Do IRA distributions count as income for Social Security purposes? The short answer is: sometimes.

The question of whether IRA distributions are considered income depends on the reasons why you're asking. I know that sounds very vague, so bear with me.

The ability to collect Social Security benefits before reaching full retirement age depends on your earned income. And the taxable nature of your Social Security income depends on a different income metric. IRA distributions affect each of these Social Security income-related topics differently.

Taxes on retirement income

Retirement income taxation is a fairly complicated topic. Certain types of retirement income are treated differently by the IRS and state governments. And if you don't already know, Social Security can be rather complicated when it comes to various tax rules.

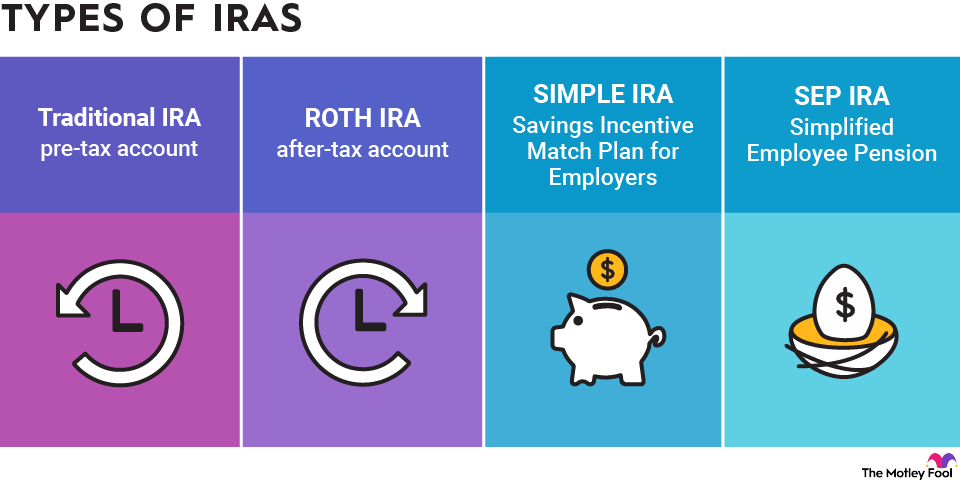

One area where there is a lot to unpack is how distributions from an individual retirement account, or IRA, can affect your Social Security benefits. There are two situations to consider:

- If your IRA income affects your ability to collect Social Security.

- If your IRA income affects the taxes you pay on Social Security.

Situation 1: IRA income will not make you forfeit your benefits

Americans who qualify can claim Social Security as early as age 62 if they haven't reached their full retirement age. However, the ability to collect benefits can be restricted based on income.

This concept is known as the Social Security earnings test. In simple terms, the idea is that some or all of your Social Security benefits can be withheld if you earn more than a certain amount.

If you will reach your full retirement age (67 for people born in 1960 or later) after 2026, you can earn as much as $24,480 with no effect on your benefits. Beyond that threshold, $1 will be withheld for every $2 in additional earnings.

If you'll reach full retirement age in 2026, you can earn up to $65,160. After that, Social Security will withhold $1 for every $3 of earnings.

There are more details to know about the earnings test. However, for our purposes, the important point is that IRA distributions do not count as earned income. The Social Security earnings test only considers money you earn from a job or that you get from a business you own or actively participate in.

Situation 2: IRA income can result in some of your Social Security benefits getting taxed

Depending on your income, some of your Social Security benefits can be subject to federal income tax. To determine this, the IRS uses a figure known as your combined income.

Your combined income is equal to:

- Your adjusted gross income (AGI)

- Any nontaxable interest income, such as from municipal bonds

- Half of your Social Security benefits.

Adjusted Gross Income (AGI)

So, if your AGI is $25,000, you have $5,000 in nontaxable interest, and you have $30,000 in Social Security benefits, your combined income for the year is $45,000.

If your combined income exceeds certain thresholds, as much as 85% of your Social Security benefits can be taxable. The general idea is that if Social Security is your primary source of income, you won't likely have to pay tax on it, but retirees who get significant income from other sources can be taxed.

When it comes to IRA distributions, here's how it works:

- Roth IRA distributions are not included in your combined income, so they have no impact on whether your Social Security is taxable.

- Traditional IRA distributions are generally included in your AGI, so they are included in your combined income.

This means traditional IRA distributions can make some of your Social Security benefits taxable.

Related investing topics

So, do IRA distributions count as income for Social Security?

As mentioned, traditional IRA distributions can be considered taxable income and will be included in your adjusted gross income for the current tax year.

However, they are not considered to be earned income.

This means that while traditional IRA distributions can result in your Social Security benefits being taxed, they won't have any effect on your ability to take Social Security while the earnings test still applies to you.