. Last quarter clearance merchandise was down 30% from the year-ago period.

But Macy's noted the business is just one that by its nature is heavy on promotion (as J.C. Penney learned when it tried to change the paradigm), though it won't fluctuate greatly quarter to quarter, suggesting it will keep discounting, while Kohl's was anticipating the holiday season to be exceptionally promotional. It's part of why both retailers cut their outlook for the year.

So with seasonal weather returning, no major storms keeping customers at home, an improving economy, and a better jobs picture, there's reason to be confident the rising tide that lifted J.C. Penney's boat will bring along the others, too.

Yet the return to health by J.C. Penney has come in part at the expense of its rivals and the strength it witnessed over the two-month holiday sales period may just mean Kohl's, and maybe even Macy's will get a lump of coal in their stockings.