The beleaguered oil industry was hit with a double dose of bad news on Tuesday, which initially sent oil prices down. On the supply side, Saudi Arabia continues to make good on its refusal to cut its production, instead, it actually boosted production close to an all-time high. Meanwhile, weaker than expected demand in China doesn't appear to be improving as factory data from the world's top oil importer slipped to an 11-month low. Unless these two trends reverse course both could continue to put pressure on oil prices in the months ahead.

Gushing supplies

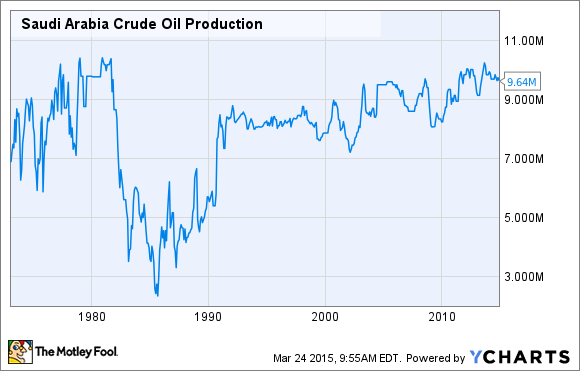

Saudi Arabia is making it abundantly clear that it has no intention of cutting its oil production to reduce the current glut of oil on the market. This past weekend its OPEC governor, Mohammed al-Madi, said that the market can forget about a return of triple digit oil prices for the time being. That statement was backed up by the country's oil production data, which according to a Reuters report is now up to 10 million barrels per day. Not only is that near its all-time high, but its 350,000 barrels per day more than the country told OPEC it would produce last month. In fact, as we can see in the following chart the Kingdom's oil output has steadily risen over the past few decades and is nearing its previous peak from the 1980s.

Saudi Arabia Crude Oil Production data by YCharts

Typically the Saudi's are the first to cut oil production when the market has too much supply. However, this time it's more concerned with keeping its share of the oil market that it's willing to flood the market with cheap oil in order to slow down production growth from places like the U.S., Canada, and Russia. This is leaving the world short of places to put the excess oil as storage space is quickly running low due to weaker than expected demand.

China continues to slow

To make matters worse, China, which is the world's second largest economy and top oil importer, continues to see its economic growth slow suggesting its demand for oil could be even more tepid in the months ahead. The latest data out of China shows that factory activity is now at an 11-month low. This was after the HSBC/Markit Purchasing Managers' Index was at 49.2 for March, well below the 50.7 mark from February. Not only is that below the 50.6 that economists had expected, but it's now below the 50-point mark that separates growth from a contraction.

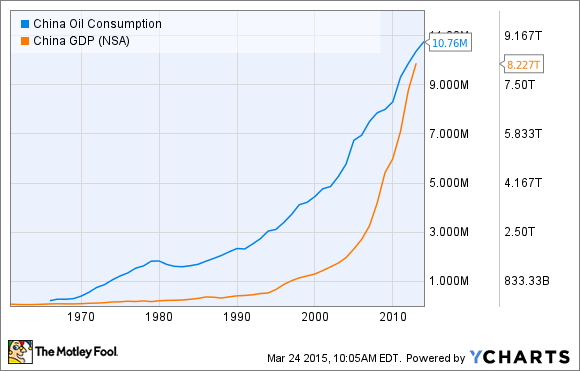

That's bad news for oil prices because as the following chart shows China's rapidly expanding economy has been a key driver of its surging oil demand over the past decade.

China Oil Consumption data by YCharts

With China's economic growth slowing down it's leading to a slowdown in its demand for oil. That leaves robust global oil supplies with nowhere to go at the moment as demand for oil in Europe has been weakened by its own economic issues while the U.S. no longer needs as much imported oil thanks to efficiency gains as well as its own robust output. This will put pressure on oil prices as increased demand for oil from China was seen as a key for an oil price rally.

Investor takeaway

So much for peak oil as Saudi Arabia has now pushed its production close to its all-time high with no signs that it plans to tap the brakes. That's coming at the worst possible moment as the oil market is oversupplied by upwards of two million barrels per day at the moment due to weaker than expected demand in China. Worse yet, Chinese demand could start to contract as its economic machine is notably showing down. This means that investors in oil stocks are in for more volatility as the market continues to work through its supply and demand issues.