| Friday's Markets | |

|---|---|

| S&P 500 6,916 (+0.03%) |

|

| Nasdaq 23,501 (+0.28%) |

|

| Dow 49,099 (-0.58%) |

|

| Bitcoin $89,522 (+0.01%) |

|

| Friday's Markets | |

|---|---|

| S&P 500 6,916 (+0.03%) |

|

| Nasdaq 23,501 (+0.28%) |

|

| Dow 49,099 (-0.58%) |

|

| Bitcoin $89,522 (+0.01%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

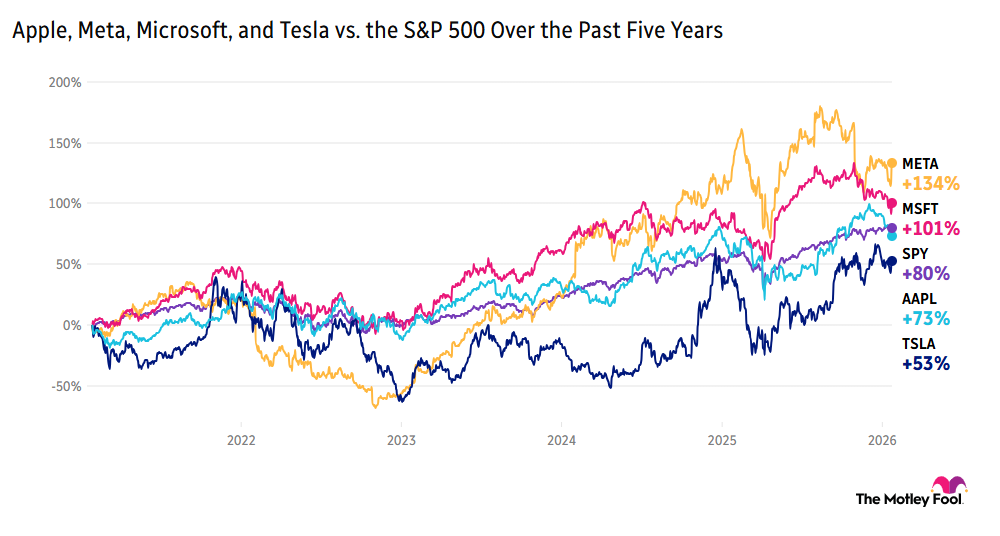

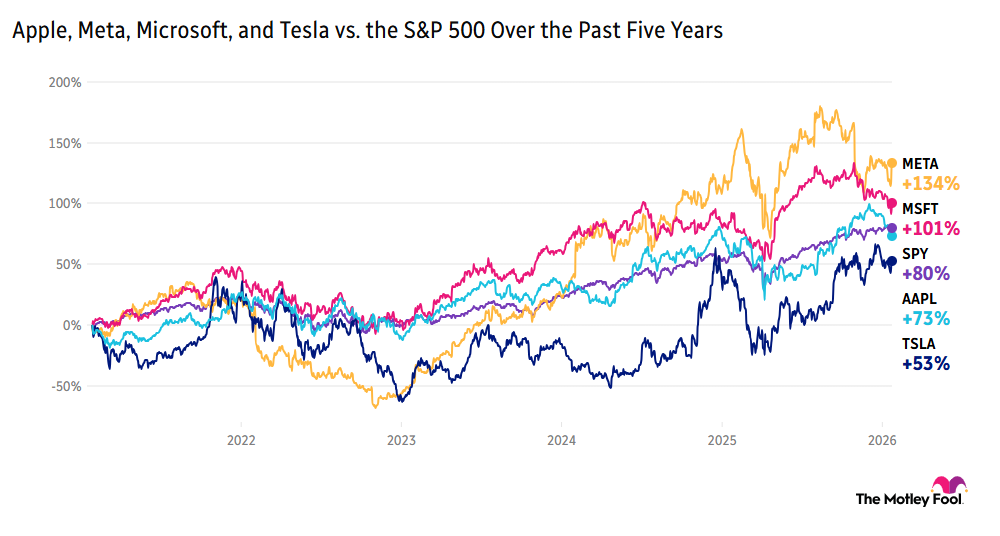

"Magnificent Seven" reporting season starts Wednesday with a second-quarter report from Stock Advisor Foundational Stock Microsoft (NASDAQ:MSFT), as the software giant looks to expand its artificial intelligence (AI) infrastructure by 80% in 2026. Meta (NASDAQ:META) is due to post a Q4 update the same day, with AI-based superintelligence a key part of the roadmap for 2026.

Gold reached a new high of over $5,100 this morning, as rising NATO tensions increase fear over financial and geopolitical uncertainty. Per Yahoo! Finance, Robin Brooks at the Brookings Institution spoke of "the start of a global debt crisis, with markets increasingly fearful governments will attempt to inflate away out-of-control debt."

Microsoft stock is up just 7.2% over the past year. Meanwhile, the S&P 500 is up 15% over the same period.

Name a company you own and have high conviction in to beat the market over the next three to five years that has lagged the index in the past 12 months, and explain why you retain that faith.

Share with friends and family, or become a member to hear what your fellow Fools are saying!