Source: Mosaic.

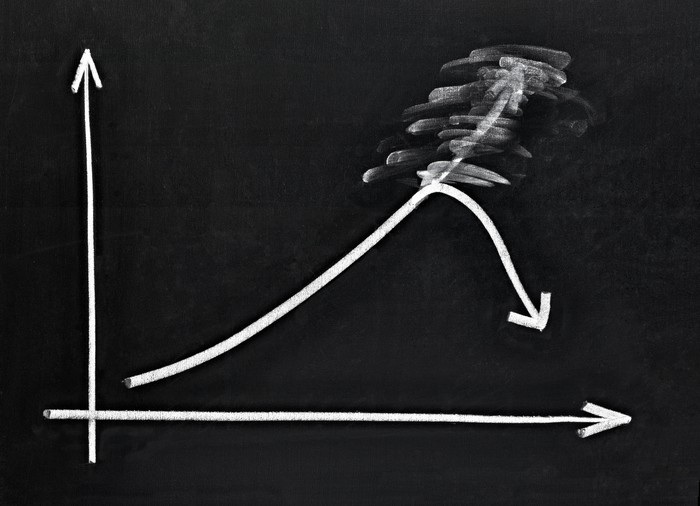

Commodity-related companies have faced unusually challenging conditions lately, and businesses that rely on healthy commodity prices have slumped in response. Fertilizer giant Mosaic (MOS 1.00%) is one such company, with weaker prices for farm crops having had an impact on demand for its products and industry dynamics further weakening Mosaic's pricing power. Nevertheless, Mosaic investors were optimistic coming into Tuesday's second-quarter financial report, and the fertilizer company's results showed that their faith in Mosaic's long-term prospects was justified, with healthy gains on the bottom line. Let's look more closely at Mosaic's latest results and why it had such strong results this quarter.

Mosaic sends up healthy growth shoots

Mosaic's second-quarter results gave investors a nice boost, with particular strength on the earnings front. Sales inched higher by 2% to $2.49 billion, which was slightly less than investors following the stock had expected to see. Where Mosaic's results really shone, though, was in its net income, which soared 57% to $391 million. That produced earnings of $1.08 per share, which was fully 20% higher than the consensus forecast among investors.

Looking at the fertilizer's companies various segments, the key phosphate division continued to play a key role in Mosaic's overall health. Sales volumes of 2.8 million tonnes were well above the guidance range Mosaic had initially provided, with selling prices at the top end of its range and better operational capacity than expected. The potash unit was more in line with Mosaic's previous guidance, but the division's low production costs continue to give the company a competitive advantage over some of its peers in the market. Potash selling prices picked up $13 per tonne to $280, and a big boost in operational capacity helped the company reach its sales targets.

Mosaic's international business also contributed to its strong results. Acquisitions helped boost overall sales volume and sent revenue up by 17.5% to $637 million, and although selling prices fell by $25 per ton, a 25% boost in sales volume was particularly noteworthy given overall poor conditions in the Brazilian fertilizer market.

CEO Jim Prokopanko was particularly proud of the progress that Mosaic has made in handling harsh conditions in the global market for various fertilizer products. "This quarter we generated higher earnings per share than two years ago," Prokopanko said, "notwithstanding lower potash and phosphates prices since then."

What's next for Mosaic?

Mosaic also updated its guidance for the remainder of 2015, with both favorable and unfavorable movements for certain parts of the fertilizer giant's business. On a positive note, Canadian taxes and royalties are expected to be $15 million to $25 million less than previously forecast, weighing in at $310 million to $350 million for the year. Mosaic reduced the upper end of its capital expenditure guidance by $100 million, now expecting investment of $1.1 billion to $1.3 billion. The company also guided final phosphate sales volumes toward the higher end of its previous range, now looking for 9.5 million to 10 million tonnes.

Not all the news was good, though. Mosaic reduced its sales volume range for potash by 300,000 to 400,000 tons, with a new range of 8.2 million to 8.6 million tonnes. The company also expects its international distribution segment to see volumes at the lower end of its previous range at between 6 million and 6.5 million tonnes.

Still, incoming CEO Joc O'Rourke sees Mosaic posting a solid second half. "Despite the recent swings in grain and oilseed prices," O'Rourke said, "stable farm economics, combined with the benefits of our strategic initiatives, position Mosaic to generate attractive returns for our shareholders."

For the most part, Mosaic investors agreed with that optimistic assessment, sending shares of the fertilizer company up about 3% during the morning trading session on Tuesday. With the stock having endured several years of weakness due to volatile conditions in the fertilizer industry, Mosaic shareholders have to hope that the worst is now behind the fertilizer company and that it will be able to grow these new seeds of prosperity and keep them producing fruit well into the future.