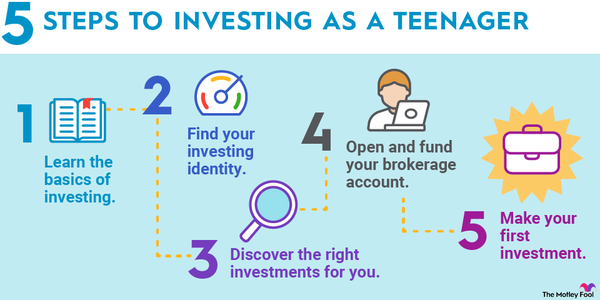

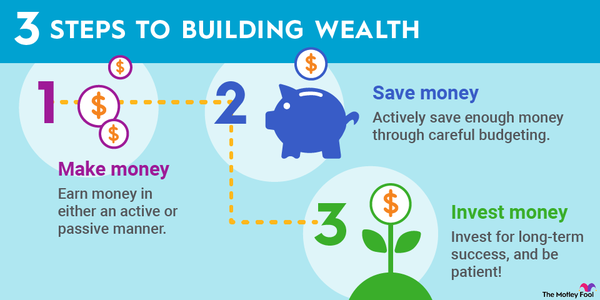

Investing is one of the best ways to put your money to work and generate wealth over time. In investing, returns are the difference between the dollar value of your principal investment and the value that has been generated after you have sold (or otherwise no longer own) that investment. For most people, the best way to maximize returns in investing is to seek out opportunities in fields they understand well. This approach puts you in a better position to determine whether a given investment is in line with your personal risk tolerance and whether it will be capable of delivering the desired level of returns.

What are returns in investing?

What are returns in investing?

Returns in investing is the difference between the initial price of an equity or asset and the dollar value that has been generated after ownership has ended. For example, if you bought a stock for $100 per share and then sold it for $110 a year later, you would have gotten a return of $10 -- or 10% of the initial purchase price.

Achieving positive returns is a core goal for most investors. If the price is greater at the time of sale than when you purchased it, then you will have positive returns -- assuming that there have been no other costs associated with owning the investment across the duration you held it. If you sell at a price that is lower than what you purchased at, you will generate a negative return on investment over your holding period.

But just because you have generated a positive return on your investment doesn’t necessarily mean that it has been successful. In order to determine whether an investment has been a success, it’s important to consider the opportunity cost -- what you have missed out on by not opting to go with a different investment option.

For example, if you generated a 10% total return on a stock over a five-year period, you might be relieved that you didn’t lose money on your principal investment. But if you could have gotten a 50% return across the same stretch by investing in an index-tracking fund with a lower risk profile, there would have been a substantial opportunity cost in not going with that option.

Calculating returns with different kinds of investments

Calculating returns with different kinds of investments

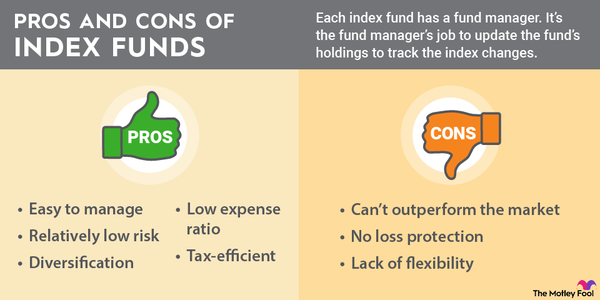

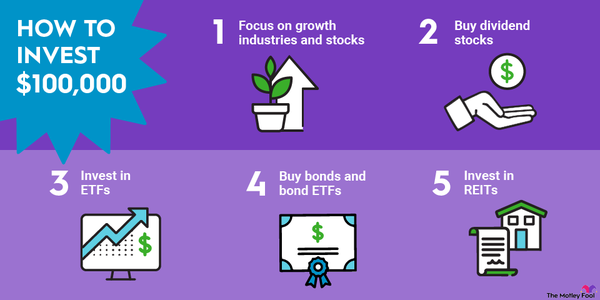

For stocks, returns will typically be shaped by the difference between the price at the time that you purchased and sold shares, plus the dollar value of any dividend payments or additional shares generated through dividend reinvestment. In the case of exchange-traded funds, mutual funds, or international stocks, you may have to pay a management or ownership fee that would lessen the overall return on your investment.

If you are investing in real estate, the same basic principles apply -- albeit with a few extra layers of complexity. In addition to the return generated from the change in value between the time of the purchase and the sale, it’s possible that you could generate additional returns by renting the property out while you owned it. But to determine your return at the time of sale, you would also need to account for any upkeep costs associated with maintaining the house, property taxes that had been paid, and loan or mortgage payments if you didn’t purchase the property outright.

For fixed-income investments such as bonds, CDs, and money market funds, a principal amount is paid in order to hold a certificate that will generate a pre-specified yield across a designated period of time. For example, if you paid $100 for a one-year bond with a yield of 3%, you would generate a 3% return on the bond value that year and have $103 when the bond reached maturity.

Example of investing returns

Example of investing returns

If you bought Microsoft (MSFT 1.82%) stock on January’s first trading day in 2020 and then sold your stock on the first trading day of 2023, the price of the stock would have gone up 49% since the time of your initial purchase. This means that you would generate a return of 49% with the stock at the time of the sale thanks to capital appreciation.

Microsoft also pays a dividend, and the company’s dividend payments would play a role in shaping your total return. Assuming that you set your dividends up to be reinvested in the company’s stock, your investment in Microsoft would have generated a total return of more than 53% across the three-year holding period.