There are several different types of income -- in the eyes of the IRS, at least. One important concept all U.S. taxpayers should be aware of is the difference between gross income, adjusted gross income, and net income.

Net Income

In this article, we'll look at gross income in particular, discuss how it differs from those other two income metrics, and explain why your gross income is important to know.

Overview

What is gross income?

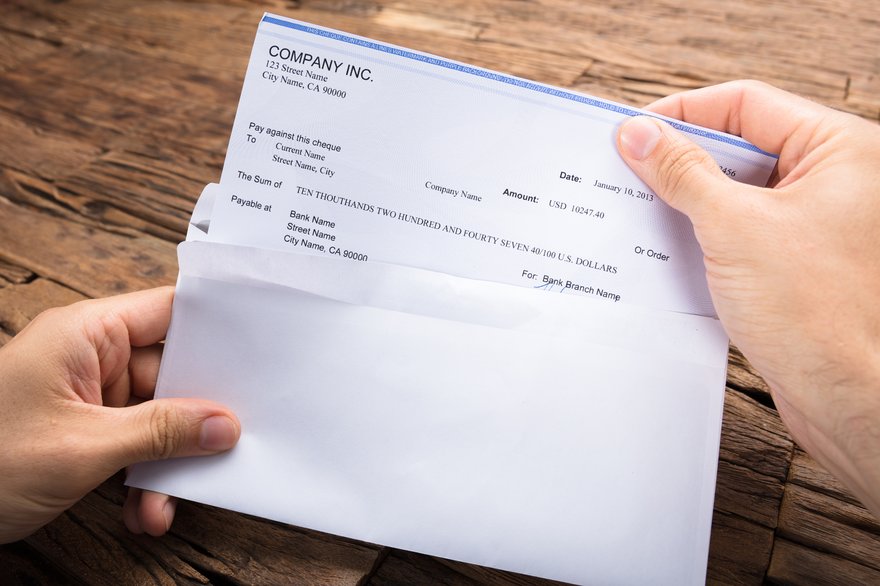

Gross income refers to all of your income from all sources before any taxes or other deductions are made. It can include wages, tips, salaries, bonuses, capital gains from investments, dividends, interest income, Social Security, other retirement income, and more. It also includes income from rental properties and 1099 income from self-employment and independent contractor work.

As a simplified example, if you earn a $100,000 salary from your job, get $500 in interest from your savings account, and get a $10,000 bonus at the end of the year, you would have gross income of $110,500.

In many situations, such as when you're applying for a loan, gross income is also referred to as your pre-tax income. It's simply the total amount of income you bring in before any adjustments are made to it. For most people, gross income is significantly more than their after-tax or take-home income.

Gross vs. taxable income

Gross income vs. taxable income

When it comes to the IRS, there are three common definitions of income that are important to know.

Gross income: As mentioned earlier, gross income is the total of all of your income sources. In most financial situations, the term "gross" refers to the entire amount of something (gross domestic product, etc.).

Adjusted gross income (AGI): AGI is your gross income minus a few specific adjustments, such as retirement account contributions and student loan interest. Adjusted gross income is important to know because it is the basis on which you qualify for many tax credits and deductions.

Taxable income: Taxable income is your adjusted gross income minus all of your tax deductions. This is the number the IRS applies to the tax brackets to determine how much you'll pay in taxes.

Note that taxable income is different from your take-home income. Taxable income is more of an accounting metric that the IRS uses when calculating your income tax. Take-home income is the amount of money you actually receive after taxes and other deductions are made from your paycheck and other income sources.

Example

Example of gross income

Let's say that you have the following income sources:

- $100,000 salary from your job.

- $2,000 in interest income.

- $20,000 in income from consulting work you do on the side.

- $10,000 annual bonus from your full-time job.

- $1,000 in dividends from your stock portfolio.

- $5,000 capital gains from selling stocks at a profit.

Adding these numbers together shows a gross income of $138,000. The amount of income you actually receive is likely to be significantly different since all of the income sources mentioned in this example are generally taxable in one way or another.

Related investing topics

Why it's important

Why gross income is important to understand

There are several reasons why gross income is an important concept to understand. For one thing, gross income is typically the number that lenders use to qualify you for mortgages and auto loans. It can also be an important tool to get an overall picture of your finances.