As the biggest mortgage lender in North America, Wells Fargo & Co. (WFC 0.96%) earnings will be closely watched to see how the housing market is likely to trend in the coming quarters. In addition, the bank has become the benchmark operator in the bread-and-butter commercial banking world. With these two considerations in mind, let's take a look at some of the key numbers behind the bank's second-quarter earnings report.

Wells Fargo & Co. earnings

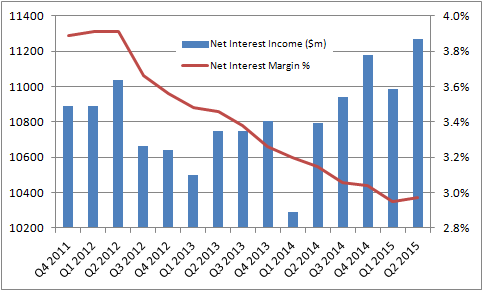

In a nutshell, the trend in Wells Fargo's earnings has been for declining net interest margins. NIM simply means the difference between the interest its investments generate and its interest expenses divided by its average earning assets. A high NIM is better for Wells Fargo.

Part of the reason behind the NIM's decline has been a rapid rise in core deposits -- which require Wells Fargo to pay interest -- while the bank has struggled to significantly grow its loan and mortgage book in recent quarters. Furthermore, credit loss provisions have been on the rise in recent quarters, which eats into net interest income.

Turning to the noninterest income side of things, the bank's noninterest profits have been curtailed in recent quarters thanks to rising expenses.

In summary, the things to look out for are:

- Non-interest expenses growth

- Movements in NIM

- Comparative growth in core deposits and loans

- Growing credit loss provisions eating into net interest income

Non-interest expenses growing

As you can see in the table below, non-interest expenses continue to grow while non-interest income declined on a year-over-year basis. The result is that income before income tax expenses declined 1.22% compared to last year.

|

Q2 2015 ($ millions) |

Q2 2014 ($ millions) |

Change | |

|---|---|---|---|

|

Net interest income after credit loss provision |

10,970 |

10,574 |

3.75% |

|

Non-interest income |

10,048 |

10,275 |

-2.21% |

|

Non-interest expense |

12,469 |

12,194 |

2.26% |

|

Income before income tax expense |

8,549 |

8,655 |

-1.22% |

Source: Wells Fargo & Co. presentations. All figures in millions of U.S. dollars.

Slight NIM increase

On a more positive note, there was a slight sequential uptick in NIM as it rose to 2.97% from 2.95% in the first quarter of 2015. According to the earnings release, there was an increase of 5 basis points (where 100 basis points equals 1%) in NIM thanks to "growth in investments and loans, and lower deposit costs" (4 basis points) and " variable sources contributed 1 basis point." Against this, the growth in customer deposits "was dilutive to net interest margin by 3 basis points."

Source: Wells Fargo & Co. presentations. All figures in millions of U.S. dollars.

The good news is the increase in NIM helped net interest income rise more than 4.4% on a year-over-year basis.

Core deposits and loans

A look at core deposits and loans reveals that Wells Fargo had a pretty good quarter in terms of increasing its loan book. As the chart below demonstrates, loans at period end increased by $27.2 billion from the end of March 2015.

Meanwhile, core deposits at period end declined by $4.5 billion from the end of March. On a year-over-year basis, total loans at period end increased by 7.2%, with core deposits up 7.5%.

Source: Wells Fargo & Co. presentations. All figures in millions of U.S. dollars.

The increase in the loan book in the second quarter is good news for investors. Moreover, mortgage originations jumped to $62 billion, an increase on the $49 billion recorded in the first quarter. However, management outlined that it expected mortgage origination to be lower in the third quarter.

Credit loss provisions

Finally, let's check in on credit loss provisions. It's something to pay close attention to because it can flatter reported profits. For example, if a bank is aggressively decreasing its credit loss provisions, then its income will receive a boost that might not prove sustainable going forward. On the other hand, rapidly increasing provisions can hurt profits.

As you can see in the chart below, credit loss provisions fell sequentially, but they increased on a year-over-year basis from $217 million in last year's second quarter to $300 million in the second quarter of 2015. This suggests that the bank's interest income isn't being artificially boosted by the bank being generous with its credit loss provisions.

Source: Wells Fargo & Co. presentations. All figures in millions of U.S. dollars.

The takeaway

All told, the increase in the loan book is a good sign, but the ongoing year-over-year increases in non-interest expenses is a matter of concern. NIM appears to have bottomed, and it will be interesting to see if it increases, if and when the Federal Reserve increases interest rates.

Meanwhile, credit loss provisions appear to be on the rise -- not necessarily a bad thing as credit quality is unlikely to increase indefinitely. On balance, it was a decent quarter for Wells Fargo from the interest income side, but investors will need to keep an eye on non-interest rate expenses in the future.