Although 3D Systems Corporation (DDD +1.46%) has had its fair share of execution issues over the last year, the 3D printing giant still managed to build a thriving health care business comprising of 3D printers, software, and services for medical professionals to help improve patient outcomes.

If 3D Systems' management can apply the same conventions that may have contributed to the success of its health care business to areas of its business where it experienced performance-related issues, it could have a profound impact on the company's overall operating results.

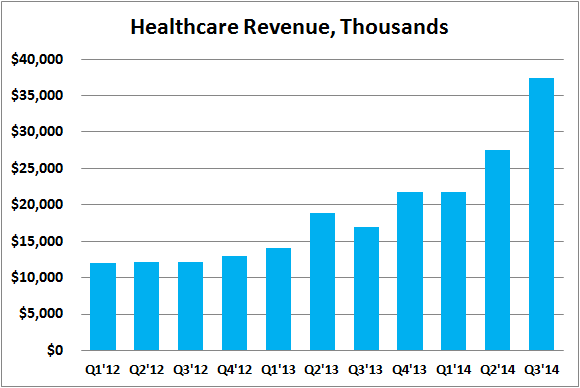

Source: 3D Systems.

The secret sauce

In recent years, 3D Systems' various health care-related acquisitions have come together to create a comprehensive portfolio of health care solutions for medical practitioners. Consequently, 3D Systems' health care-focused portfolio gives medical professionals the ability to:

- Plan and rehearse difficult surgeries, whether virtually, or with a physical 3D-printed model.

- 3D print personalized prosthetic limbs, implants, and even "exoskeletons," for a fraction of the cost of traditional manufacturing methods.

- 3D print individualized dental crowns, bridges, and implants.

- Convert medical imaging data, whether film or digital, into 3D-printable format.

Considering health care-related applications are expected to be one of the 3D printing industry's biggest growth drivers in the future, 3D Systems' health care portfolio appears to be well positioned to capitalize on this potential opportunity. If successful, one would expect that 3D Systems' health care-related revenues could continue to make up a larger percentage of the company's total revenue.

Room for improvement

It's possible that 3D Systems' success in health care could be attributed to having a more clearly defined strategy than the rest of its business. After all, 3D Systems' health care solutions essentially allows the company to be vertically integrated in a specialized market, from surgical preplanning to the operating table. The same can't necessarily be said for 3D Systems' entire business, considering the company's jack-of-all trades approach has proven to be more of an operational headache than a competitive advantage in recent times.

Specifically, the company's cash conversion cycle has been steadily rising, and the return it's been generating from its investments has been steadily declining, both of which suggest management is distracted from making operational efficiency a top priority. Management's distractedness, likely brought on by its hyper-aggressive acquisition strategy, may have also trickled down into delaying the shipment of its Cube 3 consumer-oriented 3D printer during the third quarter, and could have contributed to the persistent manufacturing constraints that has been plaguing its line of direct metal 3D printers.

Getting back on track

What 3D Systems can learn from the success of its health care business is that a clearly defined strategy can help make it successful. Looking at the bigger picture, 3D Systems has set itself on a quest to become the Amazon.com of 3D printing as the most diversified and vertically integrated 3D printing player in the industry. The risk of such an ambition is moving too fast and creating operational issues that are associated with being spread too thin. However, judging by the success of its health care business, perhaps investors aren't giving 3D Systems enough time to better define, build out, and fine-tune the remainder of its business segments?

Going forward, investors should seek evidence that 3D Systems is working to replicate the success of its health care segment in other areas of its business.