Advertising giant Omnicom Group (OMC +1.54%) reported first-quarter earnings on April 21, with revenue down slightly, but net income up 1.8%. On the surface, it looks like a less-than-spectacular quarter.

However, when you peel back the layers, there's more to the story, as is often the case. Investors who only read the highlights may have easily missed some things that give the company and its investors some durable advantages. Let's take a look.

Currency headwinds hiding solid growth

Omnicom does about half of its business outside of the U.S., and foreign exchange had a major impact on the company's top line. According to CEO John Wren, the company's international sales were reduced $226 million -- that's more than 6% of total sales -- by foreign currency exchange rates. CFO Phil Angelastro said that 45% of the FX impact was directly related to a weak euro, but essentially every currency was weaker against the dollar versus a year ago.

But what this currency business disguises is that the company actually grew organic sales -- which is revenue normalized to remove acquisitions and FX impact -- in the quarter, by about 5%. That's pretty important to the company's bottom line. It's tied to the nature of of the company's business -- versus, say, a manufacturer -- and how its revenues and related expenses are both generated in the same currencies. This is part of why, even after losing more than 6% of total sales on currency exchange, the company's profits weren't killed, but actually managed to go up -- which I will discuss in more detail next.

Why profits went up in the face of declining revenue

Understanding the economics of Omnicom Group's business is key to understanding how FX affects its bottom line less than that of companies that make a physical good. For example, a company that makes a widget in the U.S., but then sells that widget in Europe, is effectively dealing with higher costs to produce its goods today, meaning it must either raise its prices in Europe and potentially lose customers, or keep prices down, and take a hit to its profits. The higher the amount of fixed costs a company has in its primary country, the more it will be affected by foreign exchange.

Omnicom's "widget" is almost always the people and resources that live and work in the country or region where the work is being performed, and since almost all of its revenues are denominated in the local currency, its expenses track the value of the currency. So while weak foreign currencies will mean reduced revenues and profits, expenses will never outrun revenues.

As the table below shows, if organic revenue grows, then profits can grow, too, even if foreign exchange means a decline in revenues:

Image source: Omnicom Group earnings release.

This is further demonstrated in how cash operating expenses declined about $31 million in the quarter. That was one of the key drivers behind the company's slight profit gain even with the FX impact on reported revenue.

Per-share value creation remains management's goal

Omnicom Group continues to throw nearly every dollar it makes back to shareholders, either through its dividend, or through share buybacks, and this quarter was no exception.

The company produced $321 million in free cash flow in the quarter, and spent $382.3 million in dividends and share buybacks, dipping into its $1.5 billion cash stockpile to cover the difference between free cash produced and cash spent. This is not new for Omnicom Group:

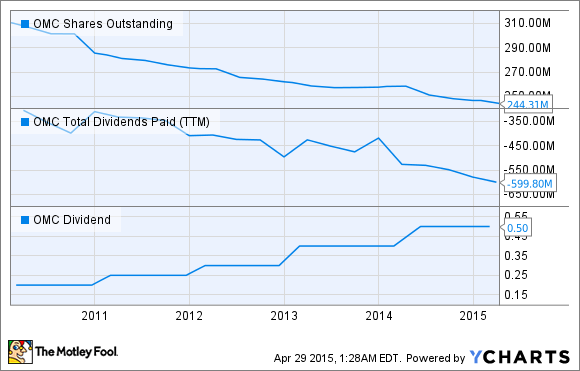

OMC Shares Outstanding data by YCharts

Since 2010, the company has reduced the share count by 21%, while increasing its per-share dividend by 150%. All those share buybacks mean that the cost of the dividend program has roughly doubled since 2010, when the company paid out about $320 million in dividends, versus $599 million over the past 12 months.

Furthermore, all that share repurchase activity has allowed what is really a rather modestly growing business to really increase its earnings per share. Over the past five years, Omnicom Group revenue has only increased about 29%, while net income has gone up about 39%. However, EPS has increased 65%, since the share count has been significantly decreased.

The company does make acquisitions, typically "bolt-on" agencies that add some small incremental value, but its aggressive focus on returning profits to shareholders has largely prevented management from misguided attempts to grow the business (last year's failed merger with Publicis excepted). Simply put, the company's efforts to keep giving cash (and more of the company) back to shareholders means less cash laying around to waste.

Looking ahead

Omnicom Group isn't sexy or very likely to grow quickly, but it's a leader in its industry, has favorable economics, and a really solid program to keep returning cash to its investors. While one should never ignore the biggest risk to the company -- the impacts of a future recession on advertising and marketing budgets -- the long-term prospects look like they're relatively solid.

The dividend yield of around 2.5% isn't sexy either, but if it's long-term dividend growth you're counting on, the company has increased its payout regularly since 1998. If you'd bought shares back then (at about $20), you'd be getting about a 9% payout on your original investment, based on the current dividend. I'm not saying an investment in the stock today would lead to the same result in 17 years, but there's something to be said for the company's track record.