Most people have heard of the law of supply and demand, but you might not know exactly what it means. Supply and demand are two of the most fundamental concepts in economics, and their interaction is key to determining the price of a product in a free market as well as to understanding the way markets work. Keep reading to learn more about the law of supply and demand and how it applies to everyday decisions.

What is the law of supply and demand?

The law of supply and demand is an economic theory asserting that supply and demand will meet each other at a certain equilibrium price. At its most fundamental level, the theory states that if supply goes down or demand goes up, prices will rise. If supply goes up or demand goes down, prices will fall.

The relationship between supply, demand, and price is one of the most important in economics, and it informs business decisions and public policy.

How does the law of supply and demand work?

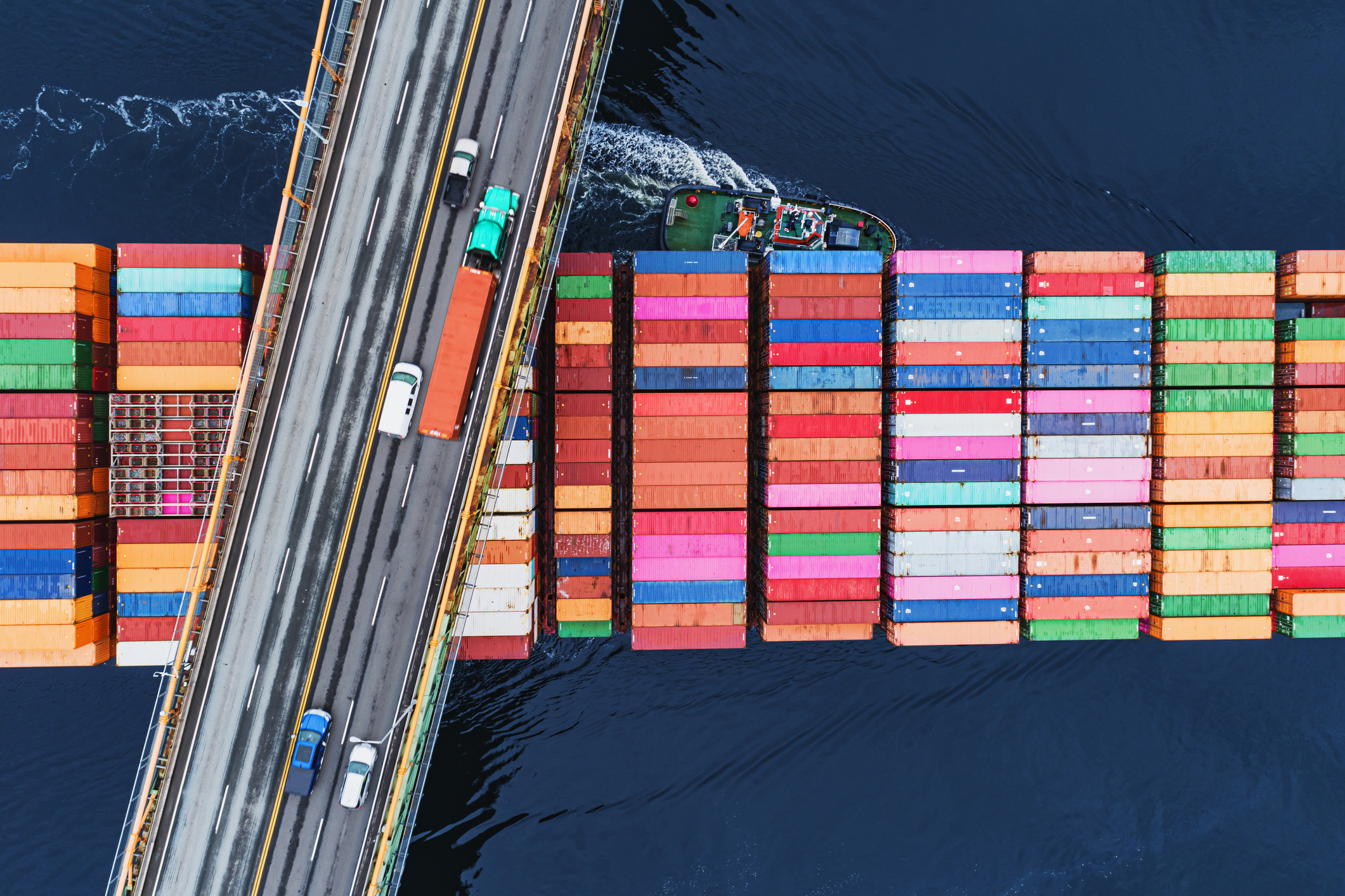

In practice, the law of supply and demand is readily visible in multiple industries. Travel-related companies, such as hotels and airlines, will raise prices according to demand, which fluctuates over the course of the year.

For example, if you wanted to visit New Orleans during Mardi Gras, you would expect to pay a higher rate for a hotel than you would at another time of year. Why? Because the supply of hotel rooms is fixed, but demand spikes when there is an event or festival in a city.

As a consumer, there’s no way to change the law of supply and demand, but you can take advantage of opportunities when demand is low and supply is high to save money.

How the law of supply and demand affects you

As a consumer and an investor, the law of supply and demand has a direct affect on your personal finances. If you’re seeking to take advantage of low prices, you’ll want to time your purchase to when demand is lowest and supply is highest.

For example, if you’re in the market for a rental apartment, you can get lower prices by looking in the winter when demand is lower. People tend to prefer to move in the summer when the weather is nicer, and the nature of the school schedule means that it’s also easier for families with school-age children to move then. Because the summer season is more competitive for moving, prices will be higher for rental properties.

As an investor, supply and demand is also worth considering. A company like Apple (AAPL -0.93%), for example, is able to charge high prices because there is so much demand for its smartphone and other devices.

Expert views

Academic views on supply and demand

Supply and demand in the real world

One good example of supply and demand can be seen on ticket resale websites such as StubHub. Sellers set prices based on existing supply and demand, and they will adjust them based on how supply and demand change.

Unlike most products, event tickets have an expiration date. So prices tend to fall as the date of the event approaches because sellers want to make sure they sell their tickets. In this case, supply outstrips demand, lowering prices.

Another example is the price of commodities, which tend to go in cycles, depending on supply and demand. Egg prices spiked when avian flu spread and decimated the hen population; the prices of oil and natural gas are also cyclical, depending on global economic demand and available demand.

The laws of supply and demand are also on display in the stock market. Prices rise when investor demand exceeds supply and drop when demand falls and investors want a lower price to buy the stock.

If you’re preparing for the next bull market, understanding the law of supply and demand will help you take advantage of it.