Social Security is an invaluable benefit to millions of Americans. And what it means for those looking for a mortgage may surprise you.

The common myth

For years, mortgage giants Fannie Mae and Freddie Mac have allowed Social Security to count as income for those applying for a mortgage.

Source: www.stockmonkeys.com

Yet many faced difficulties if they'd retired and were receiving Social Security but wanted to either buy a home or refinance their mortgage. AARP even went so far to say that "retirees living on a fixed income probably had a better chance at being chosen for The Price Is Right than qualifying for a mortgage."

That was because when banks went to approve those looking for a mortgage, one of the biggest considerations is the applicant's income, regardless of whether the applicant was retired or still in the workforce.

And while Social Security can undeniably provide substantial benefits, often the income isn't enough to qualify for a mortgage.

But thankfully, that has all changed.

Source: Freddie Mac Media Relations.

The welcome relief

In 2011, Freddie Mac changed its rules to allow baby boomers and other individuals in retirement and using Social Security to greatly increase their ability to qualify for a mortgage.

Some retirees may have a substantial sum of assets in their 401(k)s, IRAs, or other retirement accounts but may not have a significant source of income coming in each month. Freddie Mac understood this, and as a result, it changed the way it calculates a borrower's eligibility.

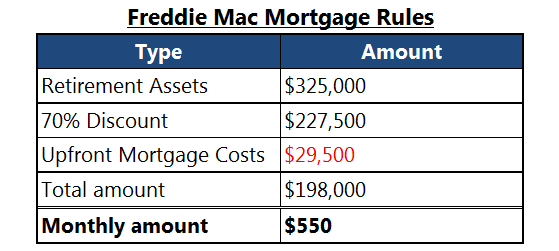

It allows all of a borrower's qualified assets to be added up and then multiplied by 70%, and it then subtracts out certain mortgage costs. That remaining amount is in turn divided by 360 and then added to the applicant's existing monthly income to "help the borrower meet the mortgage's income eligibility requirements."

For example, if a retired married couple has $325,000 in a 401(k), they would have $550 added to their monthly income calculation when applying for a mortgage:

Source: Author calculations.

The average Social Security benefit for a couple stands at a little north of $2,100, and banks seek to ensure that a mortgage is no more than 30% of monthly gross income. As a result, that boost in eligible income may be exactly what they'd need to be pushed across the line to be approved to either refinance their existing mortgage as a result of the incredibly low rates, or even purchase a new home.

Yet it must be noted that Freddie Mac chose to remind individuals of this boost just last year, because too few people -- both individuals and bankers -- even knew about it. So if your banker says your retirement assets can't be used for your mortgage application, it's time to find a new banker.

All too often we hear of scary changes with both Social Security and the titans at the heart of the mortgage industry in Fannie Mae and Freddie Mac, but thankfully this is one change that should be a welcome relief to many.