Investing can be a compelling way to build your retirement fund or to help build your savings for a big purchase -- but only if you avoid common investing mistakes. There can be a huge learning curve with investing, leaving beginning investors broken financially and spiritually if they jump in too hard without the right education.

Let's discuss some of the most common mistakes that trip up early investors and how they can be avoided.

8 beginner investing mistakes

Here are eight of the most common mistakes new investors make and some brief explanations of why they are considered mistakes.

1. Buying on someone else's convictions

Also known as "golf course stock tips," buying a stock because someone else tells you it's a great option is honestly the worst investing mistake you can make. People have all kinds of opinions on investments, and most of them aren't remotely qualified to utter them out loud.

This is where you must start to understand who you are as an investor. Who you are matters and will hugely influence what kinds of investments are best for you.

2. Not understanding why you're choosing the investment you're making

Related to No. 1, not understanding why you're choosing an investment can lead you to make some very risky moves with no conviction whatsoever. Whether you buy off a stock tip from a well-meaning stranger or because you decided you liked the sound of a particular company without understanding why you would choose it as a long-term hold, the most important thing you can do for yourself is understand your "why."

For example, I own a real estate investment trust (REIT) called UMH (UMH +0.39%), which runs mobile home parks. I own it because housing costs are out of control, and many people who cannot afford to rent or buy single-family homes still want to live in detached homes, and the demand is only growing.

UMH has also gone the extra mile to create an opportunity zone fund, which will give it additional tax benefits for building or upgrading housing in areas where it would already be doing business. I chose UMH in particular because it's a smaller company and still nimble enough to pivot as the market changes.

3. Choosing the wrong investment vehicle for your time horizon

Individual stocks are just one type of investment. Although they're what often comes to mind when people think about investing, there are all kinds of vehicles out there. Stocks perform best when you hold them over the long term, with a five- to 20-year time horizon in mind.

But maybe you want to invest your money for only a few years to boost your savings power for a down payment. Stocks would be a risky choice in this case because many things can happen in the markets over a short time horizon. So, something like a short-lived bond or certificate of deposit (CD) would be ideal.

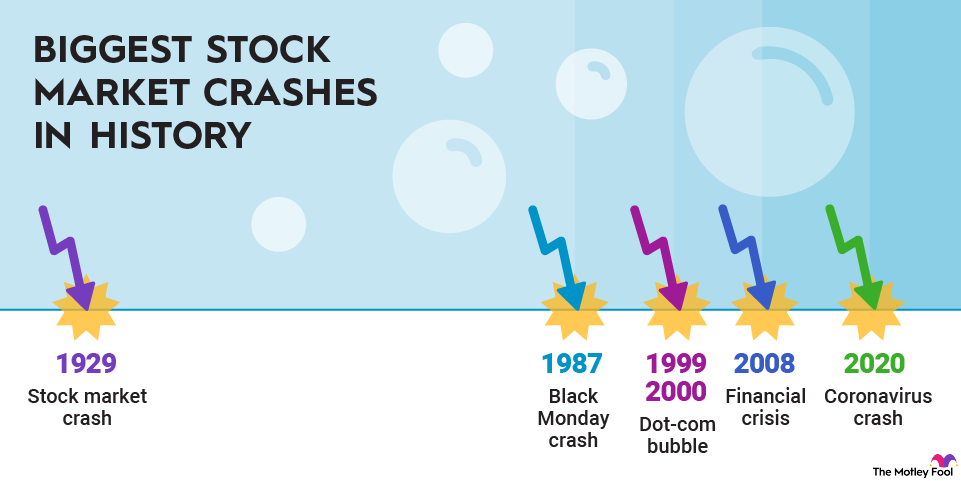

4. Panic selling

There will be many times when the market does something you don't particularly like -- such as falling dramatically in response to geopolitical news. When this happens, it's not the time to sell if you truly understand why you own what you own.

Many beginning investors use rules of thumb that tell them they should sell at a certain percentage drop to preserve what capital they can. However, when you do this, you lose money. And if it's a stock that will bounce back (many will), you didn't do yourself any favors.

5. FOMO buying

The flipside of panic selling is fear of missing out (FOMO) buying, which is just as big a mistake. If you buy the dip without understanding why you're buying or why it's dipping, you are very likely to find yourself in a big mess at the end of the day. Just because a stock drops doesn't mean it's going to bounce back.

