| Tuesday's Markets | |

|---|---|

| S&P 500 6,918 (-0.84%) |

|

| Nasdaq 23,255 (-1.43%) |

|

| Dow 49,241 (-0.34%) |

|

| Bitcoin $76,482 (-2.43%) |

|

| Tuesday's Markets | |

|---|---|

| S&P 500 6,918 (-0.84%) |

|

| Nasdaq 23,255 (-1.43%) |

|

| Dow 49,241 (-0.34%) |

|

| Bitcoin $76,482 (-2.43%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

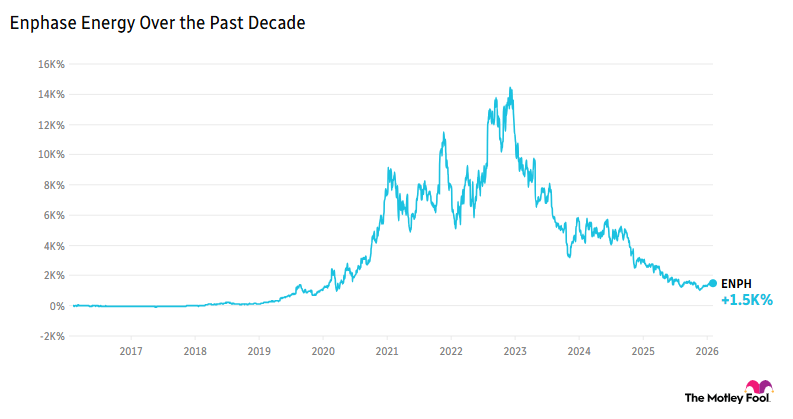

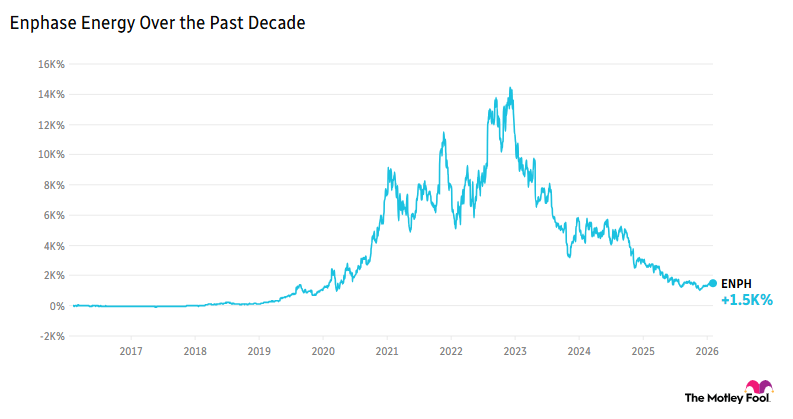

Enphase Energy (NASDAQ:ENPH) climbed more than 20% in early hours trading -- despite reporting a 24% earnings drop year over year (YOY) in the fourth quarter to $0.71. But that was well ahead of the expected $0.54.

The S&P 500's software sector fell 6% yesterday, with investors spooked by fears of artificial intelligence (AI) eclipsing more traditional software products. PayPal (NASDAQ:PYPL) plunged 20% on the day, with a number of other Fool favorites also suffering. So, what do Fool analysts think of it all?

What stocks have you added to your portfolio in the last few weeks, and why?

Share with friends and family, or become a member to hear what your fellow Fools are saying!