The offshore drilling industry is facing what Carl Trowell, CEO of Ensco calls a "severe fall-off in customer demand that's unprecedented compared to what we've seen in prior cycles." After examining the earnings and conference calls of both SeaDrill (SDRL +0.00%) and Transocean (RIG +3.01%), there are three reasons I think long-term investors will do better owning SeaDrill rather than Transocean.

SeaDrill's fleet is better where it matters most

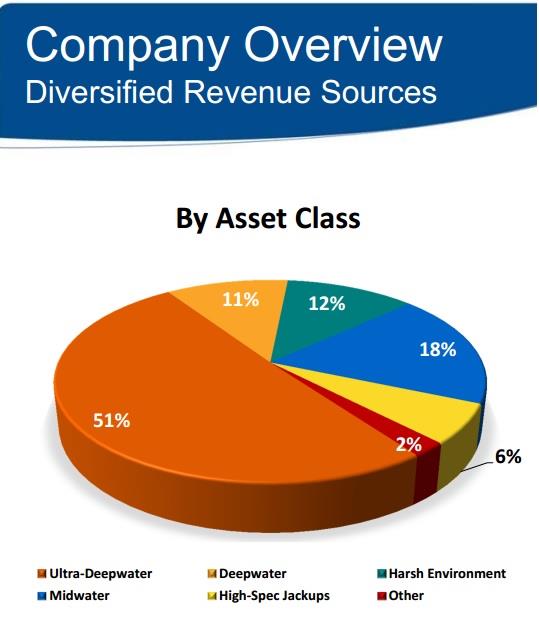

Source: Transocean investor presentation

As this pie chart makes clear, ultradeepwater (UDW) rigs represent the most important revenue source for Transocean, a fact that is also true for most other drillers, including SeaDrill. UDW rigs, especially drillships, command not only the highest day rates, but are likely to be the largest drivers of growth in this industry. That's because, according to analyst firm Rystad Energy between 2012 and 2030 UDW oil production will grow 9.5 and 19 times faster than conventional deepwater drilling, and onshore oil production, respectively.

SeaDrill's fleet of UDW Drillships makes up 47 % of its total fleet and has an average age of have an average age of just 5 years compared to 23 years for Transocean.

Source: SeaDrill investor presentation.

The older age combined with the lowest oil price in six years has resulted in a UDW utilization rate of just 69%, compared to SeaDrill's 94%, in the latest quarter.

More modern fleet equals more money

SeaDrill's more modern fleet allows it to command a higher than average day rate, even during this harsh industry downturn. For example here are the average day rates for each company's UDW drillships, the industry's most profitable rig type:

- SeaDrill: $530,000

- Transocean: $402,000

- Industry Average: $514,000

However SeaDrill's prominence over Transocean is more than just about newer rigs that command higher day rates. SeaDrill's management also seems better at securing more numerous and superior contracts.

SeaDrill's backlog grows slightly while Transocean's shrinks

In 2014 SeaDrill was able to grow its contract backlog. This is despite decreasing demand, and even accounting for the recent removal of $1.1 billion in backlog due to Petrobras (PBR +1.70%) demanding contract renegotiations for two of SeaDrill's UDW rigs..

Even if Petrobras completely cancels those two contracts SeaDrill's backlog will still have grown by $200 million--or 2%--in 2014. While 2% growth doesn't sound like much, but when viewed in the context of such a horrific industry downturn and compared to Transocean's 22% backlog decline in 2014, SeaDrill's ability to maintain a stable backlog is a triumph.

Meanwhile, Transocean's backlog shrinkage is facing a potential disaster in the form of a UDW contract cliff that, according to UBS analysts, might result in 50% to 60% of its UDW rigs becoming idle by year's end. Given that an idle rig costs an average of $110,000 per day to maintain, Transocean's might end 2015 with 18 idle rigs that cost it $2 million per day to maintain but contribute no revenue.

Takeaway: SeaDrill is more likely to come out of industry downturn stronger than ever

While the offshore drilling industry has been decimated over the past two years, I remain bullish on its long-term prospects. In my opinion, SeaDrill's newer fleet, better ability to secure high day rates, and more stable backlog give it the greatest chance of not just surviving the oil crash, but being able to participate in industry consolidation and potentially ending up with even greater market share and pricing power once oil prices finally recover to more sustainable levels.