What: According to S&P Capital IQ data, shares of longtime weight-loss stalwart Weight Watchers International (WTW +0.00%) dropped 11% last month, only to shed another 20% so far in July. This continues a trend that has seen the company shed more than 90% of its stock market value since May of 2011:

WTW Total Return Price data by YCharts.

More recently, Weight Watchers stock is down 84% since the beginning of the year.

So what: Weight Watchers has been synonymous with weight loss for decades, but as technology -- especially mobile devices -- has become more pervasive, Weight Watchers' paid membership program has simply lost relevance. There are now dozens of apps people can use to track the foods they eat, create more healthy meal programs, and track their activity -- many of which are free for users -- versus attending weekly meetings and paying for the service.

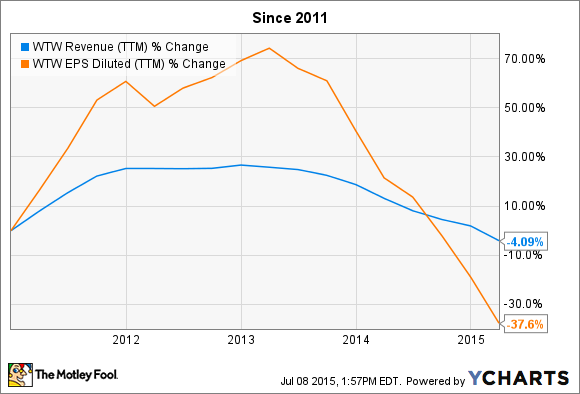

The impact has been a major blow to the company's sales and profits:

WTW Revenue (TTM) data by YCharts.

Weight Watchers has made some efforts to refocus and use technology to both be more competitive and increase its appeal to more potential customers, but so far, its efforts have yet to pay off, and sales and membership numbers continue to decline.

Now what: Recent rumors of a potential takeover bid caused the stock to shoot up, but it quickly gave back all of those gains and is down another 20% since the beginning of July. Weight Watchers' stock is also heavily shorted, with more than 20% of shares outstanding sold short as of the most recent data.

Looking long term, Weight Watchers' program has been around for decades, and it has proven to be effective for people who stick to it, which is something that the company's regular meetings are designed to help with. Its program is as much about helping people create healthy food habits as it is about tracking calories or activity, which some question if free apps can do as effectively.

But be that as it may, Weight Watchers must adapt to the way people use technology. It has invested in tech, acquiring three health and fitness-related companies over the past year in order to expand its presence in this arena if it expects to find new users willing to give its weight loss program a try.

There is also some opportunity with the Affordable Care Act, which offers reimbursement for certain weight-loss programs, but so far, the company has had very little success working with insurers to make its program part of this.

In summary, Weight Watchers has been around for decades, largely because its program works, but that's no guarantee the company will turn things around anytime soon. This could turn out to be a great price, but I'm not buying any more shares until there's some evidence the company can stem the losses and start adding and retaining more members.

Until Weight Watchers' management can figure out how to appeal to more users, it's probably best to keep this stock on your watchlist.