Image: Mosaic.

Fertilizer producer Mosaic (MOS 1.89%) has faced the same slump as many of its peers in its industry, with the decline in commodity prices weighing on demand for crop-enhancing products. Yet even though conditions in the fertilizer market have been poor for a while, Mosaic investors got even more bad news earlier this week when the company said that it would have to reduce its guidance for the third quarter and announced production cuts in both its potash and phosphate businesses. Should shareholders panic about even more trouble ahead for Mosaic, or will favorable long-term factors helping the prospects for fertilizer eventually result in a full recovery? Let's take a closer look at what Mosaic said and what investors should do in response.

Near-term challenges ahead

Just last month, Mosaic had given mixed guidance for its fertilizer production targets. The company had boosted its projections for full-year phosphate production, guiding to the top end of its previous range and expecting between 9.5 million and 10 million metric tons. On the potash side, though, less favorable conditions led Mosaic to reduce its guidance by 300,000 to 400,000 tons for the year. Even so, CEO Joc O'Rourke had seemed optimistic about Mosaic's prospects for the remainder of the year, citing "stable farm economics" and internal efforts to raise efficiency.

As a result, Mosaic's production announcement earlier this week came as a shock. As O'Rourke said, "The long-term positive outlook for crop nutrient demand has not changed, but the industry faces some near-term challenges in the current environment." In response, Mosaic said that phosphate production would be at the lower end of its quarterly range of 2.1 million to 2.4 million metric tons. Similarly, on the potash side, production should finish in the bottom half of its previous range of 1.6 million to 2 million tons.

There was some good news for Mosaic's phosphate business. Despite the drop in production, average selling prices are expected to finish in the upper half of its previous $435 to $455 per ton range. That will therefore help the company keep the Phosphate segment's margins at the level Mosaic had previously expected. In addition, international distribution volumes and margins shouldn't change from past projections, with Mosaic repeating earlier predictions for volumes of 1.9 million to 2.2 million tons and margins of $20 to $26 per ton.

Yet the outlook for potash is even gloomier. In addition to the production cuts, Mosaic thinks that average selling prices will finish in the lower half of its $260 to $280 per ton guidance. That will cause Mosaic's margins for the segment to fall into the high teens rather than sustaining 20%-plus levels.

What Mosaic investors will see

Mosaic blamed the shortfall on poor conditions, but it called out two particularly weak markets. Delayed fertilizer purchases in Brazil and North America were the primary cause for the poor market environment in Mosaic's eyes. Continued volatility in currency exchange rates, lower crop prices for grain and oilseed farm products, and the declines in several key global stock markets have all hurt the prospects for the fertilizer industry in the immediate term.

Mosaic expects to maintain its plan to slow production in its phosphates business in order to match up its supply to industry demand. The fertilizer company will also lengthen the amount of maintenance-related downtime it has at its Colonsay potash mine in Saskatchewan.

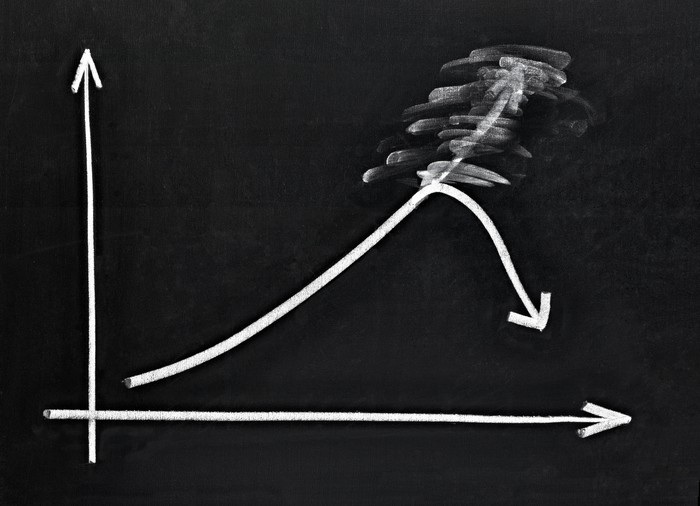

In the long run, it's clear that Mosaic sees the recent weakness as simply a consequence of ordinary market fluctuations. Prices for key crops like corn, wheat, and soybeans have all fallen dramatically from their 2012 highs, and agricultural businesses are still trying to work out the appropriate level of fertilizer purchases to maintain their own profitability. That's especially true in foreign markets like Brazil, where the weak local currency has created a huge economic ripple effect that has had consequences throughout the emerging-market nation. In North America, poor weather to begin the growing season might also have played a factor in weakening demand.

Investors have cooled to Mosaic and its fertilizer-producing peers as it becomes clear that the business isn't simply a straight-up proposition. Given enough time, though, the cyclical nature of the fertilizer business argues in favor of an eventual recovery from Mosaic.