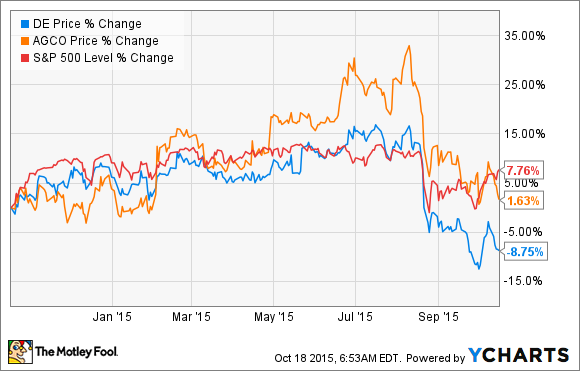

It's been a difficult year for investors in the agricultural machinery sector, as key crop prices have continued to fall, putting pressure on farmers' incomes and willingness to spend on new machinery. Consequently, the leading players in the industry, including Deere & Company (DE 1.35%), have underperformed the broader market. However, a recent report from PricewaterhouseCoopers titled "China's Agricultural Challenges" helps shed light on the long-term bullish case for buying agribusiness stocks. Let's look at the key arguments.

Near-term risk, long-term opportunity

In a previous article, I discussed some near-term risks for Deere. In particular, Deere's inventory-to-sales ratio is rising, and the company is increasingly leasing equipment, potentially putting pressure on future used-equipment prices.

But there's a case for the long-term prospects that centers on the idea that grain prices are likely to be driven higher by increasing demand from emerging markets such as China. The assumption is that as China's population gets increasingly wealthy and urbanized, its demand for protein-based calorie consumption will increase to Western levels.

The argument, repeated in the PwC report, is that "It takes approximately 7kg of feed grain to produce 1kg of beef, 4kg for 1kg of pork, and 2kg for 1kg of poultry." In other words, more protein consumed in the future could mean rising demand for grains such as corn, wheat, and soybeans. Since rising demand usually means higher prices and more acreage planted, it would be good news for Deere.

But how strong is the case?

The data

China's calorie consumption per capita has been rising in recent decades:

Data source: PWC report "Food and Agriculture Organization." All data in k-calories per capita per day.

However, the key factor is rising animal calorie consumption. China is still 30% below the U.S. in this regard:

Data source: PWC report "Food and Agriculture Organization." All data in k-calories per capita per day.

The general argument is that China's animal calorie intake will increase, leading to sharp rise in demand for feed grain. The PwC report assumes that China's meat consumption measured in kilograms per person per year will rise, from 57 kg in 2013 to 73 kg in 2025 -- approximating to current Taiwan levels.

The United States Department of Agriculture also looks into these matters, and its forecast is more conservative -- in the 60 kg to 70 kg range for China in 2025.

The PwC report argues that an agricultural area of 15 million hectares, the "size of England and Wales," will have to be planted with corn and soybeans to meet the extra grain demand from its assumptions. Again, this is music to the ears of the agricultural-machinery sector.

Moreover, even the more conservative USDA predicts that China will significantly increase its corn imports in the next decade.

A few concerns

While the case for growing meat consumption, and consequently grain demand, seems compelling, I have a few concerns.

First, there is no reason China's meat consumption will necessarily reach U.S. or even Taiwan levels. In fact, China's meat consumption of 57 kg per person per year in 2013 is already above Japan's 47 kg and Thailand's 27 kg, and it's not far off South Korea's 63 kg -- suggesting that it may not rise as much as the PwC and USDA forecast.

Second, the PwC report assumes that China's population (as well as the trend toward urbanization) will keep growing, and the decline in urban per capita direct grain consumption will level off. Both assumptions may not come true, or to the extent assumed.

Third, yield improvements could reduce the extra hectares needed to meet demand.

The takeaway

All told, the case for higher demand for grains in the future -- made by PwC and USDA -- is a compelling one and is based on extrapolating trends that are already in place. The corollary is that there will be upward pressure on prices and increased need for agricultural land -- an almost perfect scenario for Deere's long-term prospects.

On the other hand, Deere is facing near-term risks, and the assumption that China's meat consumption will necessarily rise to Western levels is open to question.