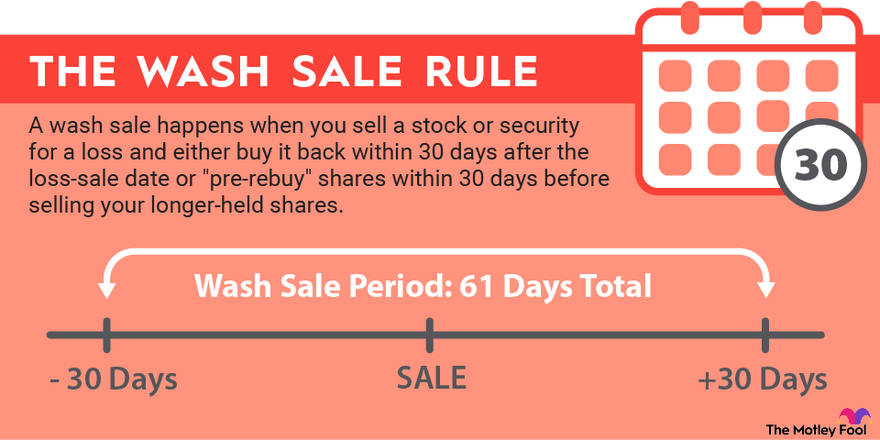

In either case, the loss is not considered realized for tax purposes, with the sale and subsequent (or prior) purchase "washing" one another out. This rule is designed to prevent people from selling stock to just to claim the tax benefit, without intending to exit the investment.

Again, the rule applies to a 30-day period before and after the sale date to prevent your buying the stock "back" before it's even sold.

Wash-sale rule examples

Let's say you own 100 shares of XYZ Corp with a cost basis (what you paid for them) of $10,000, and you sell them on June 1 for $3,000. That works out to a $7,000 loss, and if you own the shares in a taxable brokerage account, you can claim that loss when you file your taxes.

However, if you were to rebuy shares anytime between June 2 and July 1, then the sale is considered a wash sale, and the loss doesn't qualify as a taxable loss. It works the same way if you buy shares within 30 days before your sale as well; in this case, if you bought shares equal to what you sold on June 1 anytime on or after May 2, then it would "wash out" your taxable loss.