Source: Apogee Enterprises.

When strong stocks build up solid momentum, the results can be extremely favorable for long-term shareholders. That's been the case recently at Apogee Enterprises (APOG +0.32%), with the glassmaker having posted impressive growth. Coming into Wednesday afternoon's fiscal fourth-quarter financial report, some investors feared that Apogee might have trouble keeping up its breakneck pace of revenue and earnings gains. Yet Apogee put any of those fears to rest with its results, which boasted big jumps in many key areas. Let's take a closer look at Apogee and how the maker of architectural glass and framing systems has fared recently.

Building bigger success at Apogee

Apogee continued its string of topping investor expectations, capping an extremely impressive year for the company. Sales for the quarter jumped 15% to $246.7 million, easily topping the 13% growth rate that most of those following the stock had expected. Earnings per share soared 74% to $0.47, and traders reacted favorably to the $0.04 per share beat compared to the consensus figure of $0.43 per share. Backlogs made another nice jump, climbing almost by half to $490.8 million.

Nearly all of Apogee's major business segments contributed to the overall growth in the company. Only the Architectural Services unit showed flat revenue, and operating income fell by about 125 from year-ago levels. But the Architectural Glass and Architectural Framing Systems divisions were the stars of the business, as sales jumped 22% in both units and operating income improved dramatically compared to 2014's fiscal fourth quarter. A rise of 18% in sales at Apogee's Large-Scale Optical Technologies unit also resulted in a solid 15% gain in operating income.

Source: Apogee Enterprises.

Apogee celebrated its good news and anticipated further success ahead. As CEO Joseph Puishys said, "Our architectural markets are expected to again grow in the mid-double digits in fiscal 2016, and we continue to have robust bidding and award activity. Together, these factors give us continued confidence in sustained growth."

Apogee looks forward

In particular, Apogee is looking at strategies designed to make the most of all of its opportunities. Puishys noted, "Our strategies to grow through new geographies, new products, and new markets, along with our focus on productivity and operational improvements, are delivering results." Expectations to top the $1 billion mark in sales in fiscal 2016 are consistent with what investors already expect, but it's still a positive sign of the optimism that Apogee has right now.

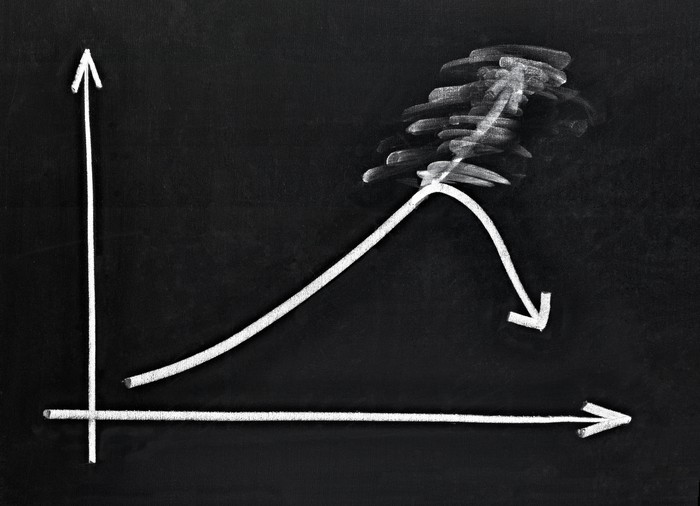

Overall, the guidance that Apogee gave, while favorable, didn't come as a big surprise to investors. Apogee thinks it will see sales growth slow to 10% to 15%, which will be a letdown after fiscal 2015's 21% gain. Earnings of $2.05 to $2.20 per share would be in line with the $2.14 per share consensus among those following the stock, even though it would represent a slowdown in earnings growth of about 10 to 20 percentage points.

One favorable sign for investors is that Apogee is looking beyond simply growing for growth's sake and instead is getting smarter about the type of growth to seek out. The company expects backlogs to continue to climb throughout the year, but it expects the rate of growth to slow later in the year specifically because it will hold back growth in the key Architectural Services sector. Instead, it will look at boosting margins by only taking on the most profitable projects available. With 80% of its current backlog expected for delivery in the coming year, that will mean that Apogee will have to generate considerable new sales to replenish its pipeline for the future.

Apogee stock soared on the favorable news, climbing almost 6% in the first hour of after-hours trading following the announcement and reaching new record levels for the share price. Although investors might need to get used to decelerating growth as the company gets bigger, Apogee appears to be well-positioned to take advantage of a strong architectural market as long as it lasts. With the U.S. economy still going strong, Apogee Enterprises could see further long-run gains as it continues to refine its approach and build up its business.