Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

| Monday's Markets | |

|---|---|

| S&P 500 6,797 (-2.06%) |

|

| Nasdaq 22,954 (-2.39%) |

|

| Dow 48,489 (-1.76%) |

|

| Bitcoin $89,572 (-3.70%) |

|

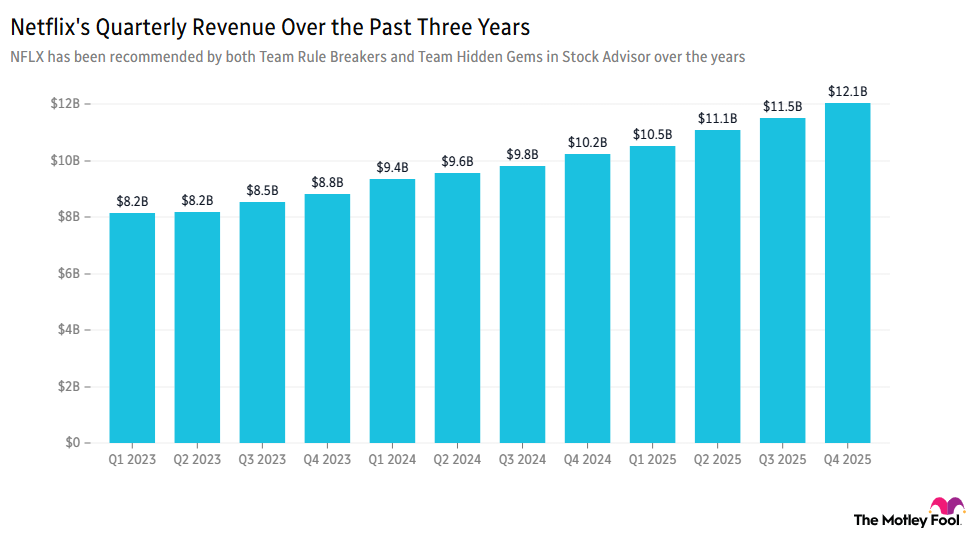

Netflix (NASDAQ:NFLX) posted a narrow fourth-quarter earnings beat yesterday, with highlights including 325 million paid subscribers and $1.5 billion in full-year ad revenue. The streaming giant confirmed its rumored all-cash Warner Bros. Discovery (NASDAQ:WBD) bid and paused share buybacks. With flat revenue expected in the current quarter, the stock fell over 5% in pre-market trading.

- "The TV landscape … has never been more competitive than it is today": In the company's earnings call, co-CEO Ted Sarandos noted the "competition for creators, for consumer attention, for advertising and subscription dollars" ahead of possible regulatory threats in the battle for Warner Bros.

- "By moving to an all-cash structure, both companies are clearing a path through the noise": Speaking of the WBD offer, TMF Chief Investment Officer Andy Cross notes, "Cash speaks louder than stock, especially with Netflix's stock off 30% over the last six months."

- Johnson & Johnson (NYSE:JNJ) fell over 2% after reporting a 9.1% rise in Q4 revenue before today's opening bell -- with adjusted earnings per share up 20.6% on the same quarter a year ago, following a 16% earnings jump in Q3. Innovative Medicine and MedTech sales grew 5.3% and 5.4%, respectively.

- Interactive Brokers (NASDAQ:IBKR) beat estimates with a 27.5% year-over-year (YOY) rise in adjusted earnings per share yesterday, boosted by a 32% rise in global customer accounts to reach 4.4 million. The company's pre-tax profit margin rose 4 percentage points YOY to 79%.

- Truist Financial (NYSE:TFC), beating the market by 23% since being recommended in Stock Advisor by Team Hidden Gems in June 2023, dropped more than 3% following its report of a 1.9% rise in Q4 net interest income this morning, after seeing fee income rise 11% in the previous quarter. Deposits rose 1.4% to $400.4 billion.

S&P 500 and Nasdaq futures both saw modest gains this morning, after President Donald Trump's Greenland threats triggered yesterday's worst trading day since Oct. 10. Both indexes nudged into the red in 2026, as the fear of further tariff rises on European imports coincides with a weak jobs market.

- S&P in profit since Oct. 10 dip: From October's previous worst day, the S&P 500 has gained 3.7% -- even including yesterday’s fall -- with ups and downs along the way. The Nasdaq is up 3.4% since then, too. Investors who sold due to short-term fear have missed out.

- New record as gold smashes through $4,800: Silver followed with new highs above $95 per ounce as the flight to safety continues. But cryptocurrencies are suffering, with Bitcoin (CRYPTO:BTC) below $90,000 again and down 29% since October's peak.

Recommended twice in SA by Team Rule Breakers in the past five years, Lululemon (NASDAQ:LULU) has paused online sales of its new Get Low range of leggings after customers complained they're "not squat-proof," becoming "see-through" when stretched.

- "To better understand some initial guest feedback and support with product education": Lululemon said it expects to get the collection back in its online offerings soon, as it remains available in U.S. stores.

- "A brand that has historically leaned on technical superiority to justify premium pricing": Jefferies (NYSE:JEF) analysts said such missteps "raise questions around consistency and the strength of LULU's innovation engine," reports The Wall Street Journal.

Member markandk provided this morning's question:

What's your personal allocation between cash/bonds, broad-based ETFs, and individual stocks, and how many different individual stocks do you own?

Discuss with friends and family, or become a member to hear what your fellow Fools are saying!