Source: Flickr user UNMEER.

Cancer immunotherapy and infectious disease treatment developer Inovio Pharmaceuticals (INO 0.66%) tracked a bit lower -- a little more than a 1% decline -- on Tuesday Sept. 22, despite the company announcing that the U.S. Defense Advanced Research Projects Agency, or DARPA, decided to execute its option to support additional Ebola research.

Inovio buys itself more time

If the DARPA contract rings a bell, that's because, in April of this year, DARPA awarded Inovio $21 million, which was contingent upon the company bringing its DNA-based monoclonal antibody treatment into preclinical and clinical studies. Since the initial payment, Inovio enrolled 75 healthy patients into a phase 1 study, with a safety and immune response readout expected in the fourth quarter, and demonstrated the complete protection of vaccinated monkeys against the Ebola virus. As such, DARPA executed its option to continue Inovio's research, and granted the company an additional $24 million.

This is an important victory for Inovio because the company is still entirely in the clinical phase of its existence. As it moves its cancer vaccines and infectious disease therapies, such as hepatitis B and C, Ebola, and influenza, into later-stage studies, the costs to complete these trials is expected to increase. Therefore, Inovio needs to build as large of cash base as possible to help counteract what's expected to be years of ongoing cash burn.

Inovio ended its latest quarter with $154.6 million in cash and short-term investments, pumped up in May by a nearly 11 million share common-stock offering, and of course the $21 million received from DARPA in April. The additional cash from DARPA, as well as the $27.5 million it netted in an upfront payment from MedImmune as part of a cancer vaccine collaboration, would put Inovio's cash and short-term investment hoard up to more than $205 million. Based on its negative $37 million in operating cash flow during the trailing 12-month period, and taking into account the likelihood of increased clinical trial costs, the DARPA deal could push Inovio's cash runway safely into 2019.

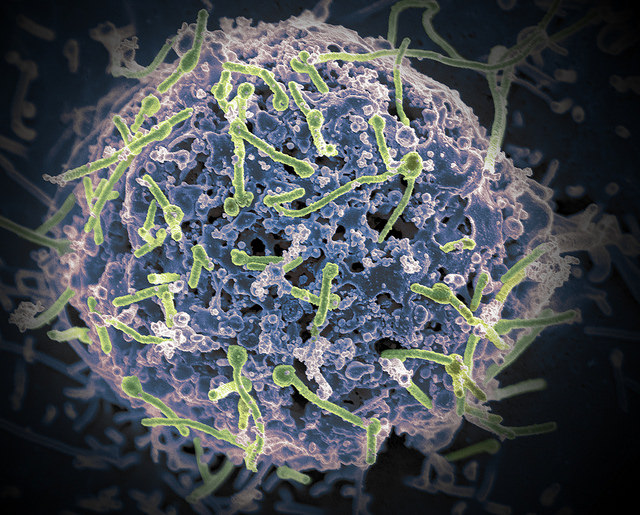

Ebola virus from Mali blood sample. Source: Flickr user NIAID.

Inovio's potentially hollow victory

Not having to worry about running out of money is a definite relief for Inovio and its investors, but Inovio's success in landing the DARPA option appears to be nothing more than a hollow victory to buy itself more time. This is in no way a knock against Inovio's DNA-based Ebola vaccine, from which we don't even have phase 1 top-line data yet. In fact, it's possible Inovio's Ebola vaccine could prove quite effective in human clinical trials.

Instead, it boils down to Inovio's Ebola program being months behind competing Ebola vaccine makers, and ultimately being at the whim of an outbreak or government demand.

Assuming Inovio's phase 1 data demonstrates a safe and effective vaccine, and it gets the green light to move into a larger phase 3 study, we're still likely looking at late 2016, or the first-half of 2017 for a data readout, and then another six-to-12 months for a possible approval from the Food and Drug Administration. It's unlikely we'd see Inovio bring its Ebola vaccine to pharmacy shelves any time before late 2017 or early 2018.

Source: Merck.

Meanwhile, Merck (MRK +0.57%) and NewLink Genetics (NLNK +0.00%) published data in The Lancet in August showing that an interim analysis of their rVSV-ZEBOV vaccine appears on pace to meet its primary endpoint in a West Africa trial sponsored by the World Health Organization. The trial of 7,651 patients were broken into two groups: one that was inoculated immediately, and another, which was inoculated after a delay.

In the group that was inoculated immediately, there were zero instances of the Ebola virus after 10 days. In the delay group there were 16 instances of Ebola infection. While the study isn't complete, this represents a statistically significant vaccine effectiveness of 100%. In other words, rVSV-ZEBOV could beat Inovio to market by one or two full years, gaining advantages that come with being first-in-class.

The other concern is that sales for any approved Ebola vaccine(s) could be held hostage by the demand of global governments. Typically, outbreaks tend to drive demand, and the most recent Ebola outbreak appears to finally be under control. Ebola vaccines aren't going to last for decades on pharmacy shelves, meaning an approved Inovio Ebola vaccine could result in lumpy sales, or worse yet, little-to-no chance of profitability.

Inovio remains gung-ho on cancer immunotherapies

The good news for shareholders is that Inovio remains committed first and foremost to its cancer immunotherapy pipeline. It could still be three or more years before we see recurring revenue from its DNA-based cancer immunotherapies, but its lead drug, VGX-3100, continues to impress.

Source: Department of Health and Human Services.

In its recently updated phase 2b data involving VGX-3100 as a treatment for cervical dysplasia caused by human papillomavirus types 16 or 18 (also published in The Lancet), Inovio announced that 43 of the 53 women whose lesions regressed exhibited a complete response. Additionally, 80% of those who demonstrated lesion regression also showed HPV-clearance, which is believed to be important for preventing recurrence of the disease. Efficacy like this is what could help Inovio land additional collaborations beyond just MedImmune as it pertains its cancer immunotherapies.

There's certainly promise to be had with Inovio, and now plenty of capital to back up years of upcoming research. Now we just need to see Inovio deliver positive late-stage clinical results in order to validate its DNA-based cancer vaccine development pipeline, and give potential Big Pharma partners and biotech blue-chips reason to seek out a partnership with Inovio.