| Thursday's Markets | |

|---|---|

| S&P 500 6,913 (+0.55%) |

|

| Nasdaq 23,436 (+0.91%) |

|

| Dow 49,384 (+0.63%) |

|

| Bitcoin $89,536 (-0.75%) |

|

| Thursday's Markets | |

|---|---|

| S&P 500 6,913 (+0.55%) |

|

| Nasdaq 23,436 (+0.91%) |

|

| Dow 49,384 (+0.63%) |

|

| Bitcoin $89,536 (-0.75%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

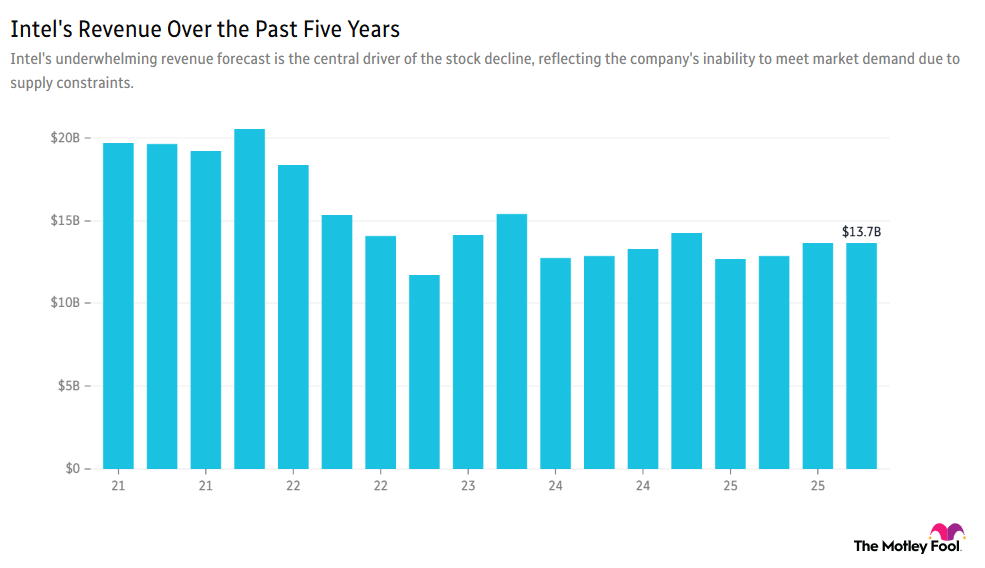

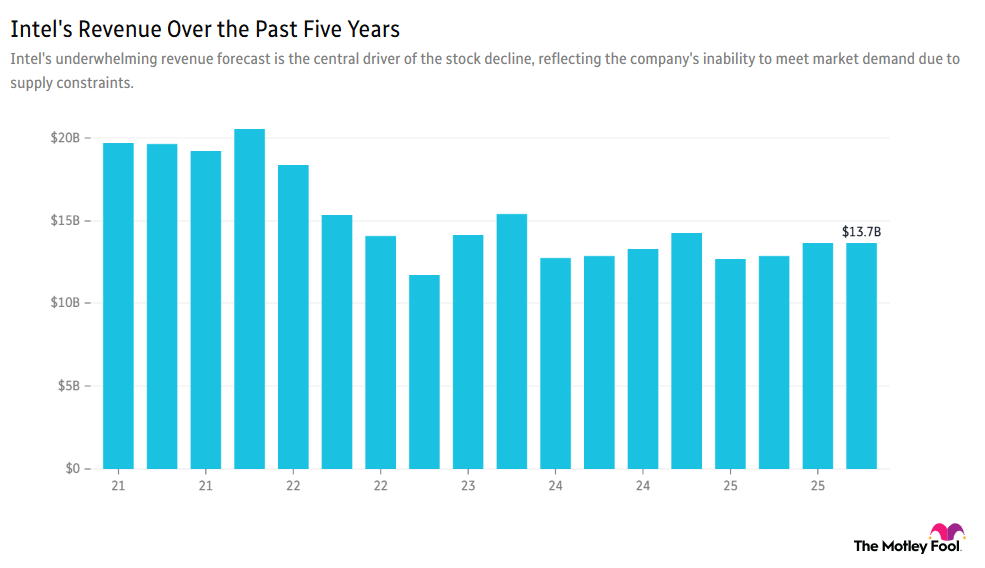

Intel (NASDAQ:INTC) was down more than 10% in pre-market trading, after results detailed an underwhelming revenue forecast, with CEO Lip-Bu Tan expressing disappointment "that we are not able to fully meet the demand in our markets."

Rule Breakers rec Intuitive Surgical (NASDAQ:ISRG) rose over 2.5% ahead of the market open, thanks to quarterly results highlighting growing adoption of medical systems, with a further procedure growth of 13% to 15% expected for 2026.

Fool senior advisor Robert Brokamp, CFP, recently sat down for a conversation with Dr. Ben Zweig, CEO of Rovelio Labs and author of Job Architecture: Building a Language for Workforce Intelligence. Here are the key takeaways.

Fun fact: small-cap stocks tend to rise more in January than in any other month, due to "new year" money hitting the market and their low liquidity. And what led the broad market rally on Thursday? Tech and small-cap stocks!