BHP Billiton Limited (ADR) (BHP 1.95%) reported underlying basic earnings of $1.20 a share in fiscal 2015. That was well below fiscal 2014 and analyst estimates. Although that's not good, it really isn't too much of a surprise, based on the continuing difficulties in the giant miner's core markets. But don't miss the silver linings on these dark clouds.

A bad year

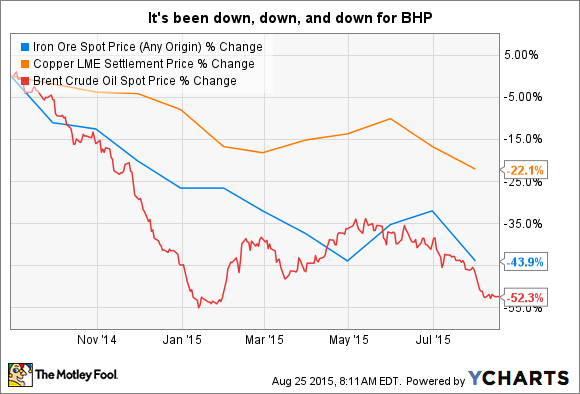

BHP reported underlying basic earnings of $1.20 a share, which isn't all that bad when you think about how ugly the commodity markets in which it operates have been. For example, iron ore prices, accounting for roughly 33% of revenues, are down more than 40% over the past year. Copper (just over 25% of revenues) is down more than 20%. And oil (about 25%) is down more than 50%. That's a nasty backdrop, and still the company's core business made money. So before looking at how bad results were relative to last year or what analysts had been expecting, step back and think about the good news that BHP made money.

Iron Ore Spot Price (Any Origin) data by YCharts

Unfortunately, though, all things are relative. Analysts had been calling for BHP to earn nearly $1.75 a share, though the low end of the range was roughly $1.00. (It looks like at least one analyst was surprised by how well the company did.) Last year, meanwhile, BHP earned nearly $2.50 a share, meaning the bottom line declined more than 50% year over year. That's pretty ugly, but makes sense given the dismal markets in which BHP was operating.

On the top line, the miner's sales also missed the mark analysts set, falling roughly 20% year over year to $44.5 billion. The average analyst estimate was $45.2 billion. It would be hard to deny that fiscal 2015 was a bad year for BHP.

Looking past the numbers

Honestly, bad was baked into the cake. But there was a lot of good in the year, too. For starters, BHP completed the spinoff of South32, which consists of most of BHP's smaller operations. It wasn't that they were bad businesses, just that they weren't material to the top and bottom lines. And they weren't as profitable. So off they went, and now BHP is a leaner, more focused company.

And while the markets in which BHP operates are under great pressure right now, BHP isn't sitting back and hoping for the best. It's actively working to keep costs down. For example, its capital spending fell 24% in fiscal 2015. Moreover, it expects that number to fall another 20% or so in the current fiscal year, with even more cuts to come in the year after that. The company is also ahead of plan on productivity gains. So BHP is doing the right things in the downturn, and it's succeeding in becoming a better company.

BHP is still chugging along despite the difficult market. Source: Bahnfrend, via Wikimedia Commons.

Then there's the dividend. BHP didn't cut it after the South32 spinoff, though it easily could have justified such a move. In fact, the dividend increased roughly 2% year over year, keeping the company's trend of more than a decade of annual dividend increases intact. It also sends a message to shareholders that BHP believes in its own future.

But that future may not show up tomorrow, so brace for another tough year in fiscal 2016. Indeed, when BHP discusses the outlook for its core commodities, it is, across the board, a long-term demand-growth story. Right now, commodities are pretty much in an oversupply situation. So the prices the company realizes aren't likely to shoot higher in the near term, which is why BHP's focus on being a low-cost producer is so important.

Nothing shocking here

If you're a long-term investor in BHP Billiton, there shouldn't be anything shocking in fiscal 2015's numbers. It was a bad year, which everyone and their brother fully expected. However, BHP is still making money and working to become an even stronger and leaner industry player. That should put it in a good position to benefit when commodity markets do finally turn around.