A REIT (pronounced REET), or real estate investment trust, is an entity that holds a portfolio of commercial real estate or real estate loans. Congress created REITs in 1960 to provide all investors, especially retail investors, with access to income-producing commercial real estate. REITs combine the best features of real estate and stock investment.

This guide will walk you through everything you need to know about real estate investing through REITs. We'll cover the types of REITs, REIT pros and cons, how to invest in REITs, and what qualifies a company as a REIT.

How does a real estate investment trust (REIT) work?

A REIT is an entity that invests in commercial real estate, residential rental properties, or real estate-backed loans. They lease space to tenants and collect rental income or earn interest income on their debt investments. REITs must distribute at least 90% of their taxable net income to shareholders via dividend payments.

Types of REITs

There are several types of REITs. Let's start with classifying REITs by access:

- Publicly traded REITs trade on major stock exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq Exchange. Anyone with a brokerage account can invest in a publicly traded REIT. Publicly traded REITs must register with the U.S. Securities and Exchange Commission (SEC) and provide audited financial reports.

- Public non-traded REITs are also open to all investors but don't trade on stock exchanges. Investors can purchase public non-traded REITs through their financial advisor or online portals, sometimes known as real estate crowdfunding platforms (e.g., Fundrise and Arrived). Public non-traded REITs also must register with the SEC and provide audited financial information.

- Private non-traded REITs aren't available to the public. They're usually open only to high-income earners or high-net-worth individuals. Private non-traded REITs are exempt from SEC registration.

Within those REIT types are three subcategories by asset type:

- Equity REITs own and operate income-producing real estate such as apartments, office buildings, and warehouses.

- Mortgage REITs, or mREITs, provide financing for real estate by purchasing or originating mortgages and mortgage-backed securities and earning fixed income from the interest on these investments. They typically hold a portfolio of income-producing mortgages, mortgage-backed securities, or other real estate-backed loans.

- Hybrid REITs invest in a combination of income-producing real estate and real estate-backed loans.

Finally, we'll look at the dozen equity REIT types by sector or property type:

- Office REITs own and manage office real estate such as skyscrapers and office parks. Many office REITs focus on a specific region (New York City or the West Coast, for example) or a type of tenant (technology companies, government agencies, or biotech).

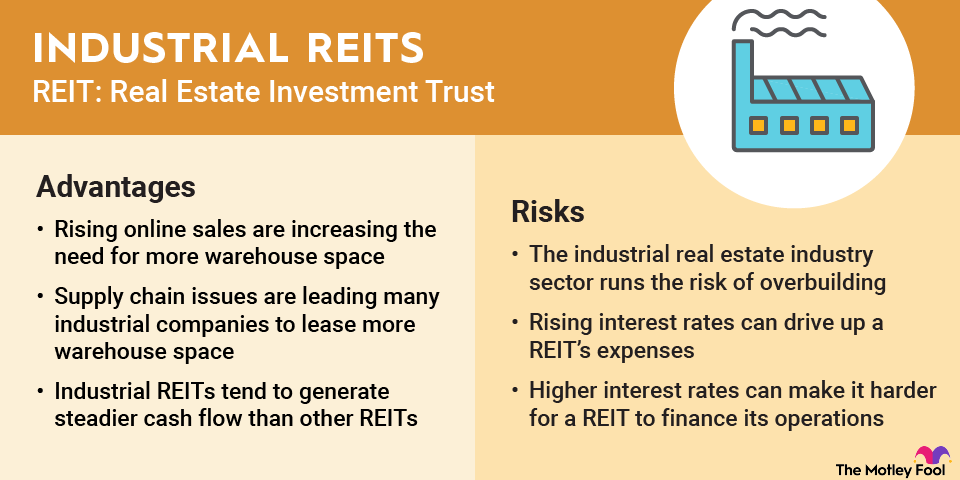

- Industrial REITs own and manage industrial facilities such as warehouses, distribution centers, light manufacturing, or cold storage. Many of these properties are crucial for e-commerce. Most industrial REITs focus on a specific industrial property type or region.

- Retail REITs own and manage retail real estate such as regional malls, shopping centers, or freestanding retail buildings. Most retail REITs will focus on a specific property type, such as grocery-anchored shopping centers or freestanding retail properties triple-net leased to essential retailers, including convenience stores and pharmacies.

- Hospitality REITs own hotels and resorts, typically managed by a third-party hotel brand. They rent space in these properties to guests on a nightly or weekly basis.

