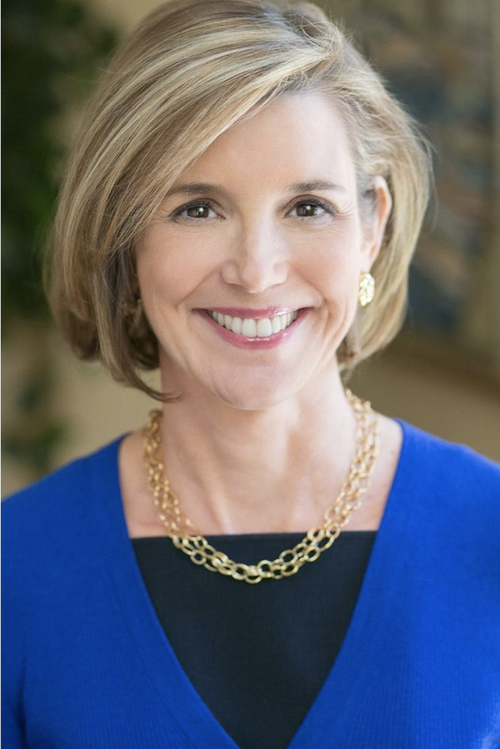

Who is Sallie Krawcheck? She's the CEO and co-founder of Ellevest, a financial planning and investment platform for women and run by women. Krawcheck has grown Ellevest from an idea in 2014 to a community of more than 3 million women and $1.5 billion in assets under management. Her original idea was simple: Make investing and financial empowerment more accessible to women and other underrepresented individuals.

Krawcheck has been trailblazing in the financial community for decades. In the 1990s, Institutional Investor magazine recognized her as the top-rated analyst in the brokerage sector. She worked for independent stock researcher Sanford C. Bernstein at the time. By 2001, she was the company's CEO.

While at the helm of Bernstein, Fortune Magazine called Krawcheck "the last honest analyst." She earned the label because her team at Bernstein had been churning out unbiased, contrarian stock research. Competitors, meanwhile, had gotten caught up and swept away by tech bubble enthusiasm.

Krawcheck left Bernstein to run Citigroup's Smith Barney. In just a few years, she had risen to the post of chief financial officer and head of wealth management for Citigroup. When the 2008-09 financial crisis hit, Krawcheck urged Citigroup's board to compensate clients for investments that went sideways. The board eventually agreed, but it also fired Krawcheck.

She would then run Merrill Lynch for several years after it was acquired by Bank of America.

Today, Krawcheck uses her leadership and investing expertise at Ellevest to put more money in the hands of women+. Ellevest was named to CNBC's 2019 Disruptor 50 list, LinkedIn's 50 Most Sought-After Startups list (two years in a row), and Entrepreneur Magazine's 100 Brilliant Ideas.

Krawcheck is also the recipient of the Socially Responsible Investor Award for The Motley Fool's 2022 Women in Investing Awards.

Sallie's Investing Style

How many years of investing experience do you have? More than 20 years

What is your investing risk tolerance? I would actually reframe this question to: What is your risk awareness? It’s true that women are more risk-aware, meaning they want to understand the risk involved and evaluate the pros and cons before diving in. And the research shows that women’s risk awareness is in fact a virtue; it keeps many of us from making the mistakes we see so many men make like chasing the hot stock of the moment or panic-trading. So, like we extol at Ellevest, I believe in long-term investing principles like diversification of assets, portfolio risk management, and tax efficiency.

What are your favorite investing sectors? We know that ESG factors (like climate change, wage gaps, and the lack of gender diversity in the workplace) all affect women disproportionately. Investing in companies that follow good ESG practices -- and divesting from those who don’t -- means our investment dollars can help advance women everywhere and align our investments with our values. Besides, data shows that companies who make good ESG decisions tend to be less risky than those who make bad ESG decisions.

When did you get started in investing and why?

I wanted my money to work harder for me. That and having more degrees of freedom in my life. I saw so many women before me who outsourced the money decisions to someone else in their lives and ultimately gave up their power and optionality.

I spent my 20s as an investment banker, and I didn’t like it. There was so much toxicity. I thought, “I don’t know how to be successful here.”

At the age of 29 years and 11 months, the idea came to me that I should become a sell-side equity research analyst because I loved analytics and numbers, building models. Loved it. And I really liked writing. I interviewed with a double-digit number of research firms, who all turned me down. One of them turned me down after they found out I had a baby at home. Only Sanford Bernstein would give me a job, but that career shift was my way of finding success in the industry because no one could argue with my results.

