It has been said that numbers don't lie. While that might be true, sometimes numbers don't tell the whole story. That can lead to some misleading assumptions.

Investors at Core Laboratories N.V. (CLB +0.00%) are currently being mislead by some numbers that, at first glance, make the company look expensive and loaded with debt. However, by drilling down a little deeper, we see a much different story.

One pricey book?

One number investors are drawn to when looking at a company's value is its price-to-book ratio, or P/B ratio. Book value gives investors a rough idea of what a company would be worth if it went belly-up. So, the P/B ratio gives investors a hint that they are either paying too much for a company's assets, or that the company is undervalued relative to what its assets could fetch if liquidated in a bankruptcy sale.

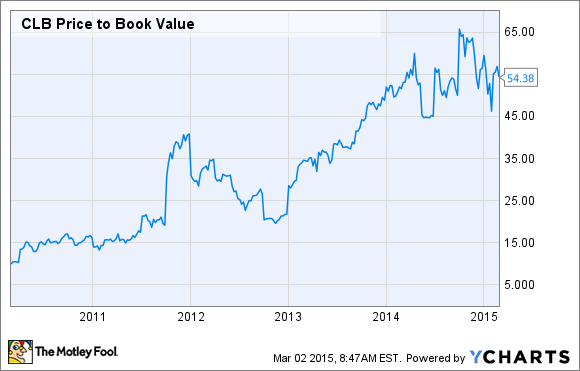

Ideally, investors would prefer to pay about 1.0 times a company's book value. Anything less than that is thought to be a good deal, while anything higher is considered a premium. That said, in most cases, a company should trade for a premium to book value, as it is hopefully creating value out of its assets. In fact, even the great Warren Buffett has said he'd buy back stock in his company hand over fist if it ever sold for 1.2 times its book value. That's why even he would likely blush at the P/B ratio of Core Labs, which is seen in the following chart:

CLB Price to Book Value data by YCharts.

At 54 times book value, Core Labs' numbers say it's wildly overvalued. However, the reason its book value is so low because the company really doesn't own a lot of assets. Core Labs is actually a technology company, so its asset-light business model doesn't really work with this type of valuation metric. We'll see why when we take a closer look at the company's balance sheet and its cash flow.

Loaded with debt?

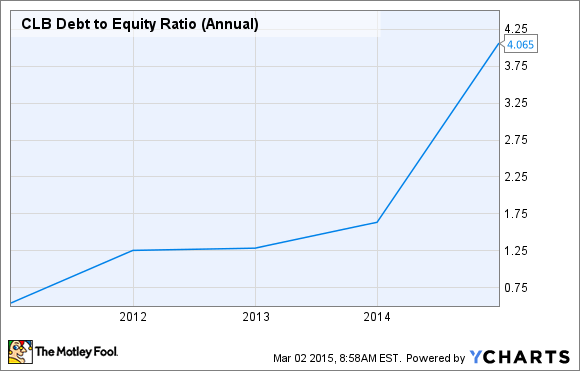

Another misleading metric for Core Labs is the debt-to-equity ratio, which measures a company's financial leverage. Here again, a high number suggests a company is using a lot of debt to fund its growth. When we look at Core Labs, this number seems to be zooming higher:

CLB Debt to Equity Ratio (Annual) data by YCharts.

But remember: Core Labs is an asset-light company. As of the end of last year, it had just $675.7 million in assets, yet the company currently has a market capitalization of just around $5 billion. Meanwhile, the company has $356 million in long-term debt and capital leases, but just total equity of $94 million. So, because its balance sheet is small because of the asset-light nature of its business, the company's debt-to-equity ratio also appears to be out of sorts.

What's more important is that those assets generate an astounding amount of cash flow. Last year, the company generated operating income of $346 million, which easily covered the company's paltry $10 million interest expense. Further, when all was said and done, the company was left with an astounding $267 million in free cash flow.

It's also worth noting that instead of allowing that cash to pile up on its balance sheet, Core Labs used it to buy back stock and pay dividends. In fact, last year, the company returned $350 million in cash to shareholders, using its balance sheet to return even more cash to investors than it produced in free cash flow.

Investor takeaway

The bottom line here is that Core Labs debt is far from a worry as it generates enough cash that it could completely wipe out its debt in less than two years if it wanted to do so. It also returns all of its cash to investors instead of letting it pile up on its balance sheet, which makes its book value look small. This makes Core Labs a textbook case where the numbers clearly don't tell the whole story.