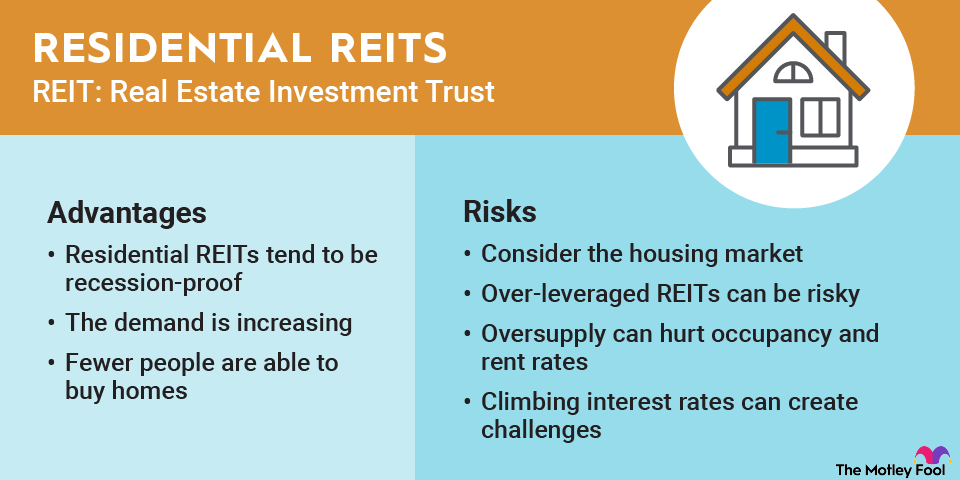

- Residential REITs own and manage residential real estate, such as apartment communities, single-family homes, and manufactured home parks, that they rent out to residents.

- Timberland REITs own and manage timberland. They specialize in harvesting and selling timber. Some timberland REITs also own wood products manufacturing facilities and sell portions of their real estate for other uses, a housing development, for instance.

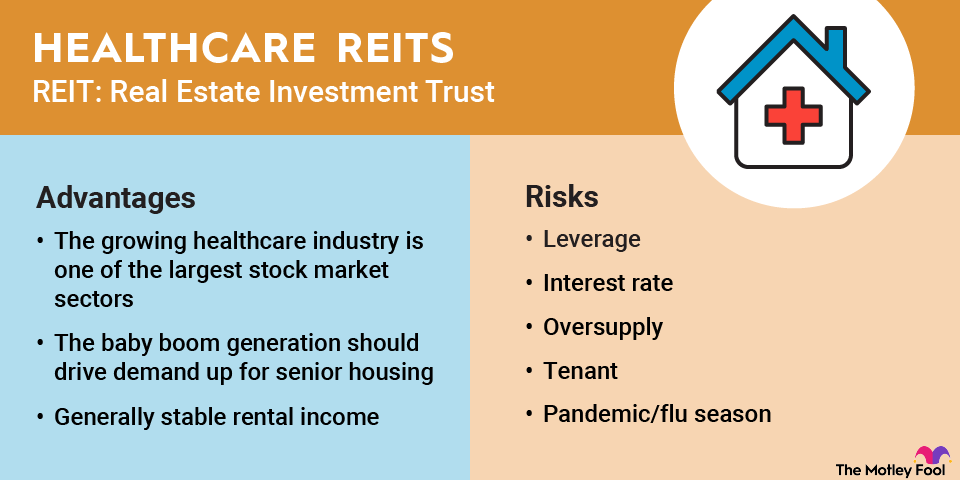

- Healthcare REITs own and manage healthcare-related real estate such as senior living facilities, hospitals, medical office buildings, and skilled nursing facilities. They lease these properties back to healthcare systems that operate the facilities.

- Self-storage REITs own and manage self-storage facilities that they rent to individuals and businesses.

- Infrastructure REITs own and manage infrastructure such as fiber cables, telecommunications towers, and data centers. They lease capacity on this infrastructure to mobile carriers and other companies.

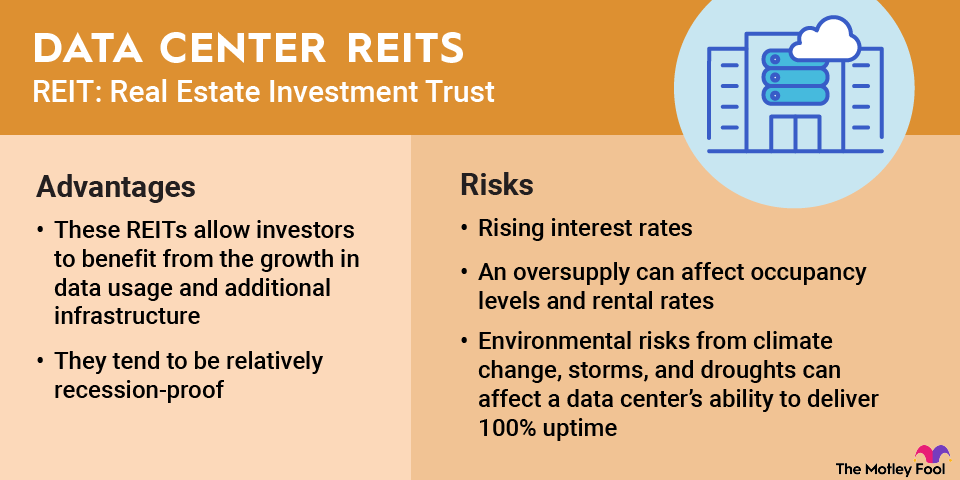

- Data center REITs own and manage data storage facilities. They lease space in these facilities to technology companies and other businesses to house servers and other equipment. These REITs also provide an uninterruptible power supply, a regulated temperature, and physical security.

