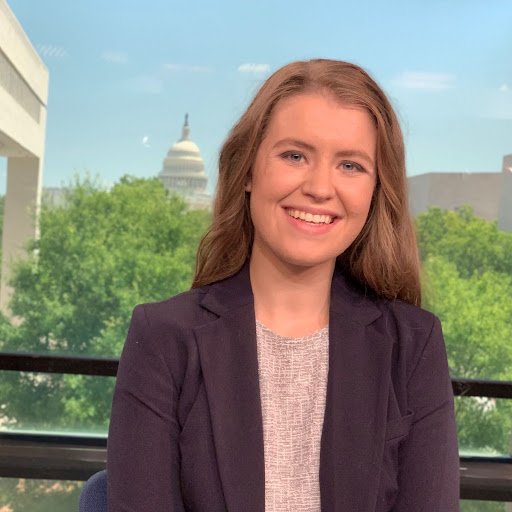

Emily Flippen is an advisor at The Motley Fool who specializes in consumer-facing businesses with high growth opportunities. Emily works on numerous products, including The Motley Fool's flagship Stock Advisor service, as well as Blast Off and Showdown, two real money portfolios aimed at achieving maximum upside returns. Emily is a Chartered Financial Analyst (CFA) charterholder and holds an undergraduate degree in Business and Finance from the first joint Sino-American university, New York University Shanghai.

Chartered Financial Analyst (CFA)

Emily's Investing Style

How many years of investing experience do you have? 5-10 years

What is your investing risk tolerance? High

What is your portfolio size? 20+ stocks

What are your favorite investing sectors? Consumer Discretionary

What makes these sectors so interesting to you? Few industries have the ability to speak so widely to so many different investors than the consumer discretionary industry. It holds a special place in my heart because consumer-facing businesses are often some of the most misunderstood and underappreciated companies despite being relatively ubiquitous. They’re also a great starting point for newer investors that allow them to dip their toes into equity research by capitalizing on preexisting knowledge while still offering the opportunity to grow and expand one's skills and expertise.

When did you get started in investing and why?

I started investing in high school. My mother helped me open a Roth IRA with a portion of the proceeds from my summer job. She invested half in a low-cost and broadly diversified index fund and encouraged me to invest the second half in an investment of my choosing. I can’t say I knew what I was doing, but by sheer luck I ended up buying a biotech mutual fund that went on to significantly outperform the market over the following years. Seeing how investing could help grow my money piqued my interest in learning more about finance and investing.

Can you tell us a little bit about your relationship with money at an early age?

Money has always burned a hole in my pocket, even as a child. I have always enjoyed buying presents for my friends and family and, of course, treating myself to chocolate desserts whenever possible. Nowadays I still consider myself a spender, but instead of buying things, I tend to treat myself to stocks.

What has your journey been like as an investor? What are some of the challenges you’ve had to overcome?

I’ve often felt like I’ve suffered from imposter syndrome during various points in my investing journey. Studying finance throughout college, working in the industry, and even pursuing my CFA charter have at points reminded me of my struggle to fit in in the world of finance. I’ve had to remind myself that the stereotypes I may associate with being an “investor” or “analyst” are not expectations I should have of myself.

With so many new or younger investors dipping their toes into investing, what’s the best advice you have for someone who may be looking to start investing or who may be newer to the industry?

Don’t let the finance world intimidate you. It’s my personal belief that much of the financial industry purposely makes managing your own money sound harder and more complicated than it is in practice. Broadly speaking, the industry has a vested interest in making the average person feel powerless and dumb. I encourage newer investors to take time to educate and empower themselves to make financial decisions that you may have otherwise entrusted to a third party. For many people this can be as simple as buying a low-cost, well-diversified index fund and letting it sit for the long term.

Do you have any advice for investors on how to diversify their portfolios?

The easiest form of diversification is often found in low-cost index funds, which offer a broad range of investments in a single package. Of course not all indexes are made the same, and investors may consider holding many different types of funds indexed to different benchmarks to further diversify their portfolios. But for an investor looking for relatively instant diversification, low-cost index funds are a great option.

Why do you think diversification is important?

Diversification is important because no one knows the future. If an investor is interested in buying individual stocks, it is impossible to know which particular stocks are going to beat the market and which may lose money over the long term. Of course, research and diligence can help make educated decisions, but there is simply no guarantee that your thesis for buying a business will come true. This is why it is vital to hold many different businesses, stocks, and other investments across a broad portfolio. It reduces the risk of a single event or business resulting in a permanent loss of capital.

Capital

What advice would you give to a newer investor who may be experiencing market volatility for the first time?

The best piece of advice I have for investors experiencing volatility for the first time is to simply do nothing. Turn off the TV, stop checking your brokerage account, and continue to follow your current investment strategy. If you typically contribute money to a retirement or brokerage account on a predetermined schedule, continue to do so. Don’t let the market whims and investing pundits sway your strategy. The best advice is to not change your process and trust that buying and holding great companies will result in strong long-term returns.

If you could go back in time and change one thing about your investing strategy, what would you change and why?

I take all of my past investing experiences as learning opportunities, so I can’t say that I would change anything in particular. However, I do wish I had learned about the persistent power of brands much earlier than I have. One of my biggest challenges as an investor is understanding the power that a brand can have on a business's performance. I have discounted this power in the past, and it has contributed to poor investment decisions that could have otherwise been avoided.

What are three things that really excite you about the future of investing?

- Ease of access to information

- Future innovation

- Better regulations

I’m thrilled to be living and investing in an age that truly empowers the average person with access to information. My generation has experienced a democratization of investing in a manner never before seen. Not to mention we’ve had the pleasure of watching groundbreaking innovation happen right in front of us. At the same time, I’m seeing the tension this has with the regulatory authorities as companies and investors challenge preexisting regulations. I look forward to seeing our regulations develop to enable innovation and development while also protecting investors.

What about three things that scare you about the future of investing?

- Ease of access to information

- Future innovation

- Better regulations

In typical investor fashion, the same things that excite me also scare me. We’ve seen the downsides of the free flow of access to investing, with retail investors often gaining access to information and services that have enabled them to commit great financial harm to themselves. Additionally, the ends may not justify the means for certain types of innovation that are pursued for the sake of financial gain. The push toward a subscription-based economy could be a good example of innovation that comes at the expense of consumer experience. Lastly, regulatory authorities could fail to find the balance between protection and capitalism -- discouraging innovation or enabling abuse.

What’s one quote or saying that inspires or challenges you?

“He who is not contented with what he has, would not be contented with what he would like to have.”— Socrates