Logo: GrubHub

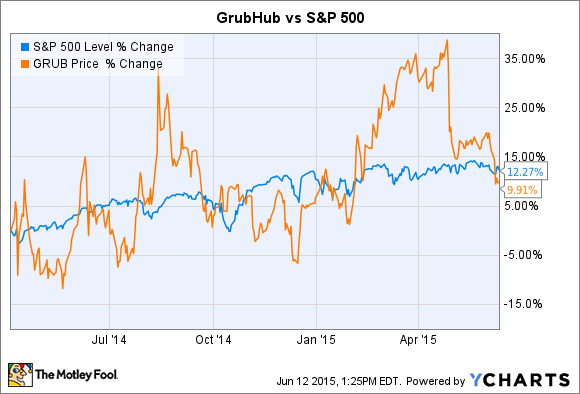

It's been just over a year since GrubHub's (GRUB +0.00%) public market debut. For investors, it's been a fairly mediocre ride. Those who managed to buy in at the IPO price of $26 have done relatively well, but those who snatched up shares after the initial spike are sitting on a modest 9.9% gain -- worse than the broader S&P 500.

Let's take a look at how GrubHub's business has performed in its first year as a public company and its prospects for the future.

Disappointing growth

Fortunately for interested investors, GrubHub's business is fairly straightforward. GrubHub is a platform for diners -- specifically, those who wish to order takeout or delivery food from nearby restaurants in an era of online shopping. Some restaurants are large enough to supply their own technology -- for example, Domino's robust pizza app -- but given that nearly two-thirds of restaurants in the U.S. are small businesses, most lack the capital and technical acumen to build their own individual platform.

Enter GrubHub, which handles online ordering for roughly 35,000 restaurants. In exchange for its services, GrubHub takes a cut of each sale. That's been the story since GrubHub's IPO, and it really hasn't changed significantly in the last 14 months.

GrubHub's business has continued to post stellar growth in the wake of its IPO. However, the growth hasn't been as explosive as many were anticipating. GrubHub shares shed more than 9% in April, for example, following a disappointing earnings report. GrubHub's revenue rose 51% on an annual basis, exceeding analysts' expectations, but its earnings of $0.12 per share fell short of a $0.14 estimate.

GrubHub is valued fairly aggressively. It currently trades with a trailing price-to-earnings ratio of around 105. That's not surprising given GrubHub's rapid growth, but any quarterly report that misses expectations is likely to be met with significant selling given the still somewhat speculative nature of GrubHub's business.

Rising competition

On a more fundamental basis, GrubHub is facing the threat of rising competition. Although it clearly isn't affecting GrubHub's growth (at least not yet), in the future, GrubHub's business could be devastated by a number of tech firms much larger than itself.

GrubHub has begun to branch out into delivery, a seemingly natural extension of its online ordering platform. In February, it acquired two companies -- DiningIn and Restaurants on the Run -- to help it facilitate this initiative. Unfortunately for shareholders, it isn't alone.

Yelp, which has direct relationships with over 34 million local businesses -- many of them restaurants -- also made an acquisition in February, buying Eat24, an online ordering and delivery platform, for $134 million. On its own, Eat24 may not have been able to topple GrubHub, but combined with Yelp, it could prove to be formidable competition.

Amazon entered the local order and delivery market last December, with a limited roll-out in its home city of Seattle. Google has also begun to dabble in the market, though it doesn't appear to be direct threat -- rather than facilitating the orders itself, it's built a platform for mobile users to choose from a variety of different services. Still, that could pull customers from GrubHub's platform and encourage increased competition. Uber has launched UberEats in select cities, using a network of drivers to deliver food.

GrubHub is in a better spot today

Nevertheless, GrubHub's business appears to be in a better spot today than it was when it entered the public markets last April. It's certainly seeing more demand: Active Diners -- the number of unique customers that placed an order on GrubHub's platform in the last 12 months -- has risen 46%. Daily Average Grubs -- the average number of meal orders per day -- has risen 30%.

GrubHub is profitable, which is more than can be said for many recent IPOs, but admittedly, only modestly so. Still, assuming that GrubHub can survive in an increasingly competitive market, it looks like a more attractive investment today than it was last year.