Catch-up contributions are intended to help older Americans who may incur outsized medical expenses, or who may not have saved enough for a secure retirement and want to boost their contributions to tax-advantaged accounts as they near the end of their careers.

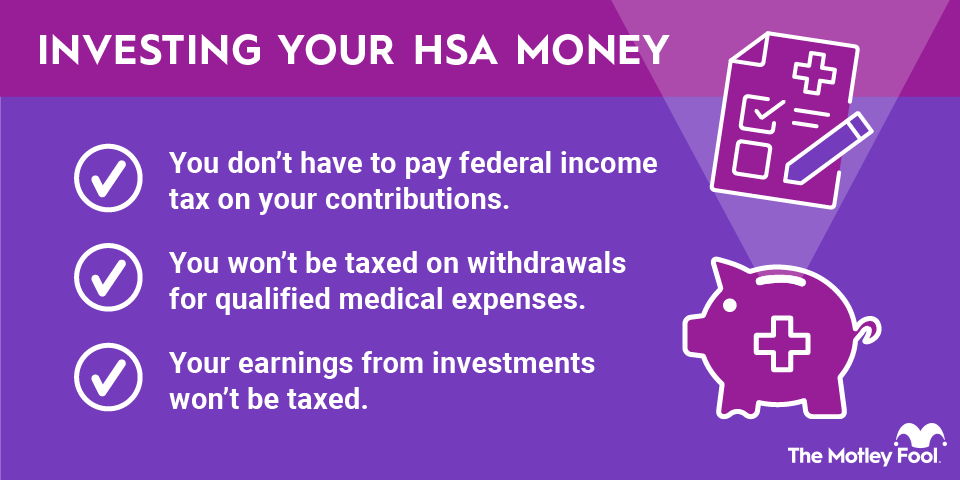

Older Americans may want to make catch-up contributions because healthcare costs tend to rise with age and because an HSA can be a valuable type of retirement savings account. HSAs work as a retirement savings plan because money can be withdrawn penalty-free for any purpose, not just medical expenses, after age 65. Once an HSA account holder turns 65, distributions not used for medical costs are taxed at their ordinary income tax rate, the same as distributions from a 401(k) or traditional IRA.

Related Investing Topics