With so many daily expenses to consider, setting up investment accounts for minors may not be a priority for most parents and guardians. But ask successful investors what they would do differently if they had the chance, and you'll often hear the same thing: I would start investing earlier.

Planting the seeds of investments early in life provides one of the greatest opportunities to grow sizable future wealth. So with time on your side, let's take a look at the best investment accounts for kids, how to open accounts for minors, the benefits of investing for kids, and whether you should start investing for kids now.

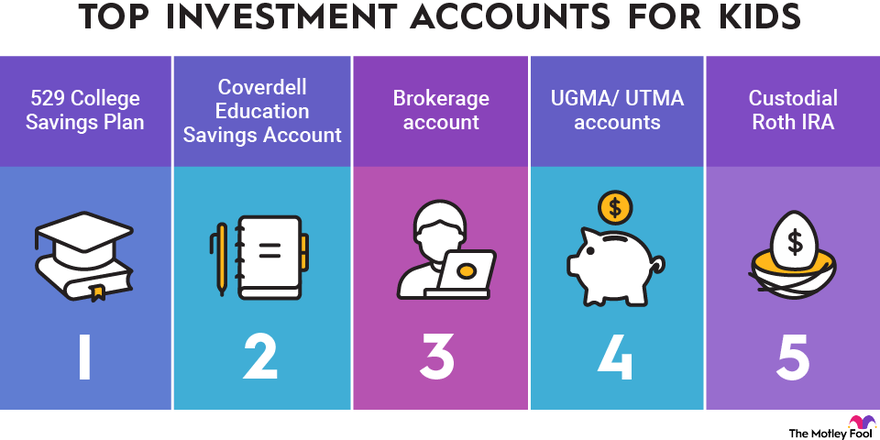

Top investment accounts for kids

Top investment accounts for kids

There are several options for opening investment accounts for kids. Trying to decide among the numerous choices may feel overwhelming, but these five accounts are worth particular attention. Choosing any of these options as opportunities to teach kids about how to invest money is a valuable way to set them up for a lifetime of prudent financial planning.

1. 529 College Savings Plan

1. 529 College Savings Plan

They may only be in diapers now, but they'll be dressing for prom and throwing their high school graduation caps in the air before you know it. So it's a good idea to start preparing for college sooner rather than later.

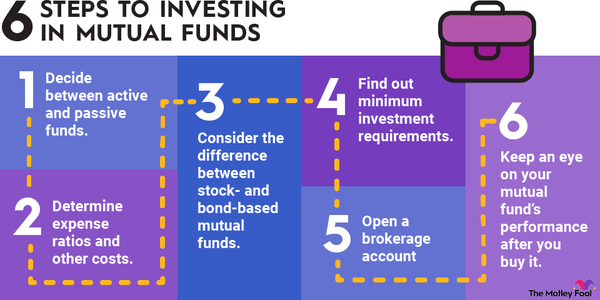

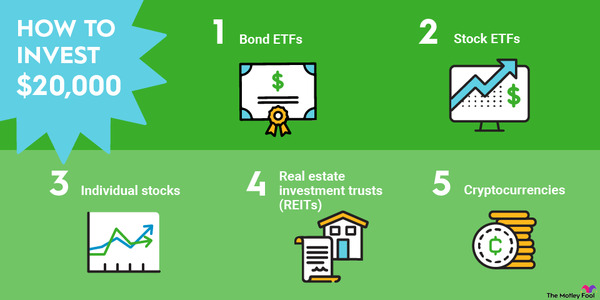

A tax-advantaged account that helps individuals and families save for qualified educational expenses -- such as room and board, tuition, and books -- a 529 college savings plan is one of the most common routes to saving for higher education expenses. Money deposited into a 529 plan is invested in various ways, including exchange-traded funds (ETFs) and mutual funds.

While they are named after the relevant section of the IRS code that covers tax deferment, 529 plans are administered at the state level.

2. Coverdell Education Savings Account

2. Coverdell Education Savings Account

Like the 529 college savings plan, the Coverdell Education Savings Account (ESA) is a tax-advantaged account geared toward qualified educational expenses. But there are several differences between the two.

First, the annual contribution limit per individual for a Coverdell ESA is capped at $2,000, whereas 529 plans vary based on the individual state but generally have higher contribution limits. Another key difference is that there is greater flexibility in options with the Coverdell ESA. In addition to ETFs and bonds, investors can choose stocks and mutual funds.

3. Brokerage account

3. Brokerage account

Whether it's the desire for flexibility in which investments they can choose or it's the interest in having an uncapped contribution limit, an ordinary brokerage account is a great option. In fact, some brokers have accounts specifically designed for minors.

For teens ages 13 to 17, the Fidelity Youth Account offers no minimum balances or minimum amount required to open the account, and there are no subscription or account fees. Charles Schwab (SCHW 0.13%) also offers an account for minors -- the Schwab One Custodial Account for people younger than 18. No minimum deposit is required to open the account, and there are no maintenance fees.

