| Wednesday's Markets | |

|---|---|

| S&P 500 6,883 (-0.51%) |

|

| Nasdaq 22,905 (-1.51%) |

|

| Dow 49,501 (+0.53%) |

|

| Bitcoin $73,198 (-4.14%) |

|

| Wednesday's Markets | |

|---|---|

| S&P 500 6,883 (-0.51%) |

|

| Nasdaq 22,905 (-1.51%) |

|

| Dow 49,501 (+0.53%) |

|

| Bitcoin $73,198 (-4.14%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

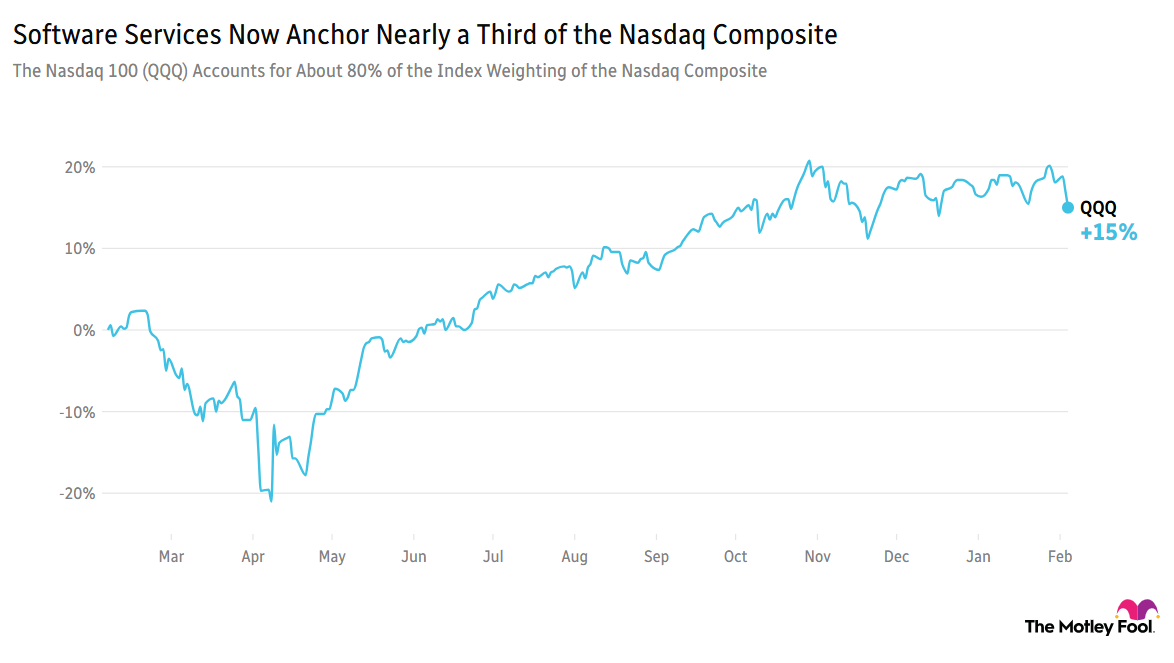

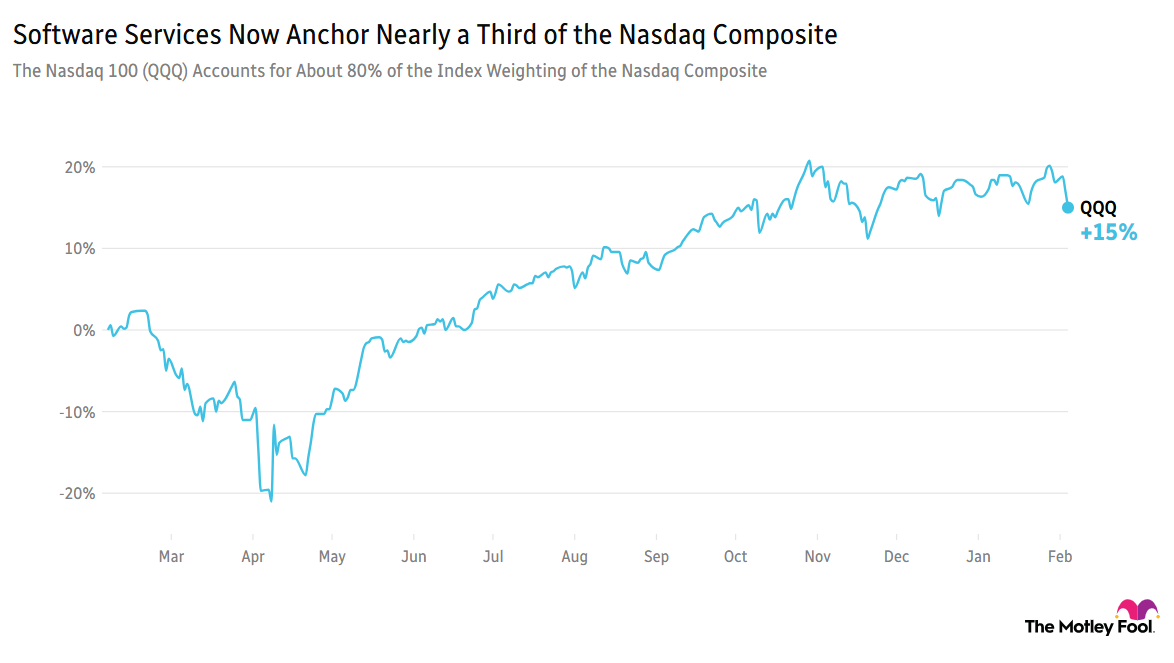

The tech-heavy Nasdaq index fell 1.5% yesterday as fears of artificial intelligence (AI) disruption picked up pace, although futures indicate a modest rebound. Software-as-a-Service (SaaS) stocks were particularly hard hit again, with the S&P 500 software and services index now down nearly 13% over the past six sessions.

IonQ (NYSE:IONQ) fell 8.14% yesterday and led quantum stocks lower due to a short-seller report claiming most of IonQ's revenue has come from acquired businesses outside of quantum computing.

TMF's Head of AI Donato Riccio yesterday wrote, "I think there's some truth to the broader concern [that agentic AI is going to "kill" software], but I also think the narrative is significantly overblown, and the market is overreacting."

Today, we're asking simply, how are you reacting to the current sell-off?

Discuss with friends and family, or become a member to hear what your fellow Fools are saying!