| Thursday's Markets | |

|---|---|

| S&P 500 6,775 (+0.79%) |

|

| Nasdaq 23,006 (+1.38%) |

|

| Dow 47,952 (+0.14%) |

|

| Bitcoin $85,185 (-0.73%) |

|

| Thursday's Markets | |

|---|---|

| S&P 500 6,775 (+0.79%) |

|

| Nasdaq 23,006 (+1.38%) |

|

| Dow 47,952 (+0.14%) |

|

| Bitcoin $85,185 (-0.73%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

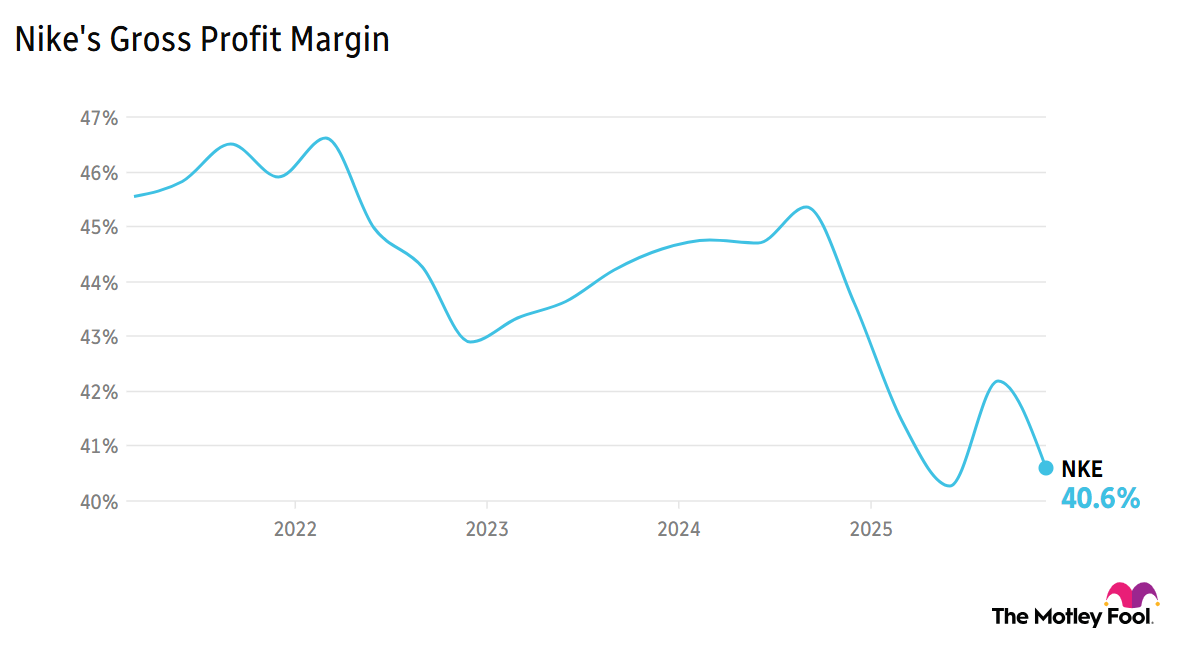

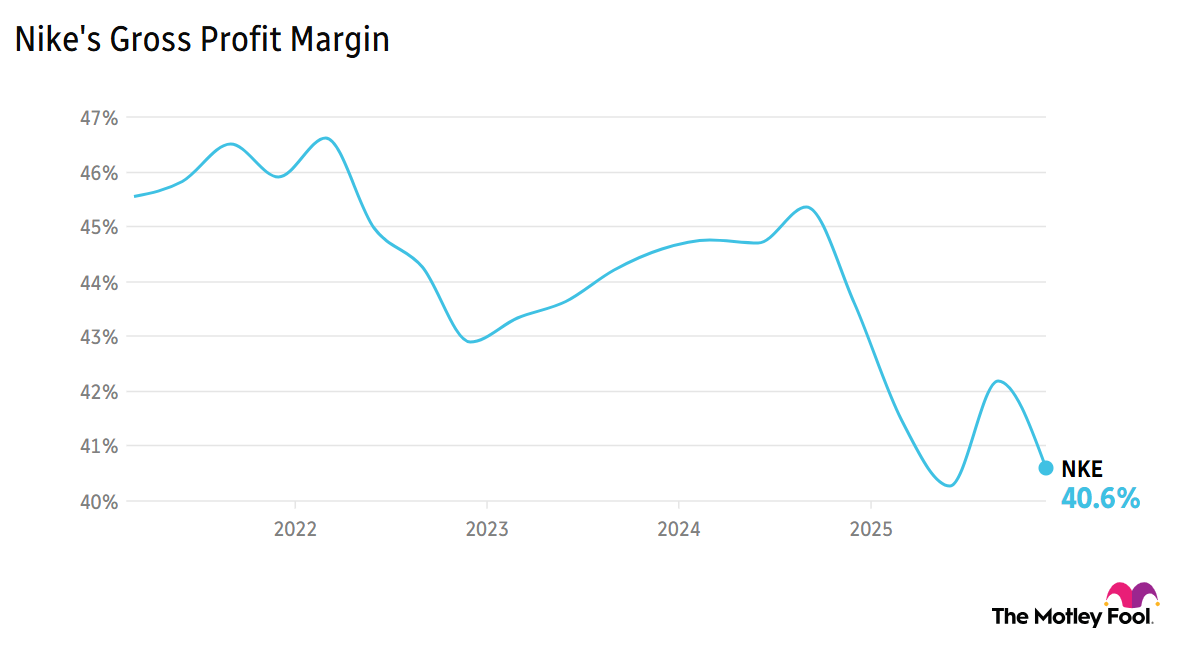

Nike (NYSE:NKE) posted a 32% fall in second-quarter earnings per share (EPS) year over year (YOY) after market close yesterday, as management expects further direct-to-consumer sales weakness in the coming quarters. We saw some signs of recovery in North American markets, with revenue up 9%, though with a gross margin down 330 basis points. Nike stock fell over 10% in pre-market trading.

TikTok's U.S. operations are to be taken over by a new joint venture, CEO Shou Zi Chew told employees in a memo yesterday, per Bloomberg. TikTok USDS Joint Venture LLC will be led by three managing investors -- Oracle (NYSE:ORCL), Silver Lake, and MGX, who will share 50% of the ownership. Chinese owner ByteDance will retain 20%, with 30% held by other affiliates.

Stock Advisor recommendation FedEx (NYSE:FDX) reported a 19% YOY EPS jump with yesterday's Q2 update -- as profitability improves despite a number of obstacles, including the grounding of the company's MD-11 aircraft following November's UPS (NYSE:UPS) crash. The stock remained stable overnight.

How important is order backlog visibility when you're choosing stocks, and in which industries does it matter most? Debate with friends and family, or become a member to hear what your fellow Fools are saying.