6. Timing the market

The stock market is often cyclical, and many investors believe they can time their buys to maximize their profits. While this would be great if it were possible, there are just too many variables that affect stock prices day to day.

Your best bet is to always buy with a long-term horizon and use dollar-cost averaging to build your position over time. This way, you gradually grow your position at many different price points, rather than relying on one buy to be THE buy that will make your fortune.

7. Lack of diversification

Although it can be easy to buy a lot of stocks in the same general industry or geographic area, the problem with this is that if your industry takes a big hit or is suddenly subject to new regulations, your entire portfolio may fail catastrophically. Choosing stocks from different industries or using other types of investments to balance your portfolio will create more stable investments.

8. Failing to review your investments periodically

You could do everything right when you choose and purchase your investments, but if you don't check in on them from time to time, you could still be making a huge mistake.

Sometimes, the company moves in a direction you might not approve of, leadership changes, or the general business environment changes. At these times, you need to consider whether you really want to keep holding that stock or if you'd be happier trading it for something else.

How to avoid these mistakes

It's easy to make mistakes when you first start investing, but there are many ways to derail these issues before they blow up in your face. Here are a few tips to get you started investing the right way.

1. Know your risk tolerance

There should be a rule that says you have to know who you are as an investor before you buy your first stock. But since there's not, you'll have to make one for yourself. You must know your risk tolerance.

Figure out how much surprise you like in life and how anxious you would be if your portfolio dropped by 20% overnight. If you can honestly say you've got nerves of steel, go for the risky start-up investments. If you're like most of us, you should at least balance them with companies with long track records of success.

2. Practice emotional control

It can be hard to breathe through a down cycle in the market, but this is the time to have some faith in yourself and your choices. Panic selling and FOMO buying are easy ways to lose a lot of money very quickly. Take a measured approach when the stock market takes a dramatic turn. Buy on your schedule, regardless of the market, and don't worry too much about whether it's up or down.

3. Understand your "why"

Knowing your "why" can help you with the emotional control part and having some faith in yourself. Before you make a purchase, really know why you want it.

Investments aren't shiny new shoes that you'll likely trade out in a year -- these companies are your future income sources. If you choose a company because you think it has an innovative product that will change the narrative in its industry, stick to that when times get tough.

Keeping a diary of your purchases and your reasoning behind them (also known as your investment thesis) will remind you of the direction you're headed. Top-down investing is a very solid method of choosing stocks with your "why," starting with the strength of the industry and flowing downward through specific sectors and then companies in that sector.

Investment Thesis

4. Only invest money you can afford to have tied up

Sometimes, it's very tempting to invest cash you should be keeping on the sidelines for emergencies or near-term expenses, but this is a great way to set yourself up for failure. When you invest money that you really need to keep liquid, you put yourself in a position where you may have to cash out your portfolio at the worst time because you have no other options. This is not just conjecture on my part.

My dog got cancer two-and-a-half years ago, and she didn't have insurance, so I ended up selling off most of my holdings, keeping only fractional shares for tracking purposes, to pay for two years of palliative cancer care. I'd do it again in a heartbeat, but I lost a lot of money just liquidating like that instead of using the cash I had on hand to make the rest of her life comfortable and happy.

5. Review your portfolio, but not too often

It's important to keep an eye on and periodically review your investments, but it's absolutely unnecessary to check in daily, weekly, or even monthly. If you have a long-term investing horizon, you need to look at the fundamentals of your investments only when your company reports its quarterly earnings or once a year when annual reports are released.

Reviewing investments too often can spook any investor. Remember, the market as a whole moves up and to the right over a long enough timeline.

Related investing topics

How to start investing with little money

Whether you're interested in investing in stocks or you'd like to buy a few small bonds, you can start investing with very little money. First, figure out what your risk tolerance is, then find an investment that will help you make money while still maintaining your sanity.

Read up on different types of investments, including things like exchange-traded funds (ETFs) and index funds, which can give you wider market exposure with limited downside risk. Once you've done that, you can find some investments that fit your needs.

Don't get too deep in the weeds at first; just get a feel for different investment types and see what sounds appealing. From there, you can explore specific investments through expert resources like The Motley Fool.