It’s critical work, and the implications of who is investing and what they are investing in have massive implications for the way our world operates. Our industry doesn’t do a great job of branding itself that way.

Can you tell us a little bit about your relationship with money at an early age?

I grew up in Charleston, South Carolina, where my parents' hope for me was to be an administrative assistant. Money was the only thing my parents fought about. Again, this represented a power imbalance, with one parent earning all the money and the other having to budget it all. I never wanted to be in that position.

What has your journey been like as an investor, and what are some of the challenges you’ve had to overcome?

Learning that I didn’t have to be taking action all the time on my investments. Not freaking out when the markets were tough. Not watching each individual stock I owned like a hawk.

Working in a predominantly male field, I dealt with sexual harassment. Back then, I didn’t think I had any options but to come into work every day and just take it. Today, there are many more options than silence, and people should make sure that they are speaking up, whether it be to a friend or family for advice, or a mentor who can help navigate those situations.Sallie Krawcheck

With so many younger investors dipping their toes in investing, what’s the best advice you have for someone who may be looking to start investing or who may be newer to the industry?

Just start. You can learn as you go because time is on your side. Start the practice of investing a portion of each paycheck into the market as early as you can, and pay attention to where that money is going and the impact that it's having.

You juggle so many tasks and wear so many hats. How do you manage the balance between your work life and your personal life and still manage to meet your investment goals?

I’m over the work-life balance question because I recognize that it’s a question so many women don’t get to ask themselves as they work three shifts to keep their families above water.

So, instead of discussing work-life balance, my family’s conversations around my work are, “What difference am I making through my work?,” and, “What impact am I having?”

As my jobs have changed, that impact has changed, of course. But the ability to see and craft a career and meet my investment goals as a means of not just paying the bills but also making the world better — that’s an important thing to model, too.

If you could go back in time and change one thing about your investing strategy, what would you change and why?

I would take on more risk historically. My first real experience with the stock market was the crash of 1987, so for many years I anchored in that and thought investing in the stock market was riskier than it has actually been. In fact, the stock market has historically gone up by about 9.8% annually since the 1920s.

What really excites you about the future of investing?

1. Women are getting more serious about practicing financial wellness. Forty-five percent of women say the events of the past few years have prompted them to either make or consider making new financial goals.

2. Impact investing is growing in popularity. More than 50% of people using Ellevest’s digital investing platform are invested in Ellevest’s Impact Portfolios.

What scares you about the future of investing?

1. Money stress is having an overwhelming impact on women+s’ mental and physical well-being, much more so than for men, and the pandemic has only made matters worse. To change that, we have to recognize that financial wellness matters a lot more than we think.

2. Women still don’t feel comfortable talking about money. In fact, despite family members, partners, and friends being the top source of financial guidance and inspiration, 56% of women don’t talk regularly with others about finances.

3. Education around finances is still low. More than one in three women (34%) were taught growing up that talking about finances with others is taboo, even crass.

Who are some leaders in the investing industry you admire and why?

Mohamed El-Erian, and not just because he’s an investor in Ellevest. I have always found him to be so thoughtful in how he frames and approaches problems and opportunities and so logical and unemotional in working through them.

What are some of your favorite educational resources (books, podcasts, websites, etc.) that you’d recommend for investors of all ages?

I truly love Ellevest’s Magazine, an online resource center, with articles and videos created specifically to answer your questions about investing, managing your money, gaining confidence in your career, and disrupting money for women everywhere. You don’t have to be a client or top investor to sign up and access the magazine.

How do you feel about cryptocurrency as an investment?

Cryptocurrency is independent from any central authority, and its value can move up and down wildly.

There is certainly something there to the concept of a global store and exchange of value. But crypto today doesn’t trade on fundamentals but on speculation, so beware, and only trade what you can afford to lose.

You hear a lot these days from people who are buying stock in Bitcoin or other cryptocurrency and then quickly selling it to retain its profits. That is not a strong long-term investment strategy. That’s trading, or rather, gambling.

All of us know people who have invested and saved their way to a comfortable retirement; few of us know any who have traded their way to one.

Feel free to trade cryptocurrency, but don’t do it with your retirement money.

You might also like:

What’s one quote or saying that inspires or challenges you?

“Nothing bad happens when women have more money.”