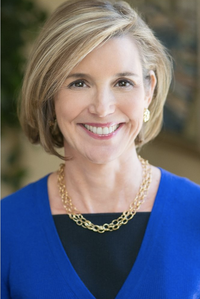

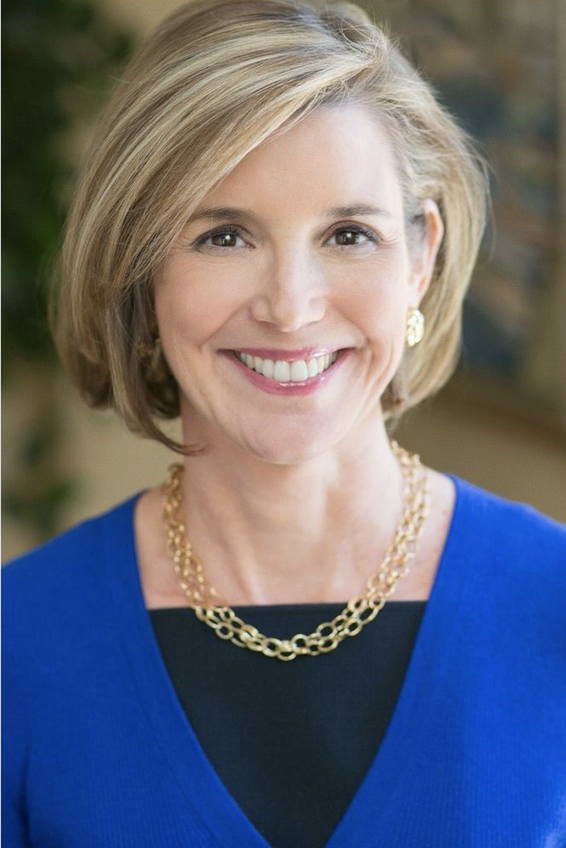

Pam Chan, CFA, managing director, is chief investment officer and global head of alternative solutions at BlackRock. She also serves as chief investment officer for the BlackRock Impact Opportunities Fund. She is a member of BlackRock's Global Operating Committee, Alternatives Executive Committee, and Global Diversity, Equity and Inclusion Steering Committee.

Pam currently co-chairs the Harvard College Schools and Scholarship Committee of New York City and has previously served on the board of the Harvard Club of New York Foundation and the Harvard Business School Alumni Board.

In 2020, she was named a World Economic Forum Young Global Leader, and, in 2012, a World Economic Forum Global Shaper.

Pam also serves on the board of Forbright, Inc., and previously served as a board member for Home Partners of America.

She graduated magna cum laude from Harvard College with a joint concentration in Philosophy and Government and earned an MBA with high honors from Harvard Business School.

Pam's Investing Style

How many years of investing experience do you have? 10-20 years

What are your favorite investing sectors? Our team invests across sectors and asset classes within the private markets, inclusive of private equity, private credit, infrastructure, real estate, and other specialty strategies (e.g., music, specialty finance, etc.). I don't have a favorite sector. What I really enjoy is continuously learning about new areas and how our various investments fit together in the context of a portfolio -- risk, relative value, overarching themes, and the macro context around us.

When did you get started in investing and why?

Having studied philosophy in college, I loved asking questions. Investing provided a work environment that felt most akin to a philosophy tutorial where we debated how x relates to y and what the relevant catalysts or mitigants might be to that relationship. It is that spirit of inquiry and curiosity, combined with the ability to explicitly measure one's performance quantitatively, that drew me to investing initially and keeps me here.

What has your journey been like as an investor? What are some of the challenges you've had to overcome?

It has been rewarding but also challenging at times. I have been fortunate to have a handful of great mentors who have helped me stay the course, even though most CIOs don't look like me. As a private market investor, I think it is a particularly exciting time given how the depth and breadth of the private markets continue to grow. We will also see increased convergence at the interface of public and private. This is a space we are watching very closely.

With so many new or younger investors dipping their toes into investing, what's the best advice you have for someone who may be looking to start investing or who may be newer to the industry?

First, read, read, read. Not just books explicitly on investing but read broadly -- economics, history, technology, psychology, philosophy -- anything that gets you to ask yourself new questions. Second, seek to have conversations with people who are not like you. It is easy to inadvertently find oneself in an echo chamber, and that is when you'll miss something obvious. Third, have compassion for yourself as you will never be able to read or learn as much or as quickly as you'd like, and don't get consumed by your mistakes -- learn from them and move forward.

What advice would you give to a newer investor who may be experiencing market volatility for the first time?

Stay focused on the rigor of your investment process even when you are tempted to respond more tactically. Surround yourself with folks who have learned from past market cycles and read broadly so you understand how markets have reacted in the past -- not because history will necessarily repeat but because context informs what happens next.

What are three things that really excite you about the future of investing?

I am excited about how private markets are growing (especially as new asset classes emerge across the private market space!); how tech and data will change the way private market investments are sourced, underwritten, evaluated, and implemented; and how we can deliver outcomes beyond risk-return (for example, as we seek ways to do well and do good).

What's one quote or saying that inspires or challenges you?

"The unexamined life is not worth living." —Socrates

"I have told you these things, so that in me you may have peace. In this world you will have trouble. But take heart! I have overcome the world." —John 16:33