4. UGMA/ UTMA accounts

4. UGMA/ UTMA accounts

Accounts under the Uniform Gift to Minors Act (UGMA) and Uniform Transfer to Minors Act (UGTA) are set up by custodians (although not exclusively) to hold gifts or transfers. They bear some similarities to 529 plans, but there are some notable differences, including tax considerations. Also, the withdrawals do not have to be used on education-related expenses.

It's important to recognize that contributions to these accounts aren't tax deductible. In addition, assets in the accounts are in the names of the minors, so they may affect federal financial aid eligibility for college.

Many brokerages offer UGMA and UTMA accounts. Vanguard, for instance, offers both accounts without enrollment, transfer, or advisor fees for custodians who eschew Vanguard's advisory services.

5. Custodial Roth IRA

5. Custodial Roth IRA

A custodial Roth IRA is a smart consideration for forward-looking individuals, as it enables kids to start saving for their golden years as soon as they start earning income. When the tax-advantaged account is opened, a parent or grandparent serves as the custodian, and the child is listed as the beneficiary.

Upon turning 18 -- or 21 in some states -- the child becomes the account holder and can independently make transactions. In 2023, the maximum contribution individuals can make to a Roth IRA is $6,500.

How to open an investment account for minors

How to open an investment account for minors

In deciding what type of account to open, one of the primary considerations is whether the minor has taxable income. If the child is collecting income and reporting it to Uncle Sam, it's possible to open a custodial Roth IRA. And it's not even required that the child fund the account.

If, for example, a young one earns $1,000 walking a dog in a given year, he can keep his earnings, and Mom or Dad can fund the Roth IRA up to $1,000.

Many brokerages offer the opportunity to open a custodial Roth IRA. Once you decide where to open the account, you must provide information such as Social Security numbers, employer details, and driver's license information, if applicable.

Benefits of investing for kids

Benefits of investing for kids

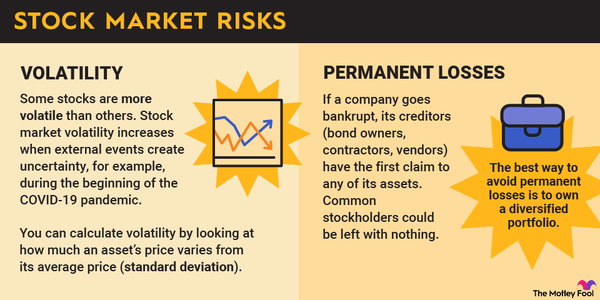

Whenever one's investing -- regardless of the circumstances -- there are risks. However, when investing for kids, the advantages far outweigh them. Following are three of the most salient benefits.

1. It sets kids up for future investing success

By opening an investing account for kids and using it as a vehicle to teach them about investing, you're helping establish a solid foundation for making prudent financial choices. Investing can be challenging and confusing. What better way to prepare them for investing on their own than by modeling good decision-making?

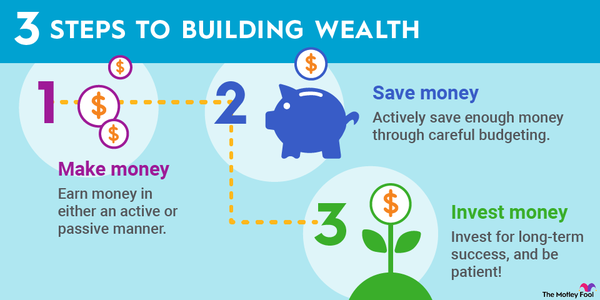

2. It takes advantage of time to build wealth

When it comes to building wealth, time is arguably your greatest asset. By putting the power of compound interest to work, you position young ones to accumulate impressive earnings. For a 529 plan and Coverdell ESA, this will help take the sting out of paying for college. On the other hand, if a Roth IRA is the investing account of choice, kids are in a great position to make their golden years a little more lustrous.

3. It's fun!

Embarking on an investing journey with a young one is a great way to deepen your relationship. You can help to cultivate the same love of investing that you have. Plus, you gain the happiness of knowing that your little loved ones will be more secure financially when they get older.

Related investing topics

Related investing topics

Should you start investing for your child?

Should you start investing for your child?

Undoubtedly, buying bonds for kids is one of the most common approaches to helping kids build wealth. But positioning kids for future financial security by setting up investment accounts may be even better.

Before parents and guardians consider this step, however, it's important for them to make sure their own financial houses are in order -- the foundation of which includes retirement savings and emergency funds. Once these financial buckets are established, setting up an investment account for a child is a lot more reasonable.

Like the directions that flight attendants provide passengers regarding oxygen masks, parents and guardians want to ensure they're well positioned for retirement and prepared for emergencies before setting aside capital for their kids' investment accounts.