There are a lot of adjectives we can apply to the stock market, but rational is probably not one of them. Every once in a while, great companies with solid fundamentals and a great long-term future sell for dirt-cheap prices. One way you can get the best bang for your investment buck is to identify great companies and then wait to buy them when they're cheap. Not sure what a cheap valuation looks like? Well, one indicator is a company that is trading at its 52-week low.

It's not too hard to find a company in the energy space trading at its 52-week low. Heck, the SPDR Energy Select Sector ETF (XLE +0.17%) -- an ETF that tracks the entire energy sector-- isn't that far off its 52-week lows.

So we asked three of our energy contributors to share with us a stock trading at or near its 52-week low that they think has a very bright future ahead. Here's what they had to say.

Travis Hoium

The solar industry is booming, but shares of SolarCity (SCTY +0.00%) have tanked along with the rest of the energy industry in 2015. Plus, short-sellers have come after the company and injected new doubt into its business model. That presents an opportunity for investors who are willing to hang on to this company long-term.

The drop in SolarCity's shares and its tremendous growth in the past few years gives investors a great value in the stock. At the end of the second quarter, the company had $3.06 billion in retained value, an estimate of the present value of all of its contracted future cash flows, which isn't much less than its current $3.74 billion market cap.

But what's interesting about SolarCity long-term is its ability to adapt and improve its market position in the solar industry. The newly announced high-efficiency solar panel that tested as high as 22% module efficiency could put the company leaps and bounds ahead of competitors in residential solar. Energy storage and energy management are also focuses of the company's long-term research and development.

As these new products roll out and the solar industry grows, investors will like the growth they see from SolarCity. At today's price, the stock could prove to be a steal a decade from now.

Adam Galas

Few oil-related stocks have taken as bad a beating as frack-sand producer Emerge Energy Services (NYSE: EMES), which is down 95% since the oil crash began.

WTI Crude Oil Spot Price data by YCharts.

While I'll admit that the market for frack sand isn't looking so hot right now, with demand down around 40% from 2014 highs, resulting in a price decline of around 30%, I think the main reason Emerge Energy Services is now trading near its all-time lows is the 2015 distribution guidance suspension that occurred on Sept. 24.

Emerge Energy is a variable-pay MLP, which means it distributes all of its DCF each quarter. That not only potentially makes the quarterly payout highly variable but also means the optimal strategy for investing in this MLP is different from investing in a steadier-paying MLP such as fellow frack-sand producer Hi-Crush Partners -- which manages its quarterly payout to maintain a steadier distribution.

Of course, this strategy works only if your time horizon is long enough to ride out the oil crash and wait for frack-sand demand and prices, and Emerge Energy's distribution, to rise again and take the unit price with it. However, If you're patient enough and can stand the kind of gut-churning volatility we're now seeing, I'm confident the gains you'll end up with when oil prices finally recover will be well worth the effort.

Tyler Crowe

One of the hard aspects of investing in a cyclical business such as energy is to be able to separate when a company's business is suffering from a broader market downturn and when there are real structural issues with the company itself. For National Oilwell Varco (NOV 0.11%), the issues the company is facing are almost exclusively the former. As a manufacturer of almost anything an oil and gas producer needs throughout the life cycle of a well, National Oilwell has services that will wax and wane with the capital spending habits of those looking for and developing oil projects.

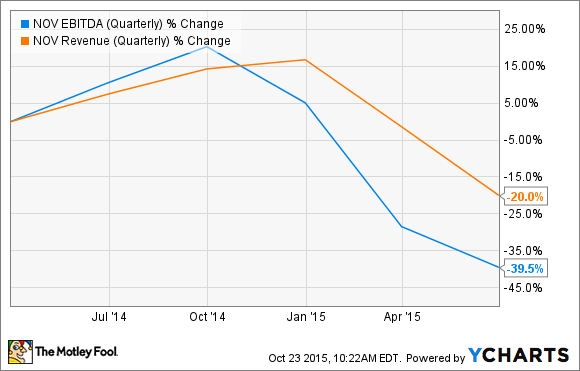

So as the demand for new rigs has dried up over the past 18 months and producers' cash flows have dried up, there hasn't been much incentive to pull more oil from the ground. This situation has caused National Oilwell Varco's revenue and profits to dry up in recent quarters.

NOV EBITDA (Quarterly) data by YCharts.

However, as a company that's been around since the very first oil well was drilled in the U.S., National Oilwell knows how to manage through the ups and downs of the market. With a rather pristine balance sheet, a large pile of cash to tap, and few continuing capital obligations, the company has the capacity to wait though these lean times and even acquire some of its competitors that may struggle through these times.

This is a stock that requires patience, as there aren't many signs that the market National Oilwell serves will pick up anytime soon. However, with shares trading near 52-week lows, and with the company's track record of working through these down cycles with grace, picking up shares today may be a pretty good idea for the long term.