After a rough start to December, infrastructure stocks have begun to recover, leading to a mixed bag of performances from energy ETFs. Here are the energy ETFs that performed the best -- and worst -- the week of Dec. 14-18, 2015:

What happened this week

The strong gains this week made by ETRACS Alerian MLP Index ETN (AMU +0.00%), UBS AG ETN (NYSEMKT: MLPI), and Alerian MLP (AMLP 0.02%) were a product of a bounce-back week for midstream stocks. Three midstream MLPs in particular that had strong stock performance this week were EQT Midstream Partners LP (EQM +0.00%), Magellan Midstream Partners, L.P. (MMP +0.00%), and Enterprise Products Partners L.P. (EPD 0.13%):

There really isn't any good news that's driving up these stocks (and the ETFs that hold them) over the past week. If anything, it's a lack of bad news -- such as midstream behemoth Kinder Morgan's (KMI 0.33%) dividend cut a couple of weeks ago, which sent the industry into a tailspin of selling -- combined with investors who are taking advantage of that sell-off to buy some great companies on the cheap.

Kinder Morgan, however, wasn't one of the midstream stocks to do well this week, falling another 6% after finishing last week roughly flat once the market factors in its capital plans and dividend policy.

Producers and service providers down on a bad week for oil

The SPDR S&P Oil & Gas Equipt & Servs. (ETF) (XES 0.33%), and SPDR S&P Oil & Gas Explore & Prod. (ETF) (XOP 0.44%) both fell more than 5% over the past week, as oil and natural gas prices continued to stay near or below prices the market hasn't seen since during or even before the recession.

West Texas crude finished below $35, while Brent, the international benchmark that plays a major role in gasoline, jet fuel, and diesel prices, finished the week below $37. Since the beginning of December, oil futures are down more than 10%, while natural gas is down nearly 20%.

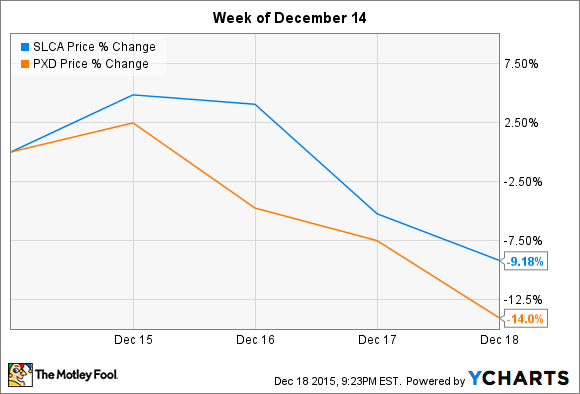

Stocks feeling the pinch include fracking-sand provider U.S. Silica Holdings Inc. (SLCA +0.00%), held in the Oil & Gas Equipment & Services ETF, and independent oil and gas producer Pioneer Natural Resources (PXD +0.00%), held in the Oil & Gas E&P ETF. Both stocks were down big this past week:

Just as with the midstream companies, there wasn't anything material regarding either U.S. Silica or Pioneer Natural Resources announced this week.

But from a big-picture perspective, Pioneer needs to see much higher gas and oil prices to make money, but that's not going to happen until the massive global oil oversupply gets reined in. And that probably means oil production needs to fall. The Catch-22 for producers such as Pioneer is that lower commodity prices have pushed many producers to increase output to make up revenue shortfalls. This situation, in turn, pushes prices even lower.

But something has to give, and eventually the music will come to a stop when the most at-risk producers run out of cash and bankers stop lending and delaying the inevitable.

That's going to be bad for U.S. Silica, since sand is a key ingredient in modern drilling. If drilling activity continues to fall in 2016, which seems almost certain at this point, U.S. Silica could see sales and earnings fall even more sharply than the 14%, and 50% declines over the past year.

Putting it all together

While the MLP and infrastructure ETFs all had a good week, these have been historically poor investments, because of the high fees they charge as well as the poor sector performance over the past few years. However, it's not clear that these funds will break that trend, because of the heavy costs of investing in MLPs via these ETFs and the fees involved.

On the other hand, both of the SPDR ETFs above, which performed so poorly over the past week, have historically outperformed the market as measured from oil lows to high prices:

XOP Total Return Price data by YCharts

Both SPDR Energy ETFs beat the market soundly, right up until oil prices started falling in mid-2014.

Looking ahead

There are lessons here. First, oil and gas is very cyclical (see the preceding chart), so investors need to be aware of the risk when too much supply meets too little demand. Second, one of two things will happen:

- Prices will rise.

- Or companies will figure out how to make money at these levels.

Prices will rebound if there's more demand, or companies will figure out to cut costs and make money at lower prices. Or enough companies will fail at low prices to drive production down, pushing prices up. The best companies will survive, and the market will find balance.

It may be a bit of an oversimplification, but that's basically what will happen: It's the when that is much less apparent. And until the what and when coincide, energy investors are in for a rough ride.