| Thursday's Markets | |

|---|---|

| S&P 500 6,921 (+0.01%) |

|

| Nasdaq 23,480 (-0.44%) |

|

| Dow 49,266 (+0.55%) |

|

| Bitcoin $91,023 (-0.07%) |

|

| Thursday's Markets | |

|---|---|

| S&P 500 6,921 (+0.01%) |

|

| Nasdaq 23,480 (-0.44%) |

|

| Dow 49,266 (+0.55%) |

|

| Bitcoin $91,023 (-0.07%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

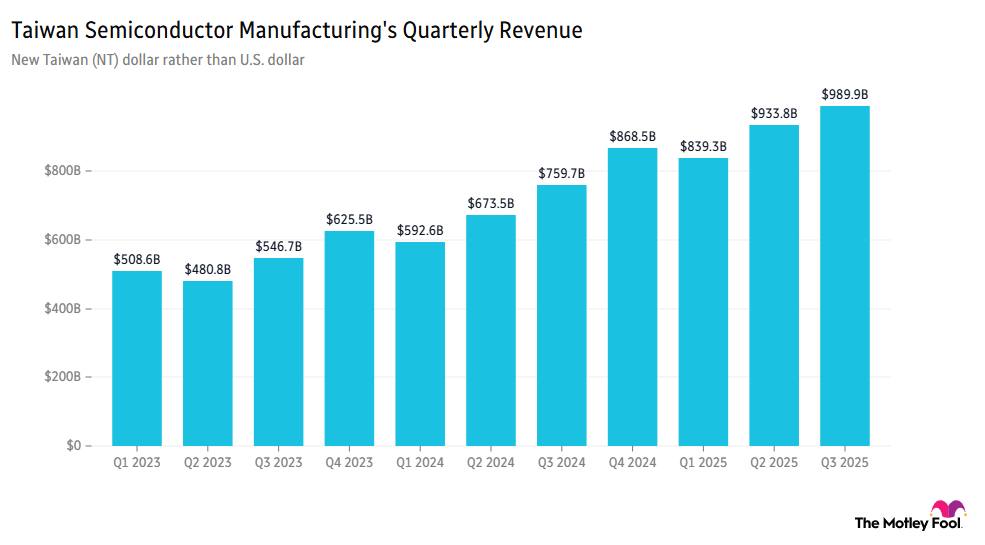

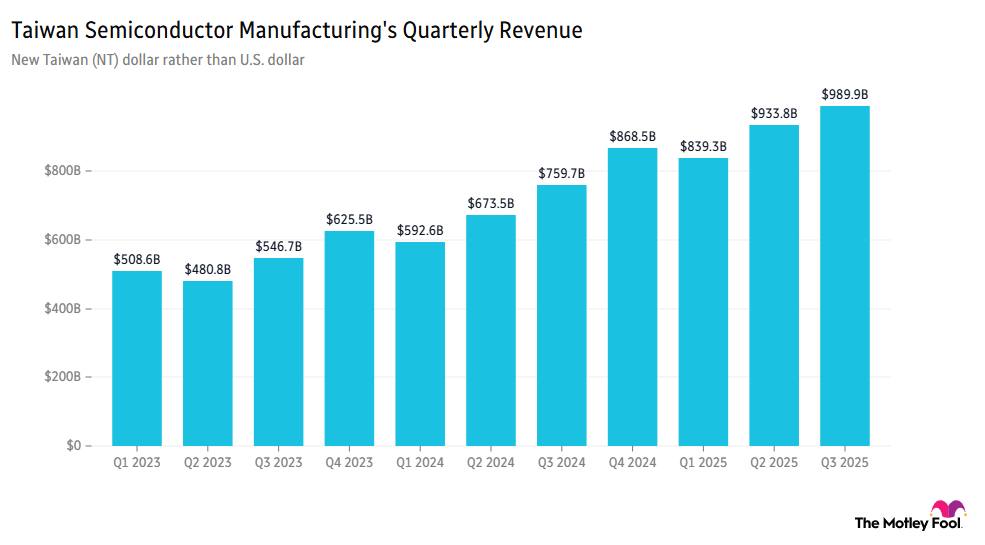

Taiwan Semiconductor Manufacturing (NYSE:TSM) reportedly broke its record for annual sales in 2025, with Reuters' calculations based on monthly data showing a fourth-quarter revenue haul of NT$1,046.08 billion (about $33.11 billion), as global demand for artificial intelligence (AI) chips continued. The stock nudged up around 0.25% ahead of the market opening.

Nvidia (NASDAQ:NVDA) has hired its first chief marketing officer, poaching Alison Wagonfeld from Alphabet (NASDAQ:GOOG), highlighting its desire to boost brand awareness and recognition outside the tech space.

Johnson & Johnson (NYSE:JNJ) has agreed to cut U.S. drug prices in exchange for tariff exemptions, with the Financial Times reporting peer Merck (NYSE:MRK) is in talks to buy cancer drugmaker Revolution Medicines (NASDAQ:RVMD).

The December jobs report, due out today, is expected to show a gain of 70,000, with the unemployment rate due to fall from 4.6% previously to 4.5%, although the data accuracy will still be partly influenced by the government shutdown.

Many established pharma companies pay solid dividends while still investing heavily in research and development (R&D). Does this combination of income and growth potential make them ideal long-term holds, or would you rather own pure growth companies or pure dividend plays? Discuss with friends and family, or become a member to hear what your fellow Fools are saying.