- Diversified REITs own and manage a diversified portfolio of commercial real estate. For example, they might have a portfolio of office properties, industrial real estate, and retail properties. Some diversified REITs focus on specific markets, owning a mix of residential, retail, and office properties in one city, while others are diversified by property type and geography.

- Specialty REITs own and manage unique properties such as movie theaters, casinos, farmland, outdoor advertising, or ground leases.

REIT pros and cons

Investing in REITs has several benefits, including:

- They usually pay above-average dividend yields compared to other stocks, making them ideal for those seeking passive income from real estate.

- They offer diversification from the stock market since REITs tend to be less volatile than other stocks.

- REITs don't pay federal corporate income tax, shielding investors from double taxation.

- They offer attractive total return potential; for example, stock price appreciation plus dividend income.

- Publicly traded REITs offer greater liquidity than owning real estate outright.

- Public REITs are highly transparent, including providing audited financial statements.

- They offer lower costs than buying commercial real estate outright.

However, REITs also have some drawbacks, including:

- REITs have higher tax liabilities because they pay nonqualified dividends that often make them best held in a tax-advantaged account such as an individual retirement account (IRA).

- They are sensitive to changes in interest rates. REIT stock prices usually decline as interest rates rise.

- REITs encounter property-specific risks such as tenant move-outs, industry headwinds, and technological disruption.

- They face the risk of using too much debt.

How to buy REITs

Investors have many ways to invest in REITs. The easiest way is to buy shares of publicly traded REITs through a brokerage account. An investor could purchase a diversified REIT or invest in several different REITs to build a diversified portfolio. REITs are relatively inexpensive to buy, with most trading below $100 a share.

Another way to invest broadly across the REIT sector is to buy a mutual fund or exchange-traded fund (ETF) focused on REITs. REIT ETFs and REIT mutual funds are also easy to buy and relatively inexpensive to purchase.

Finally, you can invest in public non-traded REITs through a financial advisor or a real estate crowdfunding portal, which makes them a little more challenging to purchase. They also often have higher minimum investments, usually $2,500 or more to start.

Essential tips for REIT investment

Here are some practical tips for those looking to start investing in REITs:

- Begin with publicly traded REITs: It's best to start by purchasing shares of a publicly traded REIT in your brokerage account. These companies typically have long operating track records, report their financial results quarterly, and don't charge high management fees.

- Start small and scale up: Investors should begin by allocating a small portion of their portfolio to one REIT. They should consider adding to that position and investing in additional REITs as they grow more comfortable with the sector.

- Diversify across REIT categories: Investors should aim to build a diversified REIT portfolio across multiple property types, including residential, industrial, and retail.

- Focus on dividend sustainability: Many REITs pay high dividend yields. However, investors should focus on companies that can sustain and grow their dividends. They should look for companies that invest in high-quality properties that benefit from durable and growing demand. They should also seek REITs with conservative financial profiles.

How does a company qualify as a REIT?

Companies must meet specific criteria to qualify as a REIT, which receives special tax treatment, so they don't pay corporate income tax. These qualifications include:

- REITs must pay out at least 90% of their taxable income to shareholders as dividends each year. Many REITs will pay out more than 100% of their taxable income because their cash flow, measured by funds from operations (FFO), is often higher than income due to depreciation.

- They must be an entity that would be taxable as a corporation.

- A board of directors or trustees must manage them.

- They must have fully transferable shares.

- They must have a minimum of 100 shareholders after their first year as a REIT.

- REITs can have no more than 50% of their shares held by five or fewer people during the last half of their taxable year.

- They must invest at least 75% of total assets in real estate assets or cash.

- REITs must get at least 75% of their gross income from real estate-related sources, including rents from real property, interest on mortgages, financing real property, and the sale of real estate.

- A REIT must get at least 95% of its overall gross income from those real estate sources and dividends or interest from any source. In other words, 75% of its gross income must come from real estate, and only 5% can come from sources other than real estate, dividends, and interest income.

- They can have no more than 25% of their assets in non-qualifying securities or stock in a taxable REIT subsidiary.

Related investing topics

REITs often make great passive income investments

Congress created REITs so that anyone could own income-producing real estate. REITs must pay a dividend, making them a great way to earn passive income. Add in their diversification benefits and historical returns, and REITs can be an excellent investment option.