After enjoying three straight years of double-digit payout raises, Time Warner Cable (NYSE: TWC) investors received no boost to their quarterly dividend checks in 2015.

Yet shareholders likely aren't too disappointed. Thanks to improving operating trends and a merger agreement with Charter Communications (CHTR +5.32%), Time Warner's stock has trounced the market this year -- rising 20% compared to a 3% decrease for the S&P 500.

The deal with Charter could receive final approval early in the year, or it might hit another delay. So it's still worth considering whether Time Warner will return to its pattern of hefty raises -- or instead keep income investors waiting for their next dividend boost.

Capital return history

Time Warner has returned billions of dollars to investors over the last few years through dividends and stock repurchases. But management has tended to favor buybacks, which can be opportunistically ramped up or down, over dividend payments, which are much harder to cut once they've been established.

In fact, since fiscal 2012, the nation's second-largest cable operator has paid out twice as much cash through stock repurchases ($4.6 billion) as it has in dividends ($2.3 billion).

Before 2015's dividend pause, TWC had hiked its payout by 15% or better in each of the prior three years:

| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

| Quarterly Payout | $0.48 | $0.56 | $0.65 | $0.75 | $0.75 |

| Change | N/A | 17% | 16% | 15% | 0% |

Data source: TWC financial filings.

In absolute terms, Time Warner is paying out roughly $850 million per year in dividends, up from $700 million per year in 2012.

Strong payout ratio

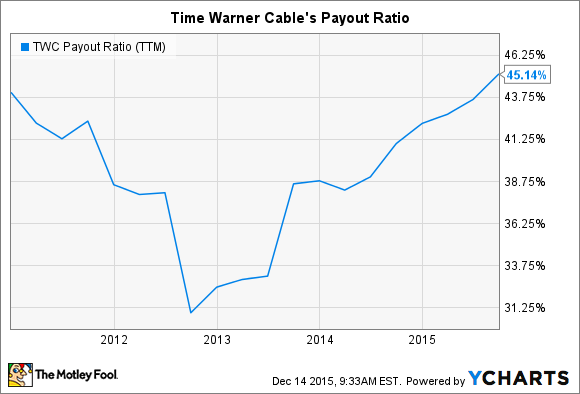

That $850 million represented less than half of the company's latest net income tally. Time Warner's payout ratio remains comfortably below 50%, which is the level that many companies aim to maintain in dividend payments.

TWC Payout Ratio (TTM) data by YCharts.

Yet, even if the payout ratio suggests CEO Rob Marcus and his executive team have room to raise the dividend in 2016, there are two other important metrics for investors to watch: earnings growth and cash requirements. After all, negative operating trends will stop a rising dividend in its tracks -- and eventually send it lower. At the same time, there are often competing cash needs, especially in a capital-intensive business like cable and Internet delivery, that may take priority over increasing a dividend payment.

Why a dividend raise is likely

The outlook is mixed on the operating front. Time Warner most recently posted accelerating revenue growth as it logged its best third quarter since 2006 in terms of cable subscriber losses and Internet service net additions. Yet operating costs also rose at a faster pace than revenue, leading to declining profitability. Content costs jumped higher by 10%, which helped push Time Warner's expenses up by 8% in the third quarter, compared to a 4% sales uptick.

Capital expenses are also growing at a quick pace. Over the last nine months the cable giant has directed $3.5 billion toward strategic investments on initiatives like customer service and network reliability, for a 10% increase from the prior year's capital spending. Investors can expect that trend to continue, since management credits the spending with helping Time Warner's business. The investments drove "dramatic improvements in customer service and operating performance," executives said in late October.

That improving operating performance, along with Time Warner's steady financial position, suggests that the company can raise its dividend significantly in 2016 without sacrificing commitments to expanding the business. A combined Charter-Time Warner entity will likely have its own dividend policy, which that management team will detail when the merger concludes. But on its own, Time Warner Cable is in a strong enough position to return to a hefty dividend growth pace after 2015's pause.