Motley Fool Options is the Motley Fool's option investing service, designed to help option investors generate cash in all kinds of markets. The Options advisor searches for the best option investments to recommend to subscribers.

Why options?

Why options?

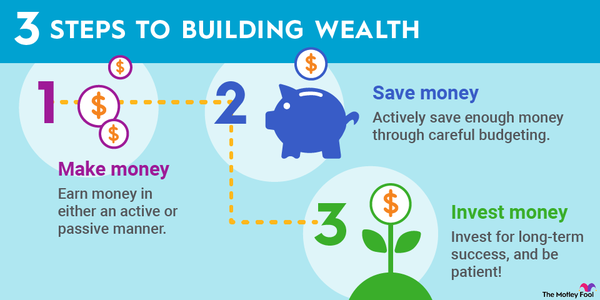

The Motley Fool preaches long-term investing, so recommending short-term strategies like options seems like a contradiction. But we have found that options, properly used, can complement a stock portfolio based on a long-term mindset. In fact, the use of option investing this way not only helps buffer a portfolio against downward moves but also provides funds for saving, investing into other positions for future growth, or providing cash to live on.

Let's take an example. We often generate cash by selling (or writing) puts. Using the same long-term, good business criteria used elsewhere at the Motley Fool, the Options advisor finds a company that we would not mind owning -- if we had to. Suppose it is currently trading at $50 per share. Instead of buying shares, however, we sell one put with a strike price of, say, $45. We get paid, say, $160 in return for the promise to buy shares at $45 if the share price is lower than that in three months. That's a 3.6% return over that time period.

If the share price is above $45 when the option expires, we keep the money and can do it again (bringing in more cash). If the share price is below $45, we could close the first put option and sell another (bringing in more cash). Or, we could fulfill that promise to buy the shares. Then we’d turn around and sell a covered call, which is a promise to sell the shares if the share price is high enough. That brings in more cash because we get paid for making that promise, too. Whichever way it goes, we're bringing in cash that can be used elsewhere.

Plus, if we average a 3.6% yield every three months, that's a 14.4% return on the dollars we would use to buy the shares if we had to. For those paying attention, that's a market-beating return for that particular investment.

Some Options members call this the "cash-generating wheel" of using options. It's a great way to both generate cash and boost the returns of your portfolio.

Making money with options

How Motley Fool Options helps subscribers make money

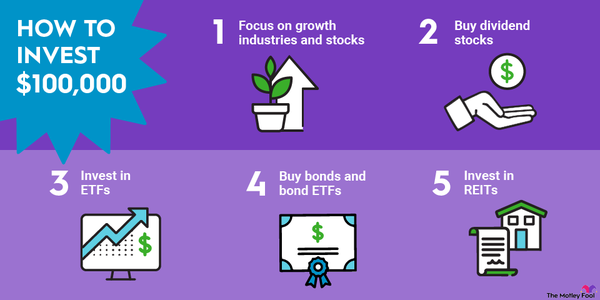

Let me elaborate on that last point. Suppose you have a $100,000 portfolio. And suppose that each month of the year, you sold one of those three-month puts or a similar one for $160 each time. Over the course of the year, you would have generated $1,920 in cash. That's a 1.92% return on the whole portfolio. And that's on top of any return the portfolio would have generated by itself.

Now, suppose your portfolio averages a 10% return per year for 10 years. Without using options, you would end up with just under $260,000. But if you were using options and averaged an extra 1.92% each year, after 10 years, you'd have over $308,000.

Of course, that extra cash can be invested into stock positions you already have or be used to open new ones. And if they do well, you could end up with even more.

Click here for a special offer on Motley Fool Options.

What's included?

Here's what a Motley Fool Options subscription gets you

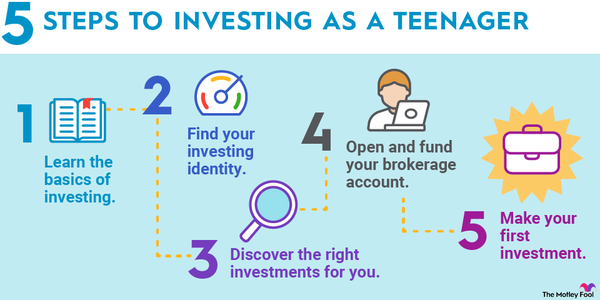

Motley Fool Options is an option investing service, so it should come as no surprise that a regular series of investment alerts comes out each month. In each alert, not only are you given instructions on which option to buy or sell, but why this company and why this option strategy. If it's a follow-on alert to an ongoing strategy, then the alert includes an update about what's been happening at the company, so you're always up to date. By doing this, we marry the Fool's long-term investing mindset with option investing.

That long-term mindset gives Options subscribers a key advantage over the rest of the market, in our opinion, because it means that we're focusing our attention on good companies as opposed to just gambling on option trades with businesses whose fundamentals they don't understand.

In addition, every month, the service's advisor sends out a column that looks at all strategies that have parts expiring that month and discusses what is likely to happen when the options expire. That means you are prepared well ahead of time for dealing with those expirations.

Plus, he includes a section called "Monthly Learning," where you get further education about using options and how they work. The more you know, right?

On top of that, we have an extensive training course -- nay, academy -- titled Options U. This is specifically designed to help investors new to options understand every component of different options strategies and how they work. This modular course is an enormous benefit to new options investors (and has components designed for the more advanced, too).

Finally, let's not forget the vibrant community of option investors who talk on the Options' message boards. This is a huge benefit to all members because not only can you talk to other beginner investors (and more seasoned veterans, too), but you can also talk directly to the service's advisor! Yes, you can get your questions answered by an option-investing expert. The message boards are a great place to give and receive questions, information, advice, coaching, and more, all from other investors who love options. That community support -- and all the education and learning that it can engender -- is truly one of the most valuable parts of a Motley Fool Options

subscription.