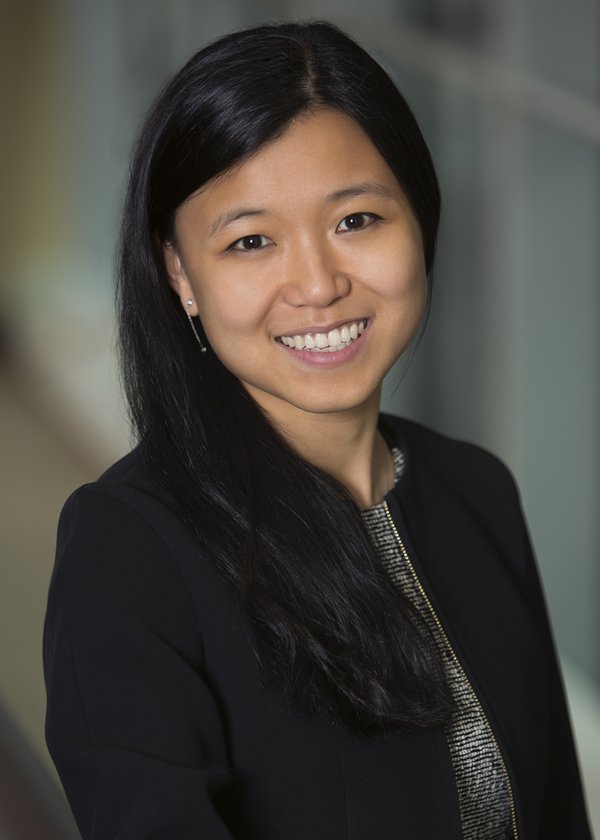

Bo Ren is an investor, writer, and director of early-stage start-ups at Silicon Valley Bank. She leverages more than a decade of product experience, innovation leadership, and ecosystem development to help the next generation of early-stage start-ups.

Previously, she invested in start-ups at Samsung Next and built consumer products at Facebook, Instagram, and Tumblr.

Bo's Investing Style

How many years of investing experience do you have? 5-10 years

What is your investing risk tolerance? Medium-high

What is your portfolio size? 10 to 20 stocks

What are your favorite investing sectors? Energy, healthcare, financials, consumer discretionary, consumer staples, information technology, crypto

When did you get started in investing and why?

I started investing when I was 13. That was when my dad bought me my first Microsoft stock. My dad taught me about the power of compounding interest, and I wanted to put it to work early.

Can you tell us a little bit about your relationship with money at an early age?

I immigrated here when I was four from China, growing up with modest means. I wanted early on to seek out lucrative employment opportunities to improve my family's situation and build up generational wealth. For me, achieving financial independence was my way of making my parents' sacrifices worthwhile.

What has your journey been like as an investor, and what are some of the challenges you’ve had to overcome?

My relationship with money comes from a scarcity mindset. I never feel like I have enough money even when my portfolio is performing well. I'm a big saver and need a certain number in my checking account to feel confident and secure.

I wish I allowed myself to take riskier positions and bigger swings at investment opportunities.Bo Ren

What’s one story from your life that totally defines who you are today, and how has that impacted your investing career?

At my first start-up job, I was barely scraping by given the cost of living in San Francisco. My dad insisted that I still contribute 20% of my salary to my 401(k). At the time, it felt like I couldn't afford to put money away for retirement, but I'm glad I did because it instilled in me the discipline to always think long term and maximize my company's 401(k) contributions.

With so many younger investors dipping their toes in investing, what’s the best advice you have for someone who may be looking to start investing or who may be newer to the industry?

Don't invest in something you don't understand. Deep subject matter expertise is necessary to make sound investment decisions.

You juggle so many tasks and wear so many hats. How do you manage the balance between your work life and your personal life and still manage to meet your investment goals?

I work with my dad to manage my portfolio and try to read up on the latest investment trends and insights in my spare time. I really love reading Berkshire Hathaway's annual shareholders' report, ARK Invest reports, and swap investment intel with friends in a WhatsApp group.

If you could go back in time and change one thing about your investing strategy, what would you change and why?

I would have bought stocks based on less hype and more conviction.

What are three things that really excite you about the future of investing?

1. The future of democratizing investing through DAOs, crypto, and Web3.

2. The consumerization of fintech will make investing more accessible to everyone.

3. For more and more people to open-source the blackbox of retail investing and venture capital.

What scares you about the future of investing?

I'm scared that the lack of diversity in crypto and fintech will exacerbate pre-existing wealth gaps in this world.

Who are some leaders in the investing industry you admire and why?

Warren Buffett, Mellody Hobson and Catherine Wood.

What are some of your favorite educational resources (books, podcasts, websites, etc.) that you’d recommend for investors of all ages?

The Millionaire Next Door, The Psychology of Money, The Motley Fool, and Yahoo! Finance.

How do you feel about crypto as an investment?

It's here to stay. I consider crypto to be the pension fund for millennials and Gen Zers. You hold onto it for decades as a hedge on the USD, hoping for a large payout in the end.

You might also like:

What’s one quote or saying that inspires or challenges you?

If you're afraid of carving your own path, just remember, "You make your path by walking." — Grace Lee Boggs

Disclosure: SVB Financial provides credit and banking services to The Motley Fool.