Image source: P&G.

Check out our Procter & Gamble page for our latest coverage.

While many of its fellow Dow components are sharply lower this year, consumer products titan Procter & Gamble (PG 0.30%) has ticked up and is now the sixth best-performing stock of the Dow 30, year to date.

That's surprising given that sales are flat thanks to what CEO David Taylor described last month as "significant macro-economic and geopolitical headwinds." As currencies tank and economic growth weakens, P&G executives see the potential for zero organic revenue gains in fiscal 2016 -- even worse than last year's disappointing 1% uptick.

And we're not talking about just a short-term speed bump: Sales and operating income are at a 5-year low, and profitability is down significantly as well.

So, putting aside the hefty dividend yield, why buy P&G stock right now?

Financial efficiency

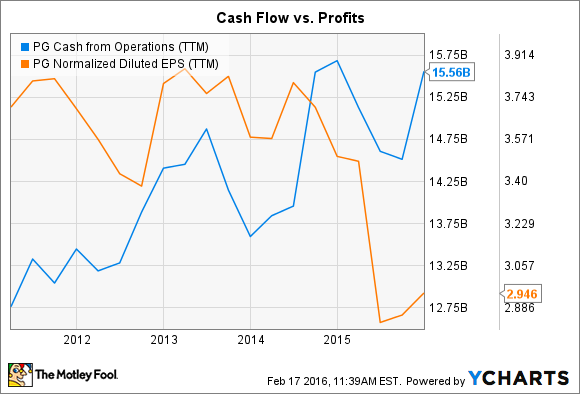

For starters, if you're a fan of efficient operations, you'll love this business. P&G executives have long targeted free cash flow productivity, or cash generated as a percentage of net earnings, at 90% or greater. Yet the company posted 102% productivity in the 2015 fiscal year, and this past quarter, that metric soared to 117%.

As a result, P&G is close to achieving record-high cash flow despite lower sales and slumping profit figures.

PG Cash from Operations (TTM) data by YCharts.

Cost cuts promise to keep P&G producing more from less. The company is on track to slice $7 billion out of its annual operating expenses -- up from the original $6 billion target. Manufacturing overhead is down 15% in the past three years, on its way to a planned 25% drop by the end of fiscal 2017. Combined, these trends should produce sharply higher reported profitability as soon as exchange rate swings stop swamping P&G's bottom line.

Risky rebound plan

Yet financial efficiency can only take the business so far; long-term growth just isn't possible unless P&G can at least match -- and ideally beat -- the growth rates in the markets where it competes. Its latest results haven't held up well against rivals Kimberly-Clark (KMB +0.53%) and Unilever (UL 0.23%), which both posted 5% higher organic sales on a healthy mix of pricing and volume gains. Both competitors see steady 2016 growth of around 4%, too, compared to P&G's expectation for flat organic sales.

Management's rebound plan involves transforming the portfolio to cover a smaller selection of consumer staples that have the best potential for market-thumping sales and profit growth. A good example is the diapers market, which P&G dominates against Kimberly-Clark's Huggies.

Image source: P&G investor presentation.

Yes, the company that emerges from the transformation initiative will have a smaller sales footprint and generate a lower level of profits. In fact, both of those drawbacks are already pinching the top- and bottom-line results.

But the new P&G should also be growing at a faster pace while boasting stronger profitability. In absolute numbers, that means organic growth that's closer to 4% than the 1% P&G is currently seeing, and operating margins closer to 15% than the 12% it booked last year.

The recent trends

While the latest earnings results showed little evidence of this transformation gaining steam, there were notable bright spots for investors. First, the U.S. market rebounded from a 2% organic sales decline to post 3% growth last quarter. Second, net earnings jumped to 19% of sales from 13% in the prior-year period thanks to the combination of higher prices and lower manufacturing and input costs.

Those gains weren't enough to convince management to increase its full-year outlook that calls for flat, or nearly flat, sales growth. Yet the company did boost its cash flow expectation to 100% of earnings from the prior 90% estimate.

So, investors who buy today aren't likely to see higher sales in the next few quarters, but they can at least count on increasing cash returns. P&G will spend $18 billion on dividends and stock buybacks this year, up from $12 billion per year over the last three years. Prospective investors should consider that a major portion of their expected returns as they wait for P&G to return to consistently strong growth.