The SAP HANA platform brings the Internet of Things to numerous industries. Image source: SAP

The holiday season is upon us, and there's no shortage of smart gadgets. Maybe you've been bombarded with their ads. Maybe you've seen them in stores. Maybe you've put some on your gift list. Regardless, the consumer market is brimming with products connected by the Internet of Things (IoT). But energy and manufacturing are also in-demand applications for machine-to-machine (M2M) communications, and SAP (NYSE: SAP) has a hand in both of them.

Energetic about the IoT

In the world of renewable energy, SAP's solutions enable the development of connected wind farms -- generating data from individual turbines and providing data analytics to optimize performance. A global leader in the wind industry, Siemens (SIEGY 1.88%), is using SAP's Hana Cloud Platform as the backbone for its Siemens Cloud for Industry solution. According to Peter Weckesser, CEO, customer service, digital factory of Siemens AG, "the introduction of the new Siemens Cloud for Industry powered by SAP HANA aims to provide a significant contribution toward the digitalization of the production space." Providing this solution is vital to Siemens if it intends to maintain its leadership position in the industry. Namely, it's a necessary step in trying to keep pace with General Electric (GE 2.84%), which has its own connected wind farm solution -- the Digital Wind Farm. For FY 2015, Siemens' wind power and renewables segment grew by 50% year over year, and it contributed 11.3% to Siemens' industrial businesses as a whole.

