| Friday's Markets | |

|---|---|

| S&P 500 6,939 (-0.43%) |

|

| Nasdaq 23,462 (-0.94%) |

|

| Dow 48,892 (-0.37%) |

|

| Bitcoin $84,171 (-0.06%) |

|

| Friday's Markets | |

|---|---|

| S&P 500 6,939 (-0.43%) |

|

| Nasdaq 23,462 (-0.94%) |

|

| Dow 48,892 (-0.37%) |

|

| Bitcoin $84,171 (-0.06%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

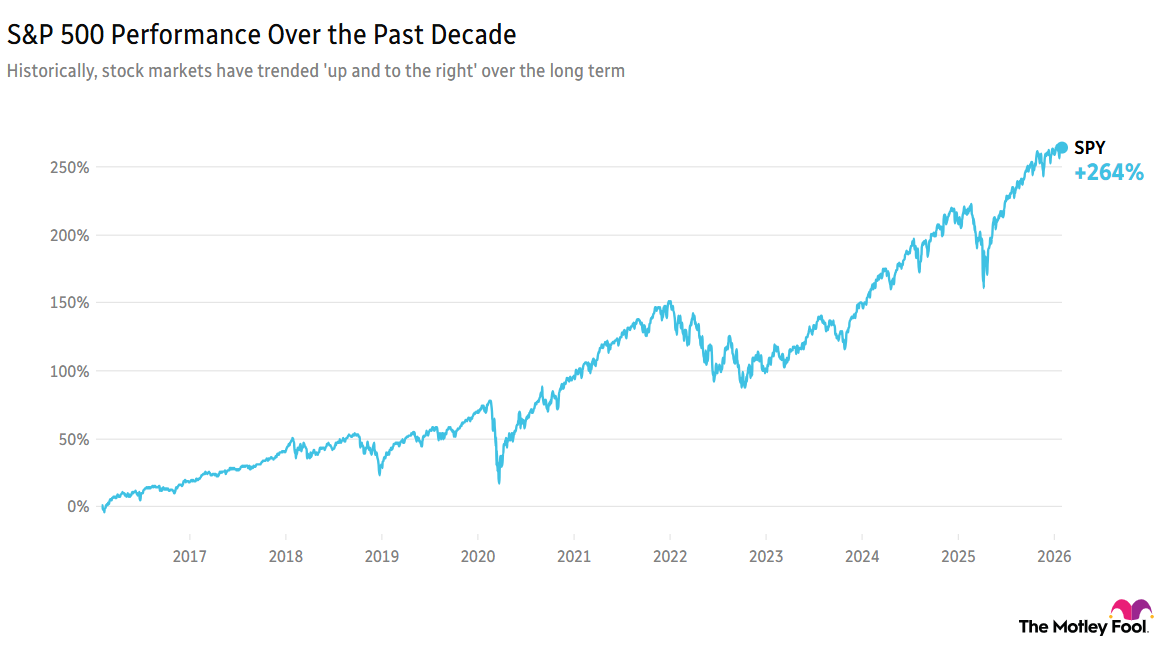

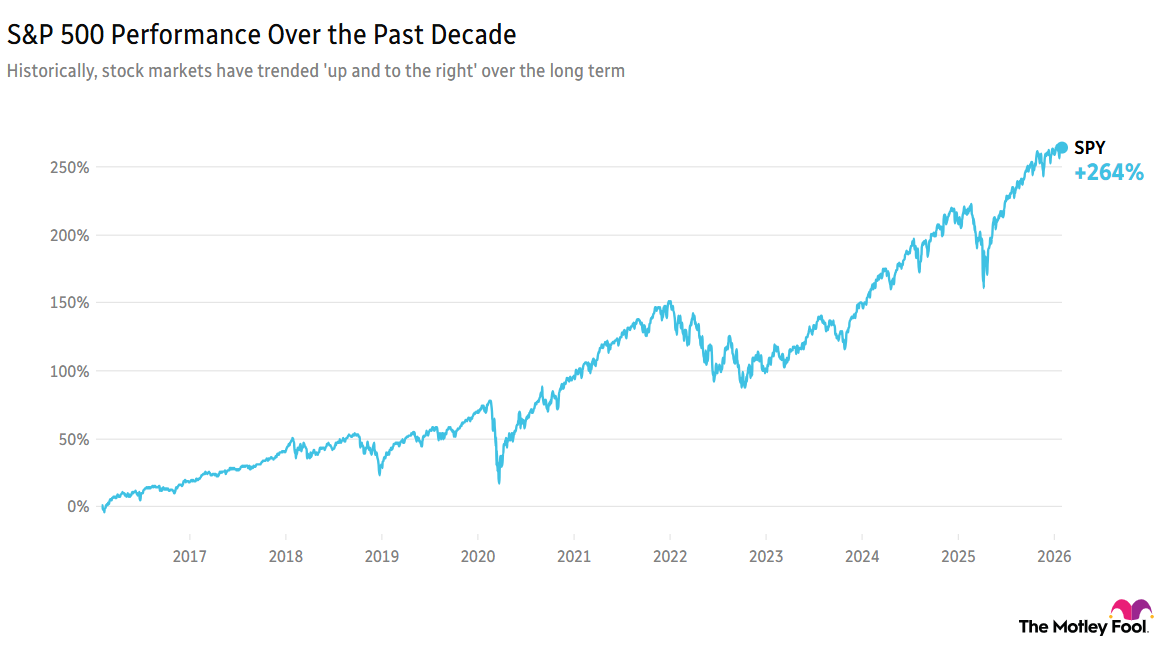

S&P 500 and Nasdaq futures fell this morning by 0.8% and 1%, respectively, as the ongoing gold and silver sell-off rattles markets -- with little cheer expected from the January jobs report due Friday. After President Donald Trump announced Kevin Warsh to replace Federal Reserve Chair Jerome Powell on Friday, expectations are growing for two interest rate cuts this year.

Recommended in Stock Advisor by Team Rule Breakers, Disney (NYSE:DIS) reported $26 billion in revenue for the first quarter this morning, pushing the stock up close to 4% in early trade, with subscription and streaming services leading with 11% growth. It follows record theme park results in 2025.

Disney's multigenerational appeal means parents who grew up with Disney introduce it to their kids.

How much value do you place on nostalgia and emotional connection as competitive advantages, and can they overcome operational challenges?

Discuss with friends and family, or become a member to hear what your fellow Fools are saying!