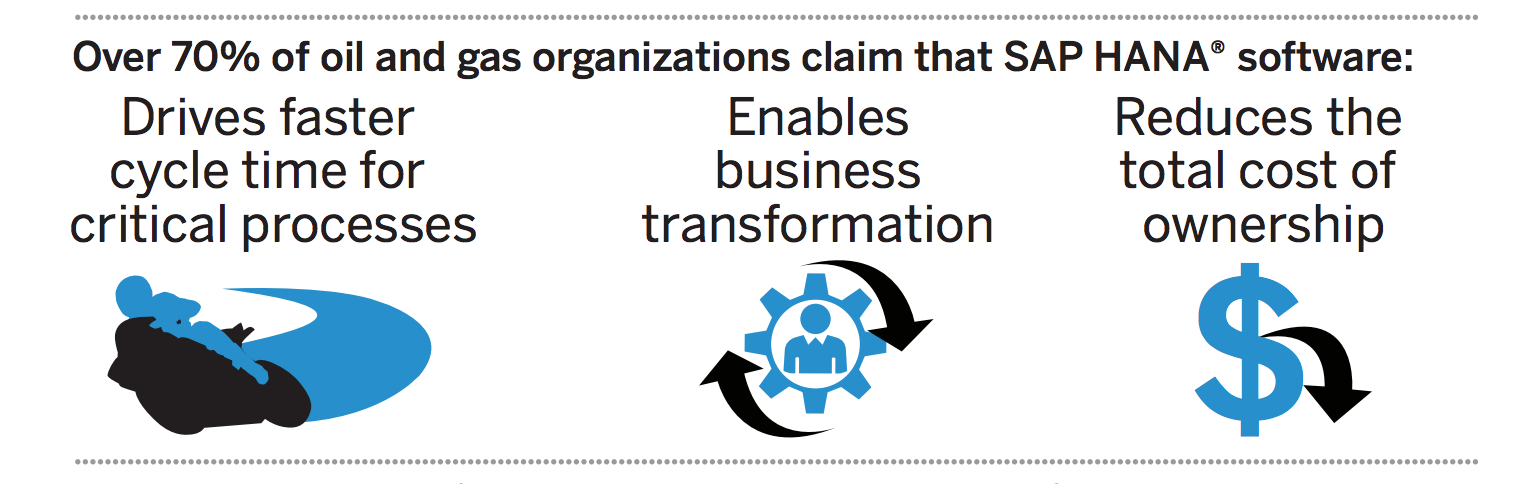

SAP's IoT solutions don't only apply to renewable energy; it services the oil and gas industry as well. Now, with oil prices as low as they are, it's crucial that oil and gas companies reduce expenses as much as possible if they hope to survive. Statoil ASA (STO +2.86%), for one, chose the SAP HANA platform and other SAP solutions, electing to shift away from the solutions it had been using from Oracle. With SAP, Statoil's financial consolidation is now six times faster, and it has mitigated risk through process automation and standardization. In speaking about SAP, Stig Skoglund, Statoil's lead analyst for performance management, said, "The new solution has a simpler architecture, enhanced features, and significant improved performance." In general, SAP identifies two key benefits for oil and gas companies:

- Optimized production processes to improve capital employed and perfect supply chains.

- Reduced operational risks and costs by leveraging available data for maximum value.

Image source: SAP.

SAP's exposure to the industry is significant. According to the company, 48% of all oil and gas organizations have installed SAP HANA, and 93% of those companies agree that the solution enables fast decision making.

Manufacturing more

Besides energy, the manufacturing industry is making use of SAP's HANA platform. Automating its manufacturing operations, Harley-Davidson (HOG +1.29%), is one of more than 1,400 companies using SAP's solutions. Subsequently, Harley-Davidson can manufacture 25% more motorcycles with 30% fewer people. In fact, the company can now do in six hours what it used to take 21 days -- produce a customized motorcycle.

Thanks to SAP, Harley-Davidson's hogs are quickly rolling off the production lines. Image source: Harley-Davidson.

But it's not just inside the factory that companies can realize the benefits of implementing SAP's solutions. Providing predictive maintenance and service, SAP is able to offer companies the ability to cut costs in the servicing of their equipment. And with its connected logistics, companies using SAP's solutions can improve their supply chain management.

The company also offers solutions directed at better warehouse management. Dr Pepper Snapple Group (DPS +0.00%) used the Supply Network Collaboration application and the SAP SNC Customer Collaboration solution to provide better data to distributors and to improve management of inventory levels. The partnership was more than successful. Realizing a nearly 20% reduction in inventory carrying costs, Dr Pepper Snapple also reported about 5% in reduced costs associated with expediting inventory transfers. Additionally, the beverage company benefited from a reduction of about 30% in costs associated with site-to-site inventory transfers. Harley-Davidson and Dr Pepper Snapple are far from the only success stories; the breadth of SAP's solutions is substantial. From research and development to manufacturing, from supply chain to sales, from finance to aftermarket service, SAP's offerings meet the varied needs of industrial manufacturing businesses.

Head in the clouds

For the past five years, management has been implementing a plan to take advantage of the growing market opportunity the cloud and IoT offer. According to Luka Mucic, the company has been successful. On the company's third-quarter earnings call, he cited SAP's "fast growing cloud business and at the same time a solid performance in the cloud. Overall cloud and software growth is strong and clearly ahead of our largest competitor."

Though he's right, the actual figures can be somewhat deceiving because of the effects of foreign currency. Cloud subscriptions and support rose 116%, from 278 million euros in Q3 2014 to 600 million euros in Q3 2015; however, in terms of constant currency, this figure becomes a 90%. In regard to cloud and software, revenue rose 19%, from 3.46 billion euros in Q3 2014 to 4.12 billion euros in Q3 2015 -- in terms of constant currency, this figure drops to a 12% improvement. Despite the adjustments, the figures are still impressive and substantiate the company's claims that it's still in growth mode.

The takeaway

Like any stock, SAP is far from perfect, and there are plenty of competitors nipping at its heels. But for those looking to grab a piece of the IoT pie, SAP offers a valid argument for investment. Companies across a wide swath of industries -- not just energy and manufacturing -- are adopting SAP's cloud-based IoT solutions. Should investors dig in further, they would be wise to keep an eye on cloud-based revenue in the